Roofers Contractors

Insurance Reliable Protection

for Your Business

Safeguard your roofing and contracting business with comprehensive insurance solutions designed to meet industry-specific risks.

Whether you’re a sole contractor or running a larger team, our insurance plans provide the security you need to focus on your work without worrying about unexpected setbacks.

Why Roofers Need Insurance

Roofing is a high-risk profession; one incident could cost you big time without insurance. Roofers contractors insurance will protect your business from:

- Injury Risks: Heights, heavy equipment, and weather make roofing dangerous. Falls, cuts, and gear-related accidents happen often. Workers’ compensation insurance helps pay for your staff’s doctor bills and missed pay if they get hurt on the job.

- Property Damage: Roofers work near homes and other buildings. Accidents like a tool breaking a window can cost a lot to fix. General liability insurance guards your business by covering these claims from others.

- Legal Liabilities: If a client or third party sues you because your business caused injury or damage, the costs of defending yourself and paying settlements can be crushing. Liability insurance for roofers protects you from these legal risks.

Common Causes of Roofing Accidents

According to the Occupational Safety and Health Administration (OSHA), roofing contractors are among the most at risk of workplace injuries of all professions due to working at heights, extreme weather, and physical demands.

If you don’t have the right insurance, a job-related accident could result in medical bills and legal action that could shut your business down.

When you get roofer contractor insurance, you look out for your business, workers, and customers.

- Falls: Falls cause most roofing accidents, often leading to bad injuries or death.

- Slips and Trips: Slick surfaces, bumpy ground, and scattered materials can make workers slip and trip.

- Electrocution: Working close to power lines or electric gear puts workers at risk of getting shocked.

- Equipment Accidents: Using tools and gear wrong or not keeping them in good shape can cause accidents.

Get a Roofers Contractor’s Insurance Quote fast

Only 5 minutes of your valuable time. We can often get same day coverage.

Coverage Options for Roofers

As a roofer, you need the right insurance to cover all aspects of your work. Here’s a breakdown of the main coverages we offer for roofers:

-

General Liability:

Roofing work happens on clients’ properties, where accidents can happen. General liability insurance guards your business against lawsuits if someone suffers an injury or property damage occurs while you’re working.

For example, if a passerby gets hurt at your job site or your equipment damages a neighbor’s house, this coverage pays for medical bills, repairs, and legal fees if needed.

This is vital to prevent costly lawsuits that can harm your business.

-

Workers’ Comp:

Roofers face daily hazards like falls, tool injuries, and exposure to hazardous materials. Workers’ comp insurance ensures that if a work-related accident happens, it covers your employees’ medical expenses and lost wages. This protects your staff and helps you comply with state regulations.

With workers’ comp, you can support your team and protect your business from lawsuits and workplace incidents.

-

Equipment Coverage:

Your tools and gear are the backbone of your roofing business and a big investment. From nail guns and ladders to heavy machinery, any damage or theft can cause project delays.

Equipment insurance covers your tools against theft, damage, or loss so you can replace or fix equipment and keep your business running smoothly.

-

Commercial Auto:

Your business relies on vehicles transporting materials, tools, or workers to job sites. Commercial auto insurance covers vehicles used for work purposes.

It covers damages from accidents, theft, or other incidents involving your company’s vehicles.

-

Custom Solutions:

Every roofing business is unique, with its own risks, operations, and needs. That’s why we offer custom insurance plans that fit your business.

Whether you have a small outfit with one crew or a big roofing company with multiple teams, we can create a policy that suits you. We can add insured parties, high-risk projects, or specific tools and materials.

We work with you to understand your business and create an insurance package that provides the right level of coverage without making you pay for coverage you don’t need

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

Roofing Insurance Rates And Coverage

This table displays typical rates and coverage for Roofers General Liability

for $1 Million/$2 Million Policy.

| State | Coverage | Next Insurance | Ace Insurance | Rockingham | PCIC | United Specialty | Shield |

|---|---|---|---|---|---|---|---|

| IL | 1M/2M | $2967 | $3077 | $2977 | $2932 | $2960 | $No Coverage |

| IN | 1M/2M | $2950 | $2909 | $2946 | $2960 | $2988 | $2994 |

| CA | 1M/2M | $4301 | $4105 | $4178 | $4298 | $4208 | $4127 |

| PA | 1M/2M | $2910 | $2933 | $2999 | $3031 | $2936 | $2900 |

| GA | 1M/2M | $3003 | $2927 | $2940 | $2939 | $2995 | $2938 |

| CO | 1M/2M | $4235 | $4306 | $No Coverage | $4102 | $4145 | $No Coverage |

| LA | 1M/2M | $4123 | $4288 | $4137 | $4074 | $4213 | $4215 |

| FL | 1M/2M | $3634 | $3586 | $3631 | $3713 | $3661 | $3647 |

| NY | 1M/2M | $4422 | $4490 | $No Coverage | $4466 | $4572 | $4551 |

Annual premium above includes unlimited certificates of insurance.

Rating assumes $50,000 – $100,000 gross revenues for roofing/general contracting with 10% subcontractor costs.

Premium are subject to underwriting approval and financing charges may apply.

Get Your Free Roofing Contractor Liability Insurance Quote

In only 5 minutes of your valuable time. We can often get same day coverage.

Benefits of Our Insurance Plans

When you pick us to take care of your roofing insurance, you’ll get a bunch of perks made to fit your business needs. Here’s what you get when you team up with us:

-

Good Prices from Reliable Insurance Companies:

We provide general liability insurance from top-rated insurers such as USLI, Tokio Marine, Shield, BTIS, Rockingham, TAPCO, Clear Spring, HISCOX, and ISC (with choices like Sutton, Obsidian, and Third Coast). This allows us to compare rates and identify the most competitive rate for your company.

Our general liability coverage ranges from $2,440 to $4,220, enabling us to offer cost-effective protection regardless of your business location.

-

Fast and Simple Claims Process:

In the roofing business, time matters a lot. We partner with insurers who handle claims. This helps you get the help you need fast, so your work doesn’t stop for long if you have an accident, lose equipment, or face damage.

We aim to keep your business running above all else.

-

Flexible Payment Plans:

Roofing jobs can be tough on your wallet, and money can come and go. That’s why we give you different ways to pay. This way, you can stay insured without worrying about tight money deadlines.

You can pay every three months or once a year – we’ll make a plan that works for you.

-

Expert Guidance from Roofing Insurance Specialists:

Our team works with many top insurance companies to offer custom-made options. This allows our experts to give you the best advice for your specific needs.

We ensure you have full coverage, from liability to workers’ comp.

-

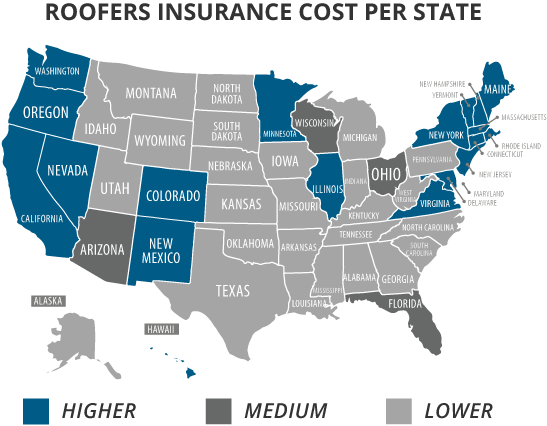

Nationwide Coverage:

Check out our state-by-state guides that tell you all about the insurance policies roofers need in each state. Keep yourself informed and follow the rules by learning the special insurance laws and suggestions for every area.

Knowing these rules lets you keep your business safe and prosperous, no matter where you work.

Statewise Roofing Insurance Information

Explore our selection of statewise articles that provide general information on the policies required for roofing contractors in each state. Stay updated and compliant by familiarizing yourself with the diverse insurance requirements and suggestions, ensuring the security and success of your business across different regions.

Roofing Insurance Cost

However, ContractorsLiability.com recommends that any general costs presented in a quote ought to be thoroughly reviewed, as customized plans will always vary.

Standard Roofing General Liability Insurance Policies start around $2,000 annually.

We want you to feel as though your insurance requirements are being met, so contact us today for a free roofing insurance quote that takes into account your business’s specific needs, as well as more information about your customized insurance plan. The common factors that insurance companies use to determine roofers insurance costs are:

-

Your company’s accident history

If you’re a company with a clean accident record, then you are less likely to have a high insurance rate than some of your competitors. This, however, does not account for the age of your business, which also plays a role in determining insurance rates.

For example: A company may have no recorded accidents, but if the company is relatively new, a rate may be higher than an older company with the same record.

-

The average age and legal background of your employees

Employees who do not pass generic background checks, as well as many younger employees, could make your liability insurance higher. A good way to save money if you do hire any of these demographics is to provide consistent and documented training.

-

How old your company is?

If a company has an established history of excellence, an insurance company will see this as a form of reliability, thus encouraging their capacity to offer a lower rate due to lower risk.

-

Where your company is located?

Believe it or not, crime can be considered part of a liability package. There is a higher likelihood of property damage due to crime, therefore it is part of the responsibility of the owners to make sure they are covering their assets and reputation.

Roofers Contractors Insurance Specialized Endorsements

Roofing have specialized needs from other types of contractors. There are specialized endorsements that can cover you for damage caused by weather as a result of open roofs and additional coverage if you use Torch Down Roofing, just to name a few types of specialized General Liability Insurance coverage roofers may want.

So why go for the generic option, which may not account for the coverage you need, when you can get a policy that is specifically designed to protect you? A Tailored policy is the safest and most accurate coverage for roofers contractors, and Contractors Liability can help you find a plan that fits your needs.

Testimonials and Real-Life Examples

Our roofing insurance solutions have consistently protected contractors from unexpected setbacks. Our clients have stayed on track with quick claims processing and personalized coverage, even in challenging situations.

Here’s how our plans have helped roofing businesses avoid disruptions and stay secure. Our insurance plans have shielded roofing contractors from major money troubles, making sure their companies remain safe:

Protect your roofing business today! Contact us for a free consultation and receive a customized insurance quote tailored to your specific needs. Don’t wait until something goes wrong — ensure your business is protected with the right coverage.

Here’s What Contractors Think

Frequently Asked Questions

The following are common questions about Roofers Insurance.

Roofing insurance is specialized liability insurance that provides custom coverage for accidents that often require coverage legally. Even in states that do not require liability insurance, it is important to consider having roofers’ insurance to protect your company in the instance of an accident.

Unfortunately, no. Roofers’ insurance only covers third parties, like your client or visitors to the worksite. Workers Compensation insurance is what’s responsible for covering your employees. However, this should be no deterrent from purchasing roofers’ insurance, as it can protect your company from serious lawsuits, and in many cases, it is the law to have it. Learn more with our Guide To Workers Compensation Insurance For Roofers.

Roofers’ insurance covers you and your company when punitive damages (penalties against your business), compensatory damages (financial losses), and general damages occur. These are very general terms for a variety of claims that are covered under the umbrella of roofers’ liability insurance.

There are many insurance agencies out there, and you might be tempted to go with the one you see consistently advertised on the television or even one that is closer to home. However, Contractors Liability is certain that if you want the best policy, you need to work with specialized agents like ours. Along with our customer satisfaction guarantee, we:

- Work with A-rated insurance companies, like the large ones advertised in popular media, to get you service that you can trust.

- Customer service iconProvide you with customer service, tailored to your needs from a licensed insurance agent.

- Customized policies iconCreate a customized roofers’ insurance plan that fits with your business demographic, history, and future.

- Lowest price icon Provide you with the lowest price for the best coverage out of any of our competitors.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.