The general contractor’s insurance doesn’t have to be complicated. Let’s start by first identifying what the insurance company considers a general contractor and the two categories that most general contractors fall into.

Wikipedia defines a general contractor as follows: The general contractor is a manager, and possibly a tradesman, employed by the client on the advice of the architect, engineer, or the architectural technologist or the client him/herself if acting as the manager. A general contractor is responsible for the overall coordination of a project.

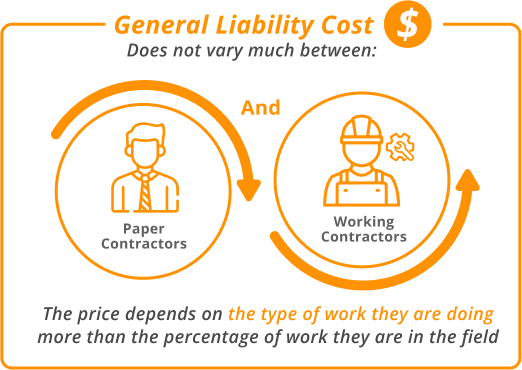

For insurance purposes, insurance companies define general contractors as “paper contractors” and “working contractors.”

Paper Contractor’s VS Working Contractors

Paper contractors: Manage projects and do not do any physical work. They charge their client a fee for their work and hire sub-contractors to do the work.

Working contractors: Are out in the field and subcontract less than 50% of their work to sub-contractors, while the remainder of the work is completed by their own company or themselves.

With respect to insurance, the liability rate is not much different for paper contractors and working contractors; however, workers’ compensation can be very different. The overall cost for general liability insurance is not much different between paper contractors and working contractors, in that the price primarily depends on the type of work they are doing more than the percentage of work they are in the field.

For example: plumbers insurance is much different than roofers insurance, in that roofing insurance is attached to much more liability on behalf of the insurance company and therefore, costs much more money.

In my 18 year history insuring contractors, I feel the biggest difference between the “paper contractor” and the “working contractor” is an overall mindset. First of all, one has to look at why they need liability insurance in the first place:

- Do they need to buy insurance by law per each state?

- Do they need to buy insurance because their client demands it?

- Or do they need insurance because they have assets to protect and could not afford the attorneys and judgments on their own in the event of a large lawsuit against them?

General Contractors Insurance

Next, when purchasing general contractors liability insurance, one has to realize they are entering into a binding contract with the insurance company and they are responsible to retain certain documents between them and the sub-contractors they are sending work to. Understanding this is critical.

When you purchase insurance you are paying money to transfer risk from yourself or your company to the insurance company. The insurance company is going to charge you a premium for retaining this risk. The more risk there is, the more premium they are going to demand.

If you want a lower premium that everyone wants, you are going to have to transfer less risk to them. This is done contractually, through the additional insured endorsement on your policy. The purpose of this endorsement is to transfer the risk of you being sued to your sub-contractor. This is done by adding your name onto your sub-contractor’s insurance as an additional insured.

This endorsement adds your name to your subcontractors policy. You are now in the same boat as your subcontractor in the event your company is named in a lawsuit. As you know, if you are a general contractor on a project, your name will be added to a claim.

At this point, your insurance company is now looking at defense costs and also a liability on the judgment. When the insurance company retains the costs, they are passed on to your clients; however, what if the insurance company can transfer this risk where you would not have to pay or defend on a judgment against them?

This is done contractually through this endorsement and is demanded of every client obtaining general contractors’ insurance. This is that their company will be added onto their sub-contractor’s insurance as an ADDITIONAL INSURED.

This means if ABC General Contractor, Inc. hires Joe’s plumbing in building a house that ABC General Contractor Inc, obtain proof (certificate of insurance) that ABC is named onto Joes Plumbing. In this case, ABC gets a copy of a certificate of insurance on an accord 25 form showing them and Joes Plumbing together on the same policy.

Now let’s say ABC General Contractor is building a house and it is almost built when Joe plumbing forgets to tighten a valve. At night, the pipe bursts and floods the whole house along with the new Cherry wood floors. This was not ABD General Contractors, Inc. fault, but the homeowner is writing the check to ABC and ABC will be named in the lawsuit.

There is a liability on ABC for they hired Joe. In the case ABC is an additional insured on Joe’s policy, ABC’s insurance company is not involved. Joe’s company handles this. Now ABC insurance company is not paying lawyers fees as well as potential judgment. Risk is taken off ABC insurance company and therefore, the premium is now lower.

Why do I need General Contractors Insurance for Myself?

The next question that all “paper” general contractors ask is “Why do I need insurance for myself if I am transferring risk to my sub-contractors insurance company. There are 4 main reasons for this:

What if

You and your sub-contractor have a conflict of interest in the case brought upon you? Are their attorneys really going to defend you when you have not paid them a dime? What if they throw you under the bus to save their client. Who defends you then? Without your own insurance, you are left in the cold.Your limits are the same as theirs and are cut up.

If your client has 1 million in general contractors insurance, you are splitting it with them. Both of you will be left with only $500,000. And what if there are other parties in the lawsuit? Then you have even less. Also, they can provide you a certificate of insurance, but what if they did not pay their insurance bill? Then you have left on your own again.No choise

It is the law of the land, and if you want to operate legally, you have to abide.It’s required by your clients.

for risk is passed down the river from big contractors to small ones. Their insurance company demands the businesses they work with have liability insurance to protect themselves. No insurance, no work, no choice!

Hopefully, you would agree that you are best purchasing your own general contractor’s insurance policy at this point. If you’re in the market for a rate, get an instant online quote. I think you will find our system easy to use and we can usually get something bound within 24 hours.