Accidents happen in every industry, but the risk of a mishap is elevated in the construction industry. Historically, 1 in 5 US worker fatalities occurred in the construction industry, and the injury rate was 71 percent higher than the average of all other industries.

Cumulatively, these accidents added up to $11.5 billion of losses. In addition to injuries and fatalities in the construction industry, there are countless more cases of costly property damage and losses. If you’re a contractor, the best way to protect your company and your workers is to be adequately insured.

An insurance provider extends financial protection or reimbursement against losses to an individual, organization, or business in exchange for premium payments. The most common insurance policy for contractors to obtain is liability insurance.

In this case, a general liability insurance policyholder is protected financially against claims made by a client related to damage or injuries caused by the contractor or their employees. Policyholders and additional insureds are also covered by a liability policy if a third party sues for damages or loss occurring on their property.

Policyholders and additional insureds are also covered by a liability policy if a third party sues for damages or loss occurring on their property.

With various types of commercial insurance, choosing the right types of policies for your business depends on several factors, including:

- The industry you’re in.

- What kind of property you need to insure.

- How many people need to be insured.

- The value of property and equipment you need to insure.

For example, builders have very different insurance requirements than lawyers. General liability, on the other hand, is a term that describes a policy that covers a wide range of risks.

In this article, we’re going to look at the similarities and differences between named insured and additional insured when it comes to your general liability insurance coverage. Let’s break it down to basics first and then dive into the finer details below.

Named Insured

Additional Insured

- Name appears on the policy

- Has full policy coverage

- Responsible for premium payments

- Name appears on the policy

- Has full policy coverage

- Responsible for premium payments

What Does Named Insured Mean?

The Named Insured is the person or entity whose name appears on the insurance policy certificate, stating they are insured on the dates specified. There can be more than one named insured, and they usually all appear on the first page of the policy document.

Named insureds are most often the business entity itself, any subsidiaries, and the business owners. Named insureds receive 100% of the full benefits of the policy and usually have input into policy decisions, including policy coverage type, policy limits, and amounts.

The first named insured is typically the policy owner, and they are generally responsible for paying the premiums. All named insureds receive notice of any change to or cancellation of the policy and might be liable for premiums.

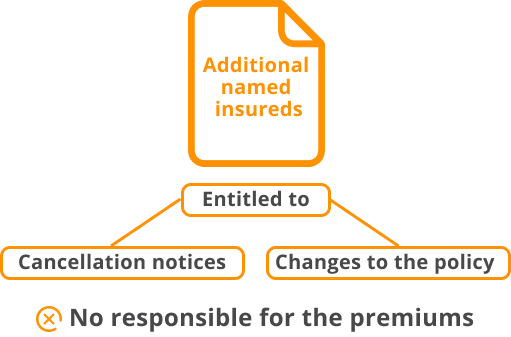

Additional named insureds may be added to the policy at a later date. They generally aren’t responsible for the premiums but are entitled to cancellation notices or any changes to the policy coverage. They are covered as a named insured and usually are a partner, co-owner, or affiliates of the named insured.

What does Additional Insured Mean?

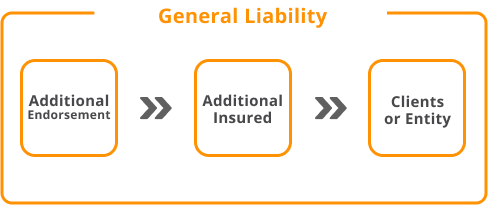

A close up of an insurance broker’s hands talking to a customer. An additional insured is a person or entity covered by the policy for general liability through an added endorsement. Generally, these endorsements protect the additional insured from being sued due to the fault of the named insured.

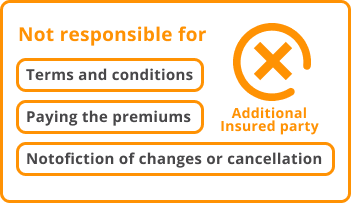

An additional insured party is not responsible for the terms and conditions of the policy or for paying the premiums. They are also not typically notified of changes or cancellations to the policy.

Two types of additional insured parties can be added to a policy. Named additional insureds are listed in the addendum. These are usually clients or partners (people with an insurable interest who stand to lose if they are sued due to a mistake your company made).

The policy can also have a blanket additional insured clause covering people not listed in the document. For example, a blanket additional insured endorsement typically occurs when a general contractor requests to be added as a subcontractor’s additional insured.

Before they extend coverage to additional insureds, insurance companies generally list requirements that must be met.

For example, the insurance company may require those additional insureds, like subcontractors, to contract with a general contractor who has an additional insured clause written into their policy.

If the insurance company agrees that the person or entity meets its requirements, they will issue a certificate of insurance to the additional insured.

3 Main Differences Between Named & Additional Named Insured

The three things that differentiate between named insured and additional insured status are claims, coverages, and policy/endorsement.

Ownership

Named insureds are the policyholders. They are responsible for purchasing the policy, negotiating the details, and paying the premiums. Additional insureds are not decision-makers and are not responsible for premiums.Coverage

The named insured is always covered by the policy, while an additional insured has certain limitations on the coverage provided. Only incidents related to the named insured’s work and responsibilities are covered.The additional insured isn’t covered if the damage, injury, or loss aren’t related to the named insured. The additional insured’s liability coverage might be for a single event or for an extended time.Policy vs. Endorsement

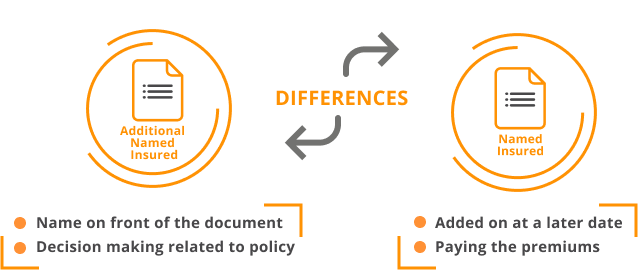

The named insured is listed on the front declarations page, usually in the opening section of the insurance policy document. The additional insured is added through an additional insured endorsement addendum at a later date, as the need arises.

Get Covered with Contractors Liability

It can be confusing, but it comes down to this: A named insured has their name right there on the front of the document and participates in the decision-making related to that policy.

In contrast, an additional insured is added on at a later date. The named insured has full coverage from the policy, while the additional insured is only covered when the claim directly relates to the named insured. Regardless, they are both excellent forms of risk management.

Lining up the right insurance can be complicated, especially for contractors that often find themselves in a high-risk industry.

Making sure you have the right coverage for your business insurance is not just important, but it could save your business from financial devastation should a major accident occur that affects yourself, your employees, or your clients.

Let us take the hassle out of searching for the best insurance quote for your contracting business.

Tell Contractors Liability about the specific needs of your business, and we’ll help you find a policy tailored to match your company at the best possible price.

If you need help with adding named insureds or additional insureds to your business insurance policy, Contractors Liability can help you navigate the insurance markets and make sure your business is protected.