The Endorsement I Have Just Been Asked For?

You are negotiating a large new contract, and the owner requests that you provide them a certificate of insurance naming them as additional insured.

You might wonder, can I get that and how much will it cost me?

You can relax; it is a simple endorsement that you can add to your general liability insurance policy. This is a very common endorsement, and the exact language of the endorsement is as follows:

This endorsement modifies insurance provided under the following: COMMERCIAL GENERAL LIABILITY COVERAGE PART SCHEDULE Name Of Additional Insured Person(s) Or Organization(s): Location(s) Of Covered Operations Information required to complete this Schedule, if not shown above, will be shown in the Declarations. A. Section II Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for “bodily injury”, “property damage” or “personal and advertising injury” caused, in whole or in part, by:1. Your acts or omissions; 2. The acts or omissions of those acting on your behalf; in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above. B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply: This insurance does not apply to “bodily injury” or “property damage” occurring after:1. All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed;or 2.That portion of “your work” out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

The first reaction after reading that is, what does this mean to me?

After you take a breath, it is pretty simple to understand. In order to be allowed on a construction site or before starting work, contractors must show that they have insurance.

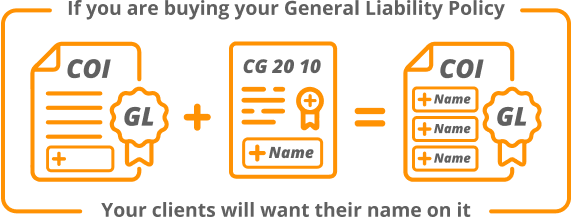

The people you will be working with also will want their name on the certificate of insurance naming them as additional insureds on your commercial general liability (CGL) policy.

By requiring this, the parties hiring the contractors have the expectation that the additional insured endorsement will defend them in case they get sued for something relating to your work. Whether or not they will be covered depends on the additional insured endorsement.

The most common additional insured endorsement for contractors is the CG 20 10

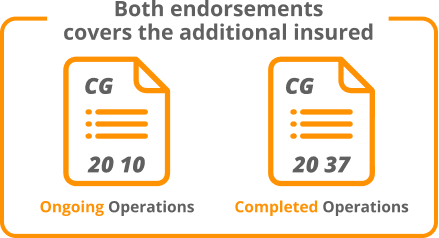

The CG 20 10 covers the additional insured with respect to liability caused by your ongoing operations. “Ongoing operations” does not include “completed operations.”

Therefore, the current form CG 20 10 does not include completed operations coverage for the additional insured. If that coverage is required, you will also need the CG 20 37 endorsement.

Ongoing Operations Occurrence, Example:

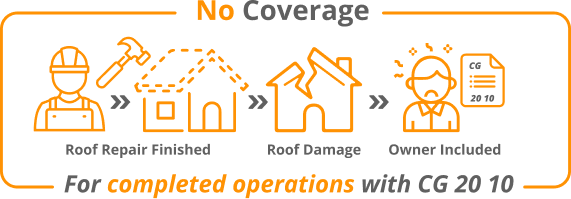

Say after 5 weeks after you finish the roof, the chimney falls over on the neighbor’s greenhouse. This is property damage out of your completed operations since to job has been completed. Once again, the neighbor sues the property owner.

If the property owner was named as an additional insured using the current CG 20 10, the property owner would not have covered for the completed operations exposure as this is not ongoing operations, as your completed work caused the damage.

The property owner would not have coverage for the completed operations exposure under the contractor’s CGL policy.

The current form CG 20 10 after 1985 does not provide coverage to the additional insured for completed operations. It only provides coverage for ongoing operations, and this was a completed operations exposure.

If they also wanted coverage for completed operations, they would need a CG 20 37 endorsement.

Blanket Additional Insured Endorsement

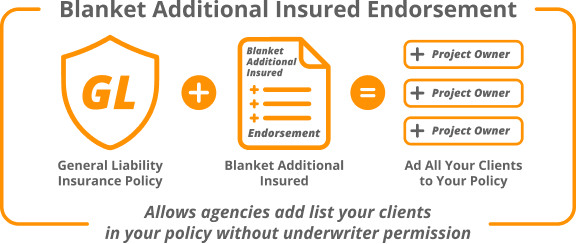

The Blanket additional insured endorsement is an endorsement that allows your agent to issue certificates of insurance to add as additional insureds, those individuals or entities for whom the named insured is performing operations and with whom the named insured has agreed in writing to name as an additional insured.

Having the blanket endorsement allows insurance agencies to send out these endorsements without requesting permission from the insurance carrier’s underwriters, which sometimes can take days.

This makes the request for a certificate of insurance quicker to process, therefore allowing you to start work sooner.

A requirement of getting a blanket additional insured is the written contract requirement saying you must name the owner as an additional insured.

A blanket additional insured endorsement can be easily added to your General Liability Insurance. However, you need to be aware of this when comparing quotes. You need to ensure that blanket additional insureds are included when comparing quotes to have an equal comparison.

By having blanket additional insured, you can request to have all your clients or customer listed as additional insured on your policy with no additional charge.

The cost to add additional insured varies by the insurance company but can be as little as $250.

In some policies, the endorsement is included at no extra cost. Regardless of cost, it is typically far cheaper to pay for the blanket additional insured as opposed to each required party.

You need to make sure any quote you are given includes Blanket Additional endorsement. Especially on larger projects, the number of entities you might need to list as additional insured can be significant.

You can rest assured that the agents at ContractorsLiability.Com can get you the right policy you need.