Why Do I Need Insurance For My Business?

According to Statista, 8.2% of contractor professionals and managers are uninsured, leaving this group vulnerable to unexpected financial loss that can potentially devastate their bottom lines and operations.

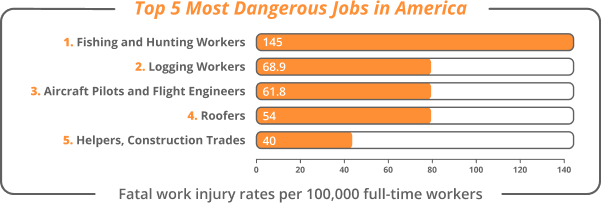

Nearly every type of business faces liability risks, so every business needs insurance and proper coverage. Contractors are especially susceptible to these risks due to the physical and equipment-heavy nature of the work.

The benefits of liability coverage can’t be overstated. Business insurance protects you and your company against financial losses when the unexpected (but completely possible) happens. Construction sites can be dangerous places riddled with all sorts of risks and potential for bodily injury. The bottom line is this: If someone can sue you for something, you need to insure against it.

Insurance is also a great selling point. Businesses and homeowners alike are leery of hiring an uninsured contractor and will probably ask for proof of insurance. Why? Your insurance protects them, too. If something happens to one of your crew members on their property, homeowner’s insurance will not cover the damages.

Instead, there are two types of insurance policies that are better suited for contractors and their work—general liability and professional liability.

| General Liability | Professional Liability |

|---|---|

| General liability insurance covers physical risk, which includes property damage and injuries. | Professional liability insurance covers things like negligence, omissions, and errors. |

What is General Liability Insurance?

Commercial general liability coverage helps protect your business and reputation from common risks. General Liability insurance has three components:

1. Personal Injury and Property Damage Liability

This pays legal defense costs for lawsuits stemming from bodily injury claims or property damage claims. (Work-related injuries are covered by a different type of insurance, workers’ compensation insurance).

Bodily injury insurance covers the costs when people who do not work for you get a physical injury on your job site. For example, if you are building a home and a neighbor trips on a roofing tile and breaks an ankle, he or she could sue for damages. Property damage, conversely, would include something like breaking a window while painting a building.

2. Personal and Advertising Injury

Personal and advertising injury liability insurance protects you in case you are sued for:

- Libel or Slander

- Having someone arrested for false reasons.

- Copyright infringement.

- Malicious prosecution.

- Stealing an advertising idea.

- Wrongful eviction.

- Committing an invasion of privacy (walking into a customer’s home without permission).

3. Medical Payments

If you’re sued for bodily injury, this part of your insurance coverage pays the medical bills for the injured person.

What Does a General Liability Policy Cover?

General liability insurance covers your costs for legal expenses related to third-party lawsuits. In other words, if you are sued, general liability coverage pays all the costs associated with going to court: legal fees, court costs, and settlements or judgments.

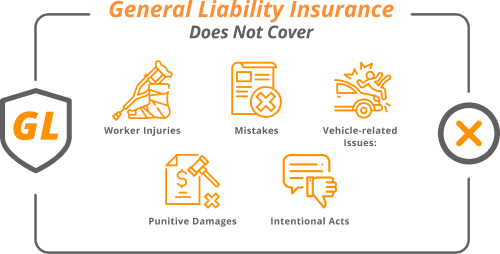

What General Liability Insurance Does Not Cover?

It’s equally important to understand what isn’t part of general liability insurance coverage and what kinds of insurance covers other issues. Here’s what’s not covered:

- Worker injuries: People who work for your company are covered by workers compensation insurance. (Texas is the only state that does not require you to carry this insurance.)

- Mistakes: Mistakes such as shoddy workmanship or materials are not covered under general liability. It is instead covered by professional liability insurance.

- Vehicle-related issues: Accidents and other vehicle-related injuries or damage are covered by commercial vehicle insurance.

- Punitive damages: Punitive damages are intangible injuries like mental anguish resulting from a traumatic experience. General liability coverage does not typically cover punitive judgments.

- Intentional acts: General liability won’t cover your costs if your employee gets angry and starts a fire or commits otherwise intentional acts of damage and harm.

How Much Does General Liability Insurance Cost?

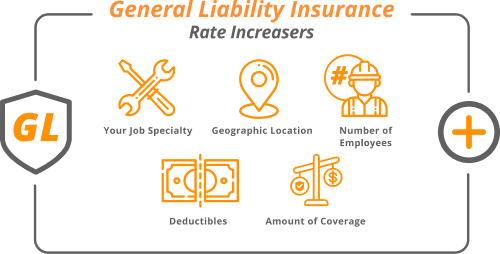

Rates vary based on a lot of factors. Your rate will depend on:

- Your job specialty: A roofer faces very different types of risk when compared to a painter or an interior decorator.

- Geographic location: Rates vary by different states and counties. In heavily populated urban areas, insurance tends to cost more than it might in rural areas.

- Number of employees: The more employees you have, your business naturally faces more risk and will need to extend coverage for everyone who is liable.

- Deductibles: Much like car insurance, if you set a higher deductible, you pay lower premiums.

- Amount of coverage: Naturally, you pay less if you choose $100,000 of insurance coverage than if you choose $1 million in coverage. The amount of coverage you choose will likely depend on the size of your company and the contracts you typically land. Your risk is greater when you are working on a 10-story office building than on a private house.

Who Should Take out General Liability Insurance?

Since general liability insurance covers a wide range of common risks and physical damage, almost every large and small business owner who has an office or a store or who goes out to job sites should seek proper coverage. For example, an architect who meets clients in his office needs coverage, and so does a handyman who works for homeowners.

What is Professional Liability Insurance?

Professional liability insurance (PLI) is a different type of coverage also known as errors and omissions insurance. It helps cover the court costs and associated fees in the event that a negligent act, error, or omission is made by your business. Typically, this type of insurance is used by professional service providers, like accountants, lawyers, real estate professionals, computer programmers, and medical professionals. However, contractors can still take out professional liability insurance coverage.

What Does a Professional Liability Insurance Policy Cover?

Most court costs and other financial damages arising from service errors are covered. Some examples are:

- Medical mistakes: Unintentional malpractice insurance is one type of professional liability insurance.

- Accounting errors: If an accountant makes a mistake that costs the client, the client can sue.

- Programming errors: If an app developer builds an app for a business and a programming error costs the client money, the app developer may be covered by professional liability insurance.

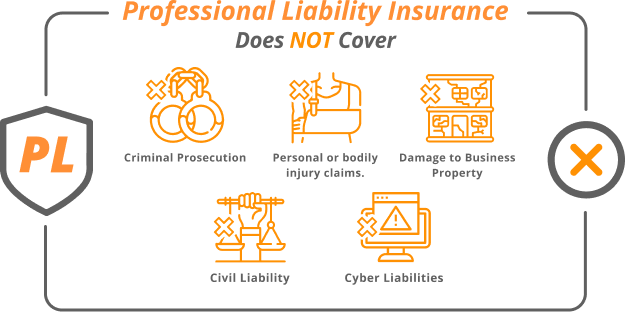

What Professional Liability Insurance Does NOT Cover

Professional liability coverage does not include:

- Criminal prosecution.

- Personal or bodily injury claims.

- Damage to business or commercial property.

- Civil liability, aside from what’s listed in the policy.

- Cyber liabilities such as data breach.

How Much Does Professional Liability Insurance Cost?

The cost of professional liability insurance varies by location, profession, and coverage limits. It can cost as little as $20 per month, but a doctor with a history of malpractice claims can pay substantially more.

The cost can also vary by state or county. An AMA study found: “In some areas of New York, premiums for obstetricians/gynecologists reached $214,999… while premiums for obstetricians/gynecologists in some areas of California were $49,804.”

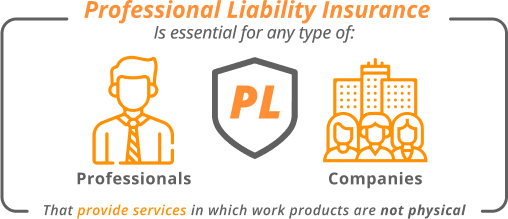

Who Should Take out Professional Liability Insurance?

Professional liability insurance is designed to protect companies or professionals that provide services in which work products are not physical. This might include web developers, tax preparers, law firms, and cyber security firms.

Protect Yourself and Your Business With Contractors Liability

Picking the right insurance for your business can be challenging. Reputable insurance companies will help you negotiate the contract terms and get the business liability coverage you need.

The type of insurance you choose depends on the type of services you offer. Building contractors primarily need general liability insurance to protect against all the accidents that might happen on a job site.

Looking for more information on what kind of insurance your contracting business needs? Call now or get a free quote now!