A Complete E-Book Guide about Workers’ Compensation Insurance

By: Thomas M. Hester

After reading this E-Book, you will have the proper tools to ensure that you are making the right decisions concerning your Workers’ Compensation needs.

Get a Fast WC Quote

Add details for the fastest quote

Call Us 24/7

We’ll answer at any time, call us.

Customer Service (888) 766-4991

Table of content

The following are typical types of damage that are covered under our roofers’ general liability insurance policy.

Experience Modification

How Much does Workers’ Compensation Insurance Cost?

Workers Compensation Coverages Explained

Ghost policies or If any policies

Workers compensation for self employed persons

Workers’ Compensation Insurance Vs. Disability Insurance

Audits

Final Thoughts on Workers compensation.

Introduction

Hello, Thank you for spending some time to learn more about Workers’ Compensation Insurance. My name is John M. Brown, and I am the owner of ContractorsLiability.Com. We are one of the largest and oldest independent insurance brokers online that specializes in helping contractors with all their insurance needs.

Along with the author of this E-Book Thomas M. Hester, we have combined over 50 years experience in helping small businesses owners, like contractors, succeed in growing their business. If you take the time to read the following material you will find many keys to success that many successful contractors follow.

The material will be easy to read and will contain real world useful advice from people that have been working in the industry for a number of years. It will give you the knowledge to avoid pitfalls that many contractors make.

Workers’ Compensation is a complex topic. We will try to break it down into easily digestible points that you will be able to understand. With an understanding of this complex subject you will be able to make informed decisions that will allow your business to flourish.

After reading this E-Book, you will have the proper tools to ensure that you are making the right decisions concerning your Workers’ Compensation needs. As a general rule, Workers’ Compensation Insurance, is the largest insurance expenditure that a contracting business will have. As a result it is in your best interest to educate yourself on the subject.

With the information contained in the following pages you may be able to save your business thousands of dollars. Even the best insurance agent will not know your business as well as you do. That is why educated input, provided to a knowledgeable agent will get you the best insurance solutions.

Thank you for your time and consideration. I guarantee that you will find this information useful. I look forward to assisting you in any workers compensation needs you may have.

Get Workers’ Compensation Insurance the same day.

Only 5 minutes of your valuable time. We can often get you same day coverage.

Get a Quote NowA Short History of Workers’ Compensation

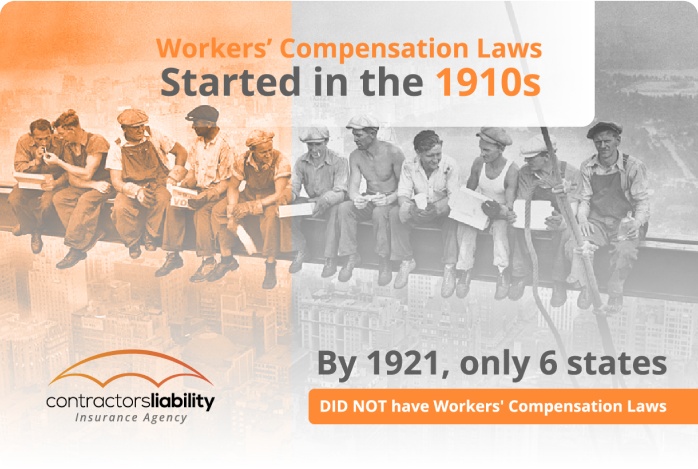

The beginnings of workers’ compensation can trace their roots to Europe. Germany had the first modern workers’ compensation laws, known as Sickness and Accident Laws.

In the United States, workers’ compensation laws started in the 1910s. By 1921, only six states did not have workers’ compensation laws.

Before workers’ compensation laws were adopted by states, injured workers had to prove the negligence of their employer. This was a long drawn-out process, during which the injured employee had to file long and costly legal actions against their employers.

Further the employers could raise claims of contributory negligence on the part of the worker or that they assumed any risk involved by taking the job. In an effort to make things more fair, states adopted workers’ compensation laws.

Each state adopted their own laws, and the benefits varied widely. The common core of all the laws was that employees no longer had to prove negligence of the employer. As long as the injury occurred during the course of employment there would be coverage. As a result, workers would be entitled to benefits for a work-related injury regardless of who caused the injury. They would give up the right to sue their employer for negligence. Employers would be responsible for benefits listed in state law in exchange for the elimination of lawsuits for negligence..

What Kind Of Insurance Should A Contractor Have?

The following items are generally covered: attorney fees, witness fees, court expenses, and more.After a lawsuit, General Liability Insurance can be the difference between stying in business or going bankrupt.If you don’t have General Liability Insurance coverage, you would have to pay for those damages out of pocket. As you can imagine, that can really put a dent in not only your business finances but your personal finances as well.

Today’s Workers’ Compensation Programs

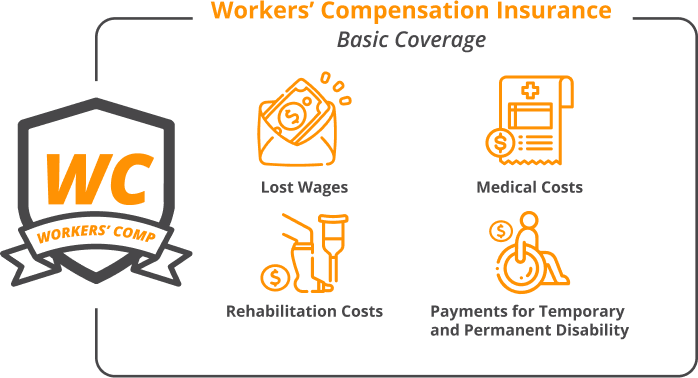

When a covered employee suffers a work-related injury or disease, they are entitled to the benefits listed in the state’s statute. At the most basic level, all these states cover lost wages, medical costs, rehabilitation costs and payments for both temporary and permanent disability.

Payments are also made to dependents in cases involving fatal injuries. The amounts and length of payments vary widely by state.

What Is a Monopolistic State?

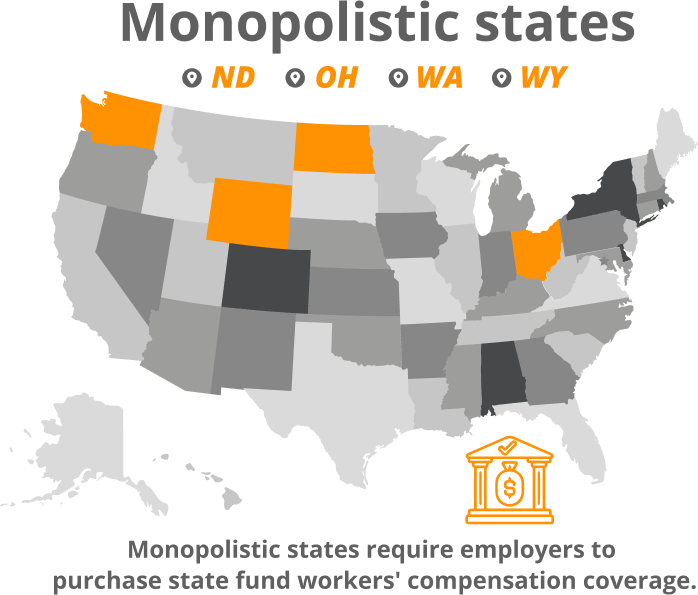

If your business is in Ohio, North Dakota, Washington or Wyoming, you are in what is known as a monopolistic state. Monopolistic states require employers to purchase state fund workers’ compensation coverage. You can not obtain coverage from private companies.

The other states are considered competitive workers’ compensation insurance states. This means that you are allowed to get coverage and quotes from private insurance companies.

If you are in North Dakota, Ohio, Washington and Wyoming, you can find out more about workers’ compensation laws for these states in the sections below:

-

Coverage in Ohio

If you need Ohio workers’ compensation, you can purchase it from the Ohio Bureau of Workers’ Compensation. You’ll need to fill out the U-3 Form and pay a $120 minimum application fee. You will be required to look up your class code at the NCCI website before you apply.

-

Coverage in Wyoming

In Wyoming, you will have to contact Wyoming workforce services. You will be required to look up your class code at the NCCI website before you apply.

-

Coverage in Washington State

You can get Washington workers’ compensation coverage from The Washington State Department of Labor & Industries. To open a workers’ compensation account, visit the Department of Labor and Industries website. Washington has its own system of classifying businesses that is different from NCCI.

-

Coverage in North Dakota

For North Dakota workers’ compensation coverage, you fill out an application with the North Dakota Workforce Safety & Insurance. North Dakota has its own workers’ comp classification system that is different from NCCI.

Monopolistic vs. Private Insurers

If your business is located in one of these 4 states, you will need to buy workers’ compensation insurance through the state fund. If you are not in one of these states, you will have the option to choose workers’ comp coverage from your state or another private insurance carrier.

Workers’ Compensation Law – State by State Comparison

ALABAMA

WORKERS’ COMPENSATION REQUIREMENTS

Businesses with five or more employees must carry coverage. With corporations or LLCs, officers and members are counted as employees. If there are more than four employees, workers’ compensation insurance is required.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Alabama Department of Labor

Read MoreALASKA

WORKERS’ COMPENSATION REQUIREMENTS

Employers with one or more employees must have workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Alaska Department of Labor and Workforce Development

Read MoreARIZONA

WORKERS’ COMPENSATION REQUIREMENTS

Required for any business that regularly hires or employs at least one employee. Sole proprietors can elect to opt out of coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Industrial Commission of Arizona

Read MoreARKANSAS

WORKERS’ COMPENSATION REQUIREMENTS

Most employers with three or more employees must obtain coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Arkansas Workers’ Compensation Commission

Read MoreCALIFORNIA

WORKERS’ COMPENSATION REQUIREMENTS

All employers and work situations, even those with just one employee. Sole proprietors without employees can opt out of coverage.

How to obtain coverage:

You can purchase coverage from a private insurer or through California’s state fund. Approved businesses may self-insure.

For more information – California Department of Industrial Relations

Read MoreCOLORADO

WORKERS’ COMPENSATION REQUIREMENTS

All employers with one or more employees, whether full- or part-time. Anyone hired to perform services for pay is considered an employee. Sole proprietors are not required to purchase Workers’ compensation.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Colorado Department of Labor and Employment

Read MoreCONNECTICUT

WORKERS’ COMPENSATION REQUIREMENTS

All businesses with one or more employees either full time or part time. Also included are uninsured subcontractors.Sole proprietors or single member LLCs are not required to purchase Workers’ compensation.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information: Connecticut Workers’ Compensation Commission

Read MoreDELAWARE

WORKERS’ COMPENSATION REQUIREMENTS

Employers with one or more employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Delaware Department of Labor

Read MoreDISTRICT OF COLUMBIA

WORKERS’ COMPENSATION REQUIREMENTS

Employers with one or more employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – DC Department of Employment Services

Read MoreFLORIDA

WORKERS’ COMPENSATION REQUIREMENTS

Construction businesses with one or more employees and non-construction industry employers with four or more employees must carry coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Florida Division of Workers’ Compensation

Read MoreGEORGIA

WORKERS’ COMPENSATION REQUIREMENTS

Employers of three or more people are required to carry coverage. Contractors who subcontract any part of their work may be liable for coverage for the subcontractor’s employees if the subcontractor lacks coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Georgia State Board of Workers’ Compensation

Read MoreHAWAII

WORKERS’ COMPENSATION REQUIREMENTS

Any employer with one or more employees must carry coverage. LLC members must also be covered. Sole proprietors and partners are excluded, but can choose to cover themselves.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Hawaii Department of Labor and Industrial Relations

Read MoreIDAHO

WORKERS’ COMPENSATION REQUIREMENTS

Employers with one or more employees are required to have workers’ compensation coverage. Sole proprietors are exempt, but can choose to cover themselves.

How to obtain coverage:

You can purchase coverage from a private insurer or through Idaho’s state fund. Approved businesses may self-insure.

For more information – Idaho Industrial Commission

Read MoreILLINOIS

WORKERS’ COMPENSATION REQUIREMENTS

Workers’ compensation is required if you have employees. Sole proprietors are exempt, but can choose to purchase insurance themselves.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Illinois Workers’ Compensation Commission

Read MoreINDIANA

WORKERS’ COMPENSATION REQUIREMENTS

All employees must be covered. Independent contractors in the building and construction trades must be certified with the Indiana Workers’ Compensation Board. Sole proprietors, partners, and LLC members are excluded from coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Workers’ Compensation Board of Indiana

Read MoreIOWA

WORKERS’ COMPENSATION REQUIREMENTS

Contractors are required to purchase workers’ compensation insurance if they have employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Iowa Division of Workers’ Compensation

Read MoreKANSAS

WORKERS’ COMPENSATION REQUIREMENTS

Mandatory for all employers with employees with gross payroll over $20,000. Sole proprietors’ and partnership wages paid to owners and owners’ family members are not counted toward the total payroll.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Kansas Department of Labor

Read MoreKENTUCKY

WORKERS’ COMPENSATION REQUIREMENTS

All employers with one or more employees. Sole proprietors, partners, and LLC members can exclude themselves from coverage. Independent contractors must have their own policy to have coverage.

How to obtain coverage:

You can purchase coverage from a private insurer or through Kentucky’s state fund. Approved businesses may self-insure.

For more information – Kentucky Department of Insurance

Read MoreLOUISIANA

WORKERS’ COMPENSATION REQUIREMENTS

All employers must provide workers’ compensation insurance for their employees.

How to obtain coverage:

You can purchase coverage from a private insurer or through Louisiana’s state fund. Approved businesses may self-insure.

For more information – Louisiana Workforce Commission

Read MoreMAINE

WORKERS’ COMPENSATION REQUIREMENTS

Any business with employees must provide workers’ compensation insurance coverage. If contractors employ subcontractors, subcontractors must be covered.

How to obtain coverage:

You can purchase coverage from a private insurer or through Maine’s state fund. Approved businesses may self-insure.

For more information – Maine Workers’ Compensation Board

Read MoreMARYLAND

WORKERS’ COMPENSATION REQUIREMENTS

Every business with employees must provide workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer or through Maryland’s state fund. Approved businesses may self-insure.

For more information – Maryland Workers’ Compensation Commission

Read MoreMASSACHUSETTS

WORKERS’ COMPENSATION REQUIREMENTS

All businesses must carry workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Massachusetts Office of Labor and Workforce Development

Read MoreMICHIGAN

WORKERS’ COMPENSATION REQUIREMENTS

All businesses with one or more employees are required to carry coverage.

How to obtain coverage:

You can purchase coverage from a private insurer or through Michigan’s state fund. Approved businesses may self-insure.

For more information – Michigan Workers’ Compensation Agency

Read MoreMINNESOTA

WORKERS’ COMPENSATION REQUIREMENTS

All employers are required to provide workers’ compensation insurance coverage to all employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Minnesota Department of Labor and Industry

Read MoreMISSISSIPPI

WORKERS’ COMPENSATION REQUIREMENTS

All employers with five regular employees must provide workers’ compensation insurance coverage .Sole proprietors, partners, and corporate officers don’t count toward the employee total if they choose to not cover themselves.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Mississippi Workers Compensation Commission

Read MoreMISSOURI

WORKERS’ COMPENSATION REQUIREMENTS

Employers with five or more employees must carry workers’ compensation coverage. All construction businesses with one or more employees including part time employees, require coverage.Sole proprietors and partners are excluded from requiring coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Missouri Department of Labor

Read MoreMONTANA

WORKERS’ COMPENSATION REQUIREMENTS

All employers must carry workers’ compensation insurance coverage for all employees. Businesses in the construction industry must provide coverage for all employees, both resident and nonresident, if and while they work in Montana.Contractors do not have to be covered, but must provide proof that they are a certified independent contractor. If you fail to obtain this proof, your business can be held responsible for their injuries.

How to obtain coverage:

You can purchase coverage from a private insurer or through Montana’s state fund. Approved businesses may self-insure.

For more information – Montana Department of Labor and Industry

Read MoreNEBRASKA

WORKERS’ COMPENSATION REQUIREMENTS

All employers with one or more employees must have workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Nebraska Workers’ Compensation

Read MoreNEVADA

WORKERS’ COMPENSATION REQUIREMENTS

All employers with at least one employee must carry coverage. Construction businesses are required to have workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Nevada Department of Business & Industry

Read MoreNEW HAMPSHIRE

WORKERS’ COMPENSATION REQUIREMENTS

All employers with any employees must carry workers’ compensation insurance. Sole proprietors, partners, and self-employed individuals are not required to carry coverage for themselves, but may choose to. Businesses that use subcontractors must ensure they have coverage or they can be held liable for any injuries to the subcontractor’s employee.

How to obtain coverage:

Purchased from a commercial provider. Approved businesses may self-insure.

For more information – New Hampshire Department of Labor

Read MoreNEW JERSEY

WORKERS’ COMPENSATION REQUIREMENTS

Any business with one or more employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – New Jersey Department of Labor and Workforce Development

Read MoreNEW MEXICO

WORKERS’ COMPENSATION REQUIREMENTS

All businesses with three or more employees are required to have workers’ compensation insurance. Construction businesses must carry coverage regardless of their number of employees.

How to obtain coverage:

You can purchase coverage from a private insurer or through New Mexico’s state fund. Approved businesses may self-insure.

For more information – New Mexico Workers’ Compensation Administration

Read MoreNEW YORK

WORKERS’ COMPENSATION REQUIREMENTS

Every employer is required to provide workers’ compensation insurance for all employees.

How to obtain coverage:

You can purchase coverage from a private insurer or through New York’s state fund. Approved businesses may self-insure.

For more information – New York State Workers’ Compensation Board

Read MoreNORTH CAROLINA

WORKERS’ COMPENSATION REQUIREMENTS

All employers with three or more employees are required to carry workers’ compensation insurance for all employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – North Carolina Industrial Commission

Read MoreNORTH DAKOTA

WORKERS’ COMPENSATION REQUIREMENTS

All employers must have workers’ compensation insurance for all employees.

How to obtain coverage:

North Dakota is a monopolistic state, The only workers’ compensation insurance option is through the state-administered fund. Self-insurance and private insurance are not permitted.

For more information – North Dakota Workforce Safety & Insurance

Read MoreOHIO

WORKERS’ COMPENSATION REQUIREMENTS

All employers with one or more employees must carry workers’ compensation insurance.

How to obtain coverage:

Ohio is a monopolistic state, The only workers’ compensation insurance option is through the state-administered fund. Self-insurance and private insurance are not permitted.

For more information – Ohio Bureau of Workers’ Compensation

Read MoreOKLAHOMA

WORKERS’ COMPENSATION REQUIREMENTS

All employers must carry workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer or through Oklahoma’s state fund. Approved businesses may self-insure.

For more information – Oklahoma Workers’ Compensation Commission

Read MoreOREGON

WORKERS’ COMPENSATION REQUIREMENTS

Employers with one or more employees must carry workers’ compensation insurance.

How to obtain coverage:

You can purchase coverage from a private insurer or through Oregon’s state fund. Approved businesses may self-insure.

For more information – Oregon Workers’ Compensation Division

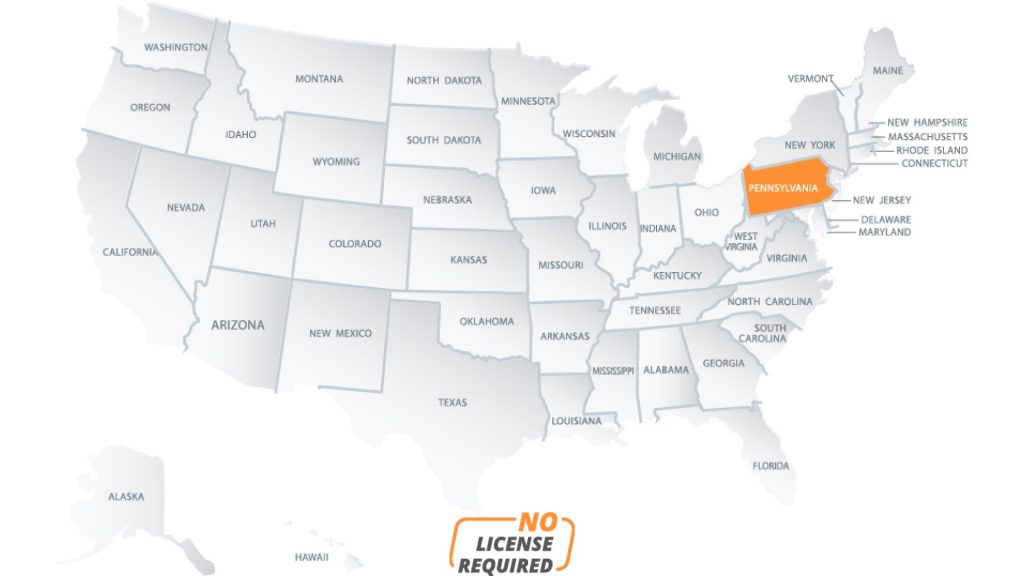

Read MorePENNSYLVANIA

WORKERS’ COMPENSATION REQUIREMENTS

Workers’ compensation insurance coverage is mandatory for all employers with one or more employees.

How to obtain coverage:

You can purchase coverage from a private insurer or through Pennsylvania’s state fund. Approved businesses may self-insure.

For more information – Pennsylvania Department of Labor and Industry

Read MoreRHODE ISLAND

WORKERS’ COMPENSATION REQUIREMENTS

Employers with four or more employees must carry workers’ compensation coverage.

How to obtain coverage:

You can purchase coverage from a private insurer or through Rhode Island’s state fund. Approved businesses may self-insure.

For more information – Rhode Island Department of Labor and Training

Read MoreSOUTH CAROLINA

WORKERS’ COMPENSATION REQUIREMENTS

Employers that employ four or more employees are required to carry workers’ compensation insurance. If you hire a subcontractor and they do not have coverage you could be liable for their injured employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – South Carolina Workers’ Compensation Commission

Read MoreSOUTH DAKOTA

WORKERS’ COMPENSATION REQUIREMENTS

All employers must carry insurance, regardless of the number of employees.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – South Dakota Department of Labor & Regulation

Read MoreTENNESSEE

WORKERS’ COMPENSATION REQUIREMENTS

Every employer in the construction and every employer with five or more employees must carry coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Tennessee Department of Labor & Workforce Development

Read MoreTEXAS

WORKERS’ COMPENSATION REQUIREMENTS

Workers’ compensation insurance is optional for employers in Texas. If you are doing work for the government, you will be required to have coverage. This is explained in more detail in the Chapter Texas Workers’ Compensation.

How to obtain coverage:

You can purchase coverage from a private insurer or through Texas’s state fund. Approved businesses may self-insure.

For more information – Texas Department of Insurance Workers’ Compensation

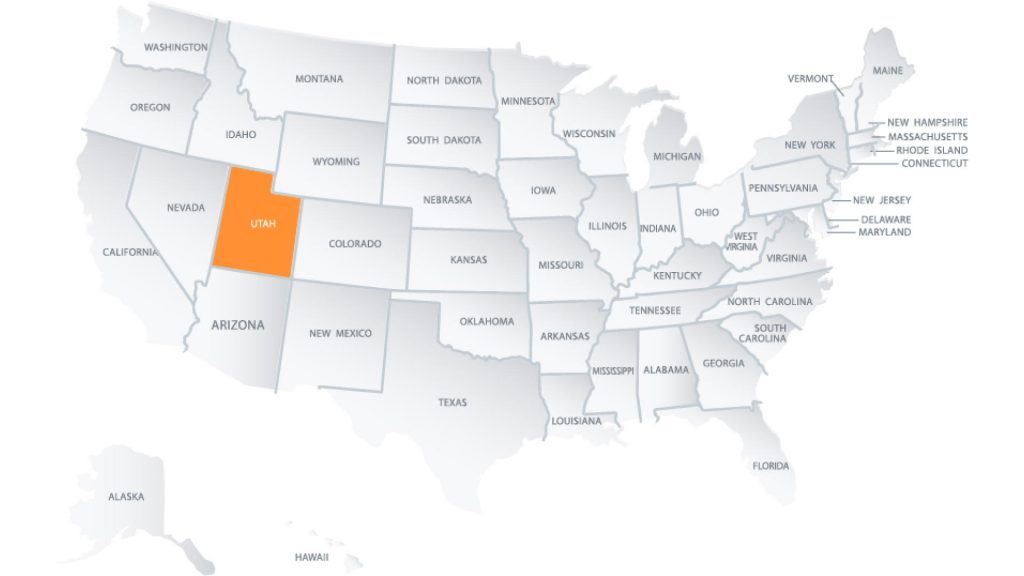

Read MoreUTAH

WORKERS’ COMPENSATION REQUIREMENTS

All employers are required to carry coverage for employees. General contractors must ensure their subcontractors have coverage.

How to obtain coverage:

You can purchase coverage from a private insurer or through Utah’s state fund. Approved businesses may self-insure.

For more information – Utah Labor Commission.

Read MoreVERMONT

WORKERS’ COMPENSATION REQUIREMENTS

All employers with employees must carry coverage.Contractors that work with independent contractors must determine in writing who is responsible for insurance. If the independent contractor does not have coverage, your business will be responsible in the event there is an injury.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Vermont Department of Labor

Read MoreVIRGINIA

WORKERS’ COMPENSATION REQUIREMENTS

Employers who regularly employ two or more employees are required to carry coverage.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Virginia Workers’ Compensation Commission

Read MoreWASHINGTON

WORKERS’ COMPENSATION REQUIREMENTS

All employers with one or more employees must carry coverage.Sole proprietors, partners, corporate officers, and LLC members are excluded from mandatory coverage, but may choose to be covered.

How to obtain coverage:

Washington is a monopolistic state, The only workers’ compensation insurance option is through the state-administered fund. Private insurance is not permitted. Approved businesses can self insure.

For more information – Washington State Department of Labor & Industries

Read MoreWEST VIRGINIA

WORKERS’ COMPENSATION REQUIREMENTS

All employers must carry coverage.Sole proprietors, partners, LLC members, and corporate officers are all included in coverage, but can choose to be excluded.

How to obtain coverage:

You can purchase coverage from a private insurer or through West Virginia’s state fund. Approved businesses may self-insure..

For more information – West Virginia Offices of the Insurance Commissioner

Read MoreWISCONSIN

WORKERS’ COMPENSATION REQUIREMENTS

Employers with three or more full- or part-time employees must carry coverage.Sole proprietors with no employees are not required to carry coverage, but may choose to cover themselves.

How to obtain coverage:

You can purchase coverage from a private insurer. Approved businesses may self-insure.

For more information – Wisconsin Department of Workforce Development

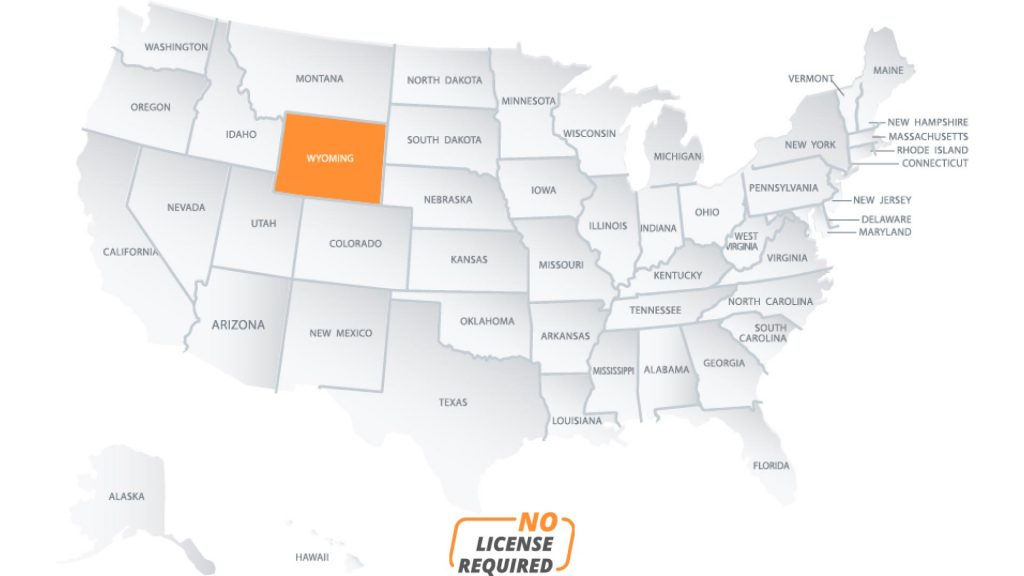

Read MoreWYOMING

WORKERS’ COMPENSATION REQUIREMENTS

All employers must have coverage for all employees. Sole proprietors and partners can exclude themselves from coverage.

How to obtain coverage:

Wyoming is a monopolistic State, The only workers’ compensation insurance option is through the state-administered fund. Self-insurance and private insurance are not permitted.

For more information – Wyoming Department of Workforce Services

Read More

State Pool or Assigned Risk Plans

Assigned Risk Plans, also commonly referred to as the “pool” were started by individual states to make sure employers can obtain workers’ compensation insurance.

In most States if you have employees, you are required by law to obtain Workers’ Compensation Insurance. If you are new in business, performing hazardous work or have a bad loss history, i.e. claims, in many instances, standard market insurance companies are not willing to provide coverage for these types of business.

Since Workers’ Comp is required by law to operate, there needed to be a way for these less than desirable risks to obtain the coverage they needed. As a result, the Assigned Risk Plan or Pool was formed.

The Pool works like this: There is either a state fund that covers these insureds or the insureds are assigned to a company that offers workers’ comp in that State. In order to offer Comp in a State, private insurers are required to take a percentage of these less desirable insureds based on their size of the comp market in that State. Rates are significantly higher than those for the same classification codes in the standard market. Assigned Risk Plans are generally the market of last resort for many states.

The pool is not the place you want to be. Since it is a market of last resort you will be paying significantly more than the same business in the standard market.

These are the reasons and type of employers who may find themselves in an Assigned Risk Plan:

Those employers whose operations are deemed to have a higher rate of injury such as crab fishing, steel erection operations or roofing.

Most new in business employers are not considered acceptable in the standard market. As a result, they are forced to obtain workers’ comp coverage through the Pool.

Employers who have a poor claims history and are no longer acceptable to insurers who operate in the standard marketplace.

As workers’ compensation coverage is required by state law within most states, Pools were needed in order to meet the needs for those employers who could not secure workers’ comp coverage through the standard market. These markets vary a great deal from one state to another. Some states run their own pools while NCCI, the National Council on Compensation Insurance, administers others.

How Do I Get Out of The Pool?

This is not the pool you want to be in. You should make every effort to get out ASAP. If you are new in business, there is not much you can do.

You can, however, make sure that you take safety seriously. If you have accidents, you will pay huge premiums. So, safety should be a number one priority. If you already have a poor claims history, you may want to review your safety protocols.

Most accidents are avoidable when proper safety measures are employed. Lack of training and poor safety protocols can make a once profitable business no longer viable as a result of Workers’ comp premiums alone.

If you are in a high-risk industry, a clean claims history may allow you to get into a standard market. For example, for a roofing company, in some standard markets may require only one-year prior coverage with no claims, lapses in coverage and $75,000 payroll minimum. However other companies may require you to have 3 years and minimum $250,000 payroll. So, it is important to have the right agent working on your behalf.

So the bottom line is that you need to make sure you run a safe operation. This will allow you access to the standard markets. As a result, those lower premiums will go directly into your pocket and not to the insurance company.

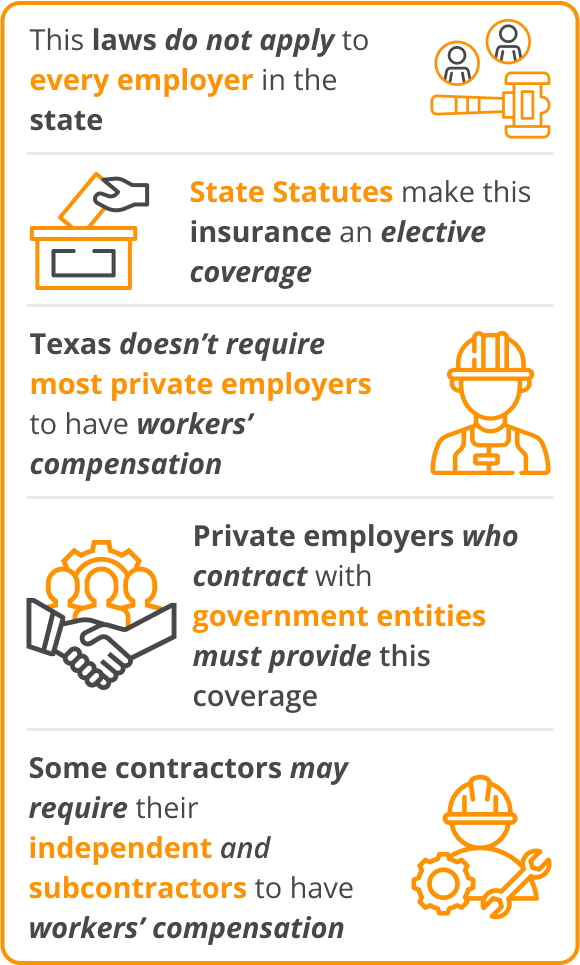

Texas Workers’ Compensation Insurance Laws

Do you know your responsibilities and rights in respect to workers’ compensation insurance if you do business in Texas?

Unlike other states, Texas’ workers’ compensation laws do not apply to every employer in the state. State Statutes make workers’ compensation insurance an elective coverage. Texas doesn’t require most private employers to have workers’ compensation.

But private employers who contract with government entities must provide workers’ compensation coverage for the employees working on the project. Some contractors may require their subcontractors and independent contractors to have workers’ compensation.

An employer that does not obtain this type of insurance coverage must notify the Division of Workers’ Compensation in writing. Employers must also notify employees of the status of workers’ comp coverage at the time of hire. The employer must place notices around the workplace informing employees whether it carries workers’ compensation insurance or not.

Also, if you do not provide workers’ compensation coverage, you lose the legal protection against most lawsuits. This means an injured employee can sue you over a workplace injury or illness.

Also, if you are sued, you cannot raise the following legal defenses.

The employee’s negligence caused the injury.

Another employee’s negligence caused the injury.

The injured employee knew about the danger and accepted it.

Just because it may not be required does not mean you should not obtain coverage.

Legal Protection For Your Business

Employers who do not carry workers’ compensation coverage are financially responsible for an employee’s injury or death if the company is found negligent. The total amount you could be responsible for is unlimited.

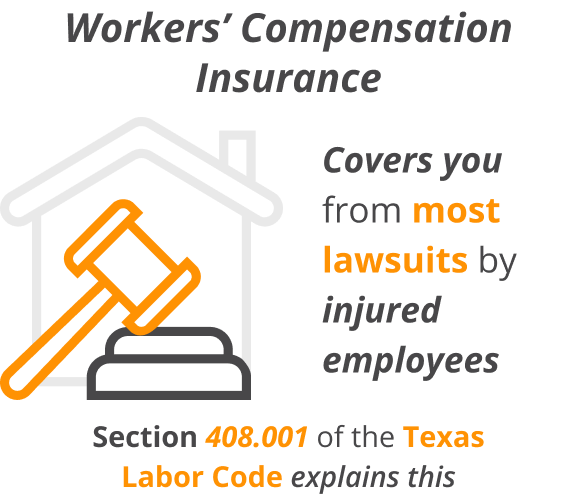

Failing to obtain this coverage could end up costing you your business and more. Section 408.001 of the Texas Labor Code explains that, with only a few exceptions, workers’ comp benefits are the injured employee’s sole source of recovery from an employer who carries valid workers’ comp coverage.

If you have workers’ compensation insurance, you have coverage from most lawsuits by injured employees. Your business can not be the subject of a lawsuit unless an employee died because of your negligence.

Injured employees resolve their claim disputes through the Division of Workers’ Compensation dispute resolution process. If you or the employee is unhappy with DWC’s decision, you may appeal the decision to district court. The court will consider DWC’s decision. Your workers’ compensation insurance company will pay for your attorneys’ fees and other costs.

Having the right kind of workers compensation policy means personal care for injured workers, increased productivity, higher employee morale, lower turnover, reduced claims costs and the elimination of financial worry. Workers’ compensation is one of many expenses employers have to consider.

Obtaining Texas Workers’ Compensation Insurance

There are several ways you can provide workers’ compensation for your employees. You can:

Buy a workers’ compensation policy from a licensed insurance company.

Self-insure your workers’ compensation claims.

Join a self-insurance group.

It’s important to buy from licensed insurance companies. The Texas Property and Casualty Guaranty Association pays claims for licensed insurance companies that become insolvent.

Claims against insurance companies that are not licensed might not get paid. The State operates Texas Mutual Insurance Company. Texas Mutual, originally the Texas Workers’ Compensation Insurance Fund. It was created by the legislature in 1991 as a last resort option for Texas employers struggling or unable to find workers compensation coverage through a licensed insurance company.How Does Workers’ Compensation Insurance Work?

Workers’ Compensation Insurance covers the costs of employee injuries and illnesses as a result of their employment. It also includes lost wages, rehabilitation, new job training along with many other things. It is required by law in most states for businesses with employees.

How Workers’ Compensation Insurance Claims Work?

If an employee suffers a work-related injury or illness, they should report it to their employer at once. All States have a time cut off for filing a claim. Each States reporting requirements are different, so it is imperative that the claim be filed as soon as possible so that coverage can be obtained.

After an injury or illness is reported, there are a number of steps that need to be followed:

Healthcare Professional Visit

The injured employee should be seen by an approved healthcare professional. The injured employee should get medical attention immediately. Delaying treatment may cause claims for benefits to be denied. Make sure the healthcare professional knows that the injury is work related so that the records can be properly notated.

Start The Claim Process

It is an employer’s responsibility to provide the appropriate forms, information about the claims process to the injured employee. This includes providing the contact details for the business’s Workers’ Compensation Insurance company.

File The Claim

The employees should get in contact with the employer’s insurance and notify them of the claim. They should provide the insurance company any State required paperwork and medical reports. As stated earlier, time is of the essence in these matters as there are strict reporting deadlines.

Getting Benefits

If the claim is approved, the employee will start to get Workers’ Compensation Insurance benefits. These include medical bills; rehab costs and a percentage of their wages will be paid to the employee if their injury prevents them from working.

Getting Back To Work

The injured employee’s doctor will determine when the employee can return to work. These recommendations might be for a reduced workload for a period of time. During this time, employers should alter the work schedule of the injured employee, if necessary to allow the employee to return to work.

Safety Training

Finally safety training should be provided to make sure the same type of accident does not happen again.

What Injuries Are and Are Not Covered by Workers’ Compensation Insurance?

Workers’ Compensation Insurance covers injuries that result from an accident at work. There are certain situations where Workers’ Comp Insurance will not provide coverage. The biggest exception to coverage is from injuries that happen because an employee is intoxicated or using illegal drugs.

Coverage may also be denied in situations involving:

Self-Inflicted Injuries: If an employee intentionally injures themselves at work, an employer is generally not liable for the injuries. By intentional it means that the injury was inflicted by the employee who had the mindset of causing injury to themselves. An example is an employee cannot intentionally slip and fall or injure themselves and claim benefits.

Injuries suffered while a worker was committing a serious crime.

Injuries suffered while an employee was not on the job when the injury occurred.

Injuries suffered when an employee’s conduct violated company policy.

If Any Workers’ Compensation Insurance or Ghost Insurance Policies

If you are hired by a large General Contractor or any other large company, before they will let you set foot on the job site, they will request you provide them a certificate of insurance.

This is standard procedure industry wide. They will always ask for basic things at a bare minimum, General Liability Insurance and Workers’ Compensation Insurance.

-

Well, a lot of small contractors do not have Workers’ Comp, since they are not legally required to have workers’ compensation insurance if they have no employees. So you might scratch your head and say, how am I going to get covered? Since you have no employees, how do you obtain a certificate of insurance showing they have Workers’ Compensation Insurance? At first glance, you might think this is a crazy request. Why would anyone get and pay for insurance that offers no coverage? Also, is there even such a policy and why would anyone want such a policy of. The mysteries will be explained below.

Injuries suffered while a worker was committing a serious crime.

Injuries suffered while an employee was not on the job when the injury occurred.

Injuries suffered when an employee’s conduct violated company policy.

Since every state except Texas requires that contractors that have employees carry Workers’ Compensation Insurance, you as a contractor with no employees are exempt from having to purchase Workers’ Compensation Insurance. However, as with everything in life it is not that simple. If you are a contractor with no employees, you should already have General Liability Insurance.

But what about Workers’ Compensation Insurance? the answer is probably no since you have no employees. What can you possibly do that will cheaply and efficiently satisfy your contractual obligations? The answer is an If Any Workers’ Compensation Insurance Policy or a Ghost Workers’ Compensation Insurance Policy.

To get you a certificate of insurance that meets your contractual requirements, you need to purchase what is called either a Ghost Workers’ Compensation Insurance policy or an If Any Policy Workers’ Compensation policy. At this point you might be thinking this is crazy. Why in the world would I buy Workers’ Compensation Insurance to cover employees when I do not have any employees?

You have to step back and think about why this request is being made. This request for this type of coverage is when you are being hired by a general contractor or other large entity. They will request that you provide them a certificate of insurance showing that you have general liability insurance, possibly commercial auto insurance and always Workers’ Compensation Insurance.

The reasoning behind this is relatively straightforward. When the GC’s Workers’ Compensation Insurance carrier does an audit, they will request that they provide certificates of insurance from any subcontractors they hired.

If they cannot provide these certificates showing the sub-contractor had comp coverage, the amount paid to the sub-contractor will be considered wages. As a result these amounts will be included in the GC’s payroll and therefore the GC will be liable for additional premium.

So, for example if they pay you $100,000 and they do not get a COI that amount will be treated as payroll. As a result, their Workers’ Compensation Insurance Premium will be much higher. Also, in many states the liability for uninsured subcontractors who have employees falls back on the GC. You should also make sure if you hire any subcontractors, they provide you with a COI showing they are insured.

You need to make sure that any subcontractors hired provide them with certificates showing they have Workers’ Comp Insurance. If you have Workers’ Compensation Insurance, an If Any or Ghost Policy and you paid money to a sub-contractor when your policy is audited you will be requested to produce certificates from the subs showing they had coverage.

If you do not, those amounts paid to the subs will be treated as payroll and you will get a hefty bill. Finally, it is a best practice to get these certificates before you let any sub start working as it is usually very difficult to get them after the fact.

How Much Does a Ghost or If Any Workers’ Compensation Cost?

A Ghost Policy or If Any Policy Workers’ Compensation Insurance Policy is generally around $1,000 per year. Again, each state is different and this is just an estimate. You can use this number in working out a bid on a job that is going to require you to get this type of policy. It is important to remember to pass these costs along to your customers.

It is not all bad news when it comes to these types of policies. When they are audited, and you show that you had no employees and supply certificates of insurance from any subcontractors you may have hired, you may be entitled to a refund of a portion of the premium you initially paid.

States Where Ghost or If Any policies Are Available

The table below lists where these types of policies are available. For states where this option is not available, there are options for you. Workers’ compensation ghost policy may not be an easy type of policy to find and not every insurance agent is willing to do the work for you. So, make sure you find an agent that is willing to go the extra mile for you.

| State | Availability |

|---|---|

| Alabama (AL) | Available |

| Alaska (AK) | Available |

| Arizona (AZ) | Available |

| Arkansas (AR) | Available |

| California (CA) | Not Available |

| Colorado (CO) | Not Available |

| Connecticut (CT) | Available |

| Delaware (DE) | Not Available |

| Florida (FL) | Available |

| Georgia (GA) | Available |

| Hawaii (HI) | Not Available |

| Idaho (ID) | Not Available |

| Illinois (IL) | Available |

| Indiana (IN) | Available |

| Iowa (IA) | Available |

| Kansas (KS) | Available |

| Kentucky (KY) | Not Available |

| Louisiana (LA) | Not Available |

| Maine (ME) | Not Available |

| Maryland (MD) | Not Available |

| Massachusetts (MA) | Not Available |

| Michigan (MI) | Not Available |

| Minnesota (MN) | Not Available |

| Mississippi (MS) | Available |

| Missouri (MO) | Available |

| Montana (MT) | Available |

| Nebraska (NE) | Available |

| Nevada (NV) | Available |

| New Hampshire (NH) | Available |

| New Jersey (NJ) | Not Available |

| New Mexico (NM) | Available |

| New York (NY) | Not Available |

| North Carolina (NC) | Not Available |

| North Dakota (ND) | Available |

| Ohio (OH) | Available |

| Oklahoma (OK) | Not Available |

| Oregon (OR) | Not Available |

| Pennsylvania (PA) | Not Available |

| Rhode Island (RI) | Not Available |

| South Carolina (SC) | Available |

| South Dakota (SD) | Available |

| Tennessee (TN) | Not Available |

| Texas (TX) | Not Available |

| Utah (UT) | Not Available |

| Vermont (VT) | Available |

| Virginia (VA) | Available |

| Washington (WA) | Available |

| Washington DC | Available |

| West Virginia (WV) | Available |

| Wisconsin (WI) | Not Available |

| Wyoming (WY) | Available |

What Are Workers’ Compensation Class Codes?

Workers’ compensation class codes are numeric codes (usually three to four digits in length) that help identify the type of work that you are involved in. Insurance companies utilize these classification codes to estimate your exposure to risk while determining workers’ compensation insurance. Each profession has its own code.

Developed by the NCCI (National Council on Compensation Insurance), these classification codes include information on the losses that specific work is prone to. Insurance agents and underwriters can refer to the NCCI Scopes Manual to analyze the risks and evaluate workers’ comp insurance costs.

What Is the National Council on Compensation Insurance?

The National Council on Compensation Insurance (NCCI) is an organization that collects workers’ compensation data and figures such as exposure units, premiums, and losses stats to:

Formulate advisory workers’ comp ratings

Develop workers’ comp policy forms

Injuries suffered while an employee was not on the job when the injury occurred.

File workers’ comp information with regulatory bodies

The insurance companies look up to the NCCI to identify the risk level for various professions. The NCCI is a non-profit organization that provides services to insurance agents, insurers, regulatory authorities, legislators, state governments, and other related parties.

What Are NCCI Class Codes Used For?

The National Council on Compensation Insurance maintains over 700 classification codes. These NCCI codes are used primarily to determine and allocate the cost of Workers’ compensation insurance considering the risk levels of a particular trade among the employers.

Insurance underwriters consider a number of factors while determining customers’ premiums, classification codes being one the most important in determining a rate.

NCCI Codes Determines the cost of Workers’ Compensation insurance by assessing the risk level of the job. By using NCCI codes, companies that fall under high-risk service areas pay more for insurance coverage in comparison to low-risk industries.

Many businesses operate under different workers’ comp classification codes based on the fact that they are employing workers for many different jobs. Take for instance a large roofing company.

They may have several people on the payroll. The receptionist job is not as dangerous as the employees that are doing the roofing. It is imperative that you make sure your employees are classified correctly.

Since in most states Workers’ Compensation premiums for roofers is generally around 50% of the payroll and an office worker is generally less than 1% of payroll. You can see the importance of classifying employees correctly.

While a majority of states follow the NCCI class code system, others choose to operate with more independent guidelines. NCCI NOC codes help the insurance companies to easily evaluate the risks that a particular job may involve. It also allows consistency in workers’ comp classification codes across states. Different classification systems include:

NCCI states

Independent Bureau States

Monopolistic States

About two-thirds of states follow NCCI codes because they subscribe to and abide by the National Council of Compensation Insurance. These states have their own Workers’ Compensation Insurance agencies, but they rely on the NCCI for administration. formalities. Some of the examples of NCCI states are Alabama, Colorado, Georgia, Kentucky, Louisiana, Mississippi, South Carolina, Texas, and Virginia.

A total of eleven states along with the District of Columbia are categorized as the Independent states as they do not follow the NCCI rules or guidelines. These eleven states include California, Massachusetts, Pennsylvania, Delaware, Minnesota, New York, Indiana, Wisconsin, New Jersey, Michigan, and North Carolina.

The Monopolistic States are the four states that interdict the sale of private workers’ comp insurance to employers and are known as the monolithic states. These states are Washington, North Dakota, Wyoming, and Ohio.

What Are the Benefits of Accurate NCCI Codes?

No one wants to pay more for the Workers’ comp insurance policy and therefore, it is crucial to identify and assign accurate NCCI codes. Insurance providers are equally responsible for evaluating the accurate NCCI codes; any sort of mistake can result in paying extra premiums. On the other hand, any wrong class codes can cause cancellation or denial to pay claims.

Where to Look Up NCCI Class Codes

To look up NCCI classification codes, you may refer HERE.

Experience Modification

One of the most important components in determining Workers’ Compensation Insurance cost is your previous loss history. This is usually called your experience modification (EM).

It is a numeric representation of your business’s claims history and safety record compared to other businesses in the same class code. The average company is assigned an EM of 1, if you have poor safety and claims, your EM will be greater than 1.

If you have a good safety and claims history, your EM will be less than 1. This can greatly affect the amount you pay in premium. This may sound complicated, but it is actually very simple as the examples I will show will help you understand how important this is.

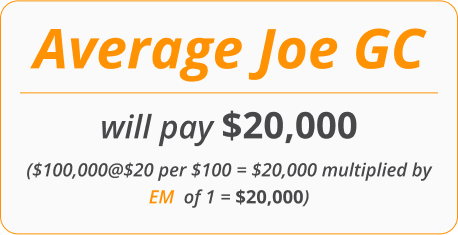

Example of how EM affect the Policy price

I will use it as an example of 3 General contractors. Safety Sam GC with EM of .75, Average Joe GC with an EM of 1, and Risky Ralph GC with an EM of 1.25. They all have a payroll of $100,000. The state rate for coverage is $20 per $100 of payroll.

All these policies will have the same coverage. So you can clearly see that a safety-conscious business will pay off in the end. With Risky Ralph GC paying $10,000 a year more than Safety Sam GC. If your payroll is large, this can amount to huge differences.

How Much does Workers’ Compensation Insurance Cost?

The main factors in determining the costs are:

Type of business: The National Council on Compensation Insurance (NCCI) oversees Workers’ Compensation issues in much of the country. The NCCI has developed a system of class codes to categorize the types of work people do. Currently, there are more than 700 codes. Each class code identifies a specific type of work. The higher risk a profession has, the more it costs to buy Workers’ Compensation for an employee in that profession. It stands to reason that it would cost more to cover a roofer than someone that strictly works in the office answering phones.

Your Location: The cost for Workers’ Compensation Insurance varies greatly from state to state. For example, in Texas, you will pay about $13 per $100 of payroll. In California, you can pay as much or more than your payroll for coverage. So in California for example, if you had $100,000 in payroll your insurance cost would be around $100,000. As a general rule, the more liberal the state is, the more you will pay./p>

Age of your business: New companies will generally have to go into their state’s assigned risk plan oftentimes called the Pool. The Assigned Risk Plan was formed by individual states to make sure employers can obtain Workers ‘Compensation Insurance. As Workers’ Compensation Insurance is required by law in most states, insurance companies that write business in that state are required to accept a certain number of “Pool” companies. Assigned Risk Plan rates are generally higher than those for the same classification codes in the standard market. Assigned Risk Plans are generally the market of last resort for many states. Some states administer their own programs while NCCI, the National Council on Compensation Insurance administers others.

Safety Record or Loss History: Workers’ Compensation Insurance cost is also determined by your previous loss history. This is usually called your experience modification (EM). It is a numeric representation of your business’s claims history and safety record compared to other businesses in the same class code. The average company is assigned an EM of 1, if you have poor safety and claims your EM will be greater than 1. If you have a good safety and claims history your EM will be less than 1. This can greatly affect the amount you pay in premium. This may sound complicated, but it is actually very simple as the examples I will show will help you understand how important this is.

The cost of the policy is determined by a simple formula, but how those numbers are figured is any but simple. At the most basic level the premium you will pay is determined by the following:

Your NCCI Class code or equivalent depending on your state and even City you work.

Amount of payroll./p>

Your Experience Modification- A fancy way of saying how your company’s safety/claims record compares to others in the same industry.

So to determine the premium the formula is:

Workers’ Compensation When You Are Self Employed

What Is Self Employed Workers’ Compensation?

You might ask yourself; do I need a Self Employed Workers’ Compensation policy if I run my own business and have no employees? The first and most basic question that should be asked is What is Self Employed Workers’ Compensation? At its simplest level, Workers’ Compensation protects employees from injuries or illness that arise from their job-related duties.

Some examples are a painter that falls off a ladder and breaks her leg or a worker in a manufacturing facility that is exposed to toxic substances and develops cancer. In almost every state if you have employees, you are required by law to have Workers’ Compensation Insurance to cover your employees.

The question that comes up quite often is, “I don’t have any employees, do I need to get Workers’ Compensation insurance?” The answer is that in most states if you are self employed you are not required to have Workers’ Compensation insurance.

Some states may require you to file an affidavit. Two examples are Illinois, where you can elect to have coverage and Kentucky, where you have to sign an affidavit to opt out of coverage.

WHAT IS COVERED

One of the most basic questions asked when purchasing an affordable Self-Employed Workers’ Compensation Insurance Policy is what is covered? The coverage you obtain under the policy is the same as if you purchased coverage for an employee. There is no difference in the coverage afforded.

State law determines how and what benefits are available to an injured worker. Most state Workers’ Compensation laws typically provide the following types of benefits:

Medical Coverage: Includes doctor visits, hospital care, prescription medications, physical therapy, and any other medical treatments deemed necessary.

Disability Income: Provides a replacement of income lost when workers are unable to work due to an on-the-job injury. The amount and duration of benefits depend on whether the disability is temporary or permanent, and partial or total. This is usually a percentage of wages and is generally around 70% of the injured workers’ weekly wages in most states./p>

Job Rehabilitation or Retraining: This provides support and training for workers who cannot return to their prior occupation to learn a new skill based on their current capabilities.

Death Benefits: If a worker is killed on the job their spouse and minor children are entitled to payment of a death benefit.

To sum it up all states give injured workers similar types of benefits, the amounts they pay varies greatly from state to state.

Workers’ Compensation Insurance Vs. Disability Insurance

One thing that is often overlooked when you are self-employed is how you will earn a living if you become injured, sick or disabled. Medical bills and your regular bills will start to pile up. You will in most cases have no other source of income.

Jobs will go unfinished, new work will not be started. No money will be coming in as work has stopped. You have maybe looked into purchasing disability insurance in case of such a situation. You would have discovered that these premiums are outrageously expensive.

This is where the alternative of electing to purchase a low-cost Self-Employed Workers’ Compensation Insurance Policy may be a financial lifesaver.

The cost of Workers’ Compensation is significantly lower than disability insurance, but it contains most of the same benefits for lost wages and the like.

The important caveat is that your injury or illness must be caused by a work-related incident for Workers’ Compensation to cover you. If you break your arm at the local skateboard park showing off to your kids, you will not have coverage. It should also be noted that workers’ compensation will also pay medical bills and rehabilitation costs as well.

Finally, if you decide to get coverage, it will give you the added benefit of being able to bid on jobs with larger companies and general contractors as they will almost certainly require you to show proof of workers’ compensation coverage before they will let you on a jobsite.

Workers’ Compensation Audits

When you get Workers’ Compensation Insurance, you will pay an estimated premium up front based on the figures you provide your insurance agent. You can expect an audit at least every policy term for low-risk trades and up to quarterly if you are a high-risk trade or new in business.

As long as you are aware of this it should be of little or no concern. This is assuming you gave your agent accurate information in the beginning and followed some simple basic rules.

You will have to provide the insurer copies of your payroll records. This should be a relatively painless process as these are legally required to be filed by your business in most instances. The trouble comes in if you grossly underestimated your payroll.

It is important to remember the original figure you gave was just an estimate of what the premium might be. The actual premium is going to be based on your actual payroll.

The other major pitfall that traps many unwary contractors is money they paid to subcontractors. If you do not obtain a certificate of insurance from a subcontractor showing they had their own Workers’ compensation Insurance, any money paid to them will be treated as payroll. As a result, you may be shocked with a large bill come audit time. That is why it is imperative to collect those certificates of insurance before any subcontractor starts work. Trust me experience has shown it is next to impossible to get them after they have been paid.

As a side note when I started selling insurance there were some contractors that thought they were wise guys. They tried gaming the system by forming new corporations with different tax id numbers to get around what they owed. I can assure you those days are over. They have many ways to link various companies today by using technology. So it is always a best practice to take these obligations seriously.

Final Thoughts on Workers’ Compensation Insurance

Congratulations and thank you for getting to the end of this E-Book. By reading this you are at least aware of the basics of how Workers’ Compensation Insurance works.To summarize the most important parts of this E-Book are as follows:

Safety of your workers and your jobsite should be a number one priority. Not only to protect your workers, but it will save you money in the long run.

Make sure your employees are properly classified. Having your office staff payroll included in your construction workers payroll can cost you thousands of dollars.

Make sure your experience modification is correct. If you are unsure about your current EMR rate, contact your insurance agent to find out what your rate is. Your EMR rate can also be found on the “Declarations” page of your company’s workers’ compensation policy. Again, an incorrect figure can cost you money.

Be diligent if you hire subcontractors in collecting certificates of insurance from them showing they have workers’ compensation insurance. If not, you can expect a big bill come audit time.

Download a PDF Version of the E-Book Now

Get a Workers Comp Quote Now