This article will show you how to distinguish the difference between a 1099 or W-2 worker. You may have noticed if you were reading closely that I never mentioned the word “employee”. This was chosen with good reason. If you take the next five minutes and finish reading this article you will learn why. You may also save yourself and your business a world of hurt by avoiding the entanglement of the all-powerful Internal Revenue Service.

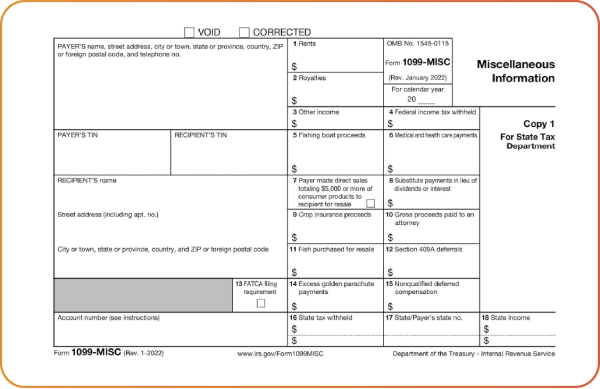

Let us start with the basics. Contractors are constantly using the word employees when describing the people that work for them. In most instances this is wrong. A person that receives a 1099 at the end of the year for the money they earned is legally an independent contractor. The IRS has recently changed how these payments are named. Previously they were reported on a 1099 Miscellaneous Form (1099-MISC).

Now they are required to be reported on a separate 1099 Non-Employee Compensation Form (1099-NEC). There has been no change in any tax consequences as a result of this change. However, it does show that the IRS intends to start strictly enforcing the rules concerning 1099-NEC payments and W-2 payments.

What Is 1099 Non Employee Compensation

1099-NEC, is also known as payments from a business to an independent contractor from a business to persons that provided services to the business. Contractors as a general rule like to treat labor costs this way for a number of reasons. If you keep reading I will let you know the main reasons contractors prefer this way for payment. The IRS has very strict guidelines that set forth the definition of an Independent Contractor for tax purposes.

The general rule is that an individual is an independent contractor if the party making the payment has the right to control or direct only the result of the work. They are not allowed to dictate what will be done and how it will be done.

Facts that provide evidence of the degree of control and independence fall into three categories:

- Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the party making the payments? These include things like how a worker is paid, whether expenses are reimbursed, who provides tools, materials, etc.

- Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue after the project is complete? Also is the work performed a key aspect of the business, such as roofing company paying someone to supply labor to install a roof. Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no “magic” or set number of factors that “makes” the worker an employee or an independent contractor and no one factor stands alone in making this determination. Also, factors which are relevant in one situation may not be relevant in another.

At the end of the year, the person receiving payment is issued a 1099-NEC to be used in filing their tax return. Generally, no money is withheld for taxes. Further, the party making the payment has no obligation to pay “payroll taxes” on the money paid.

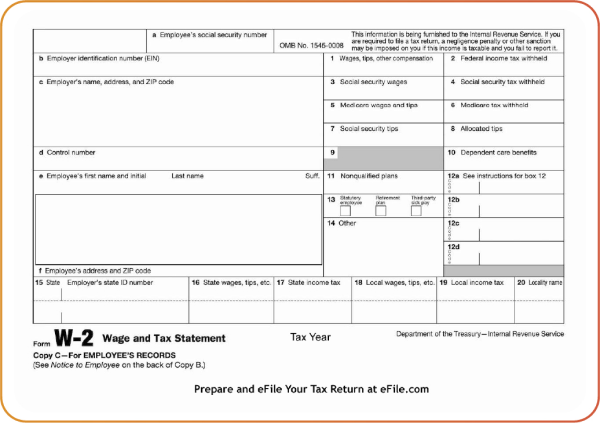

What Is A W-2 Worker?

Under IRS rules, anyone who performs services for you is your employee if you can control what will be done and how it will be done. This is so even when you give the employee freedom of action. What matters is that you have the right to control the details of how the services are performed. People treated as employees are given a W-2 Form at the end of the year and use that information to file their tax returns.

Federal and State taxes are withheld from an employee’s earnings and are paid to the government. The employer is also required to pay directly to the government certain taxes as well based on the amounts paid to the employee.

Why Does the Classification As A W-2 Employee VS 1099-NEC Independent Contractor Matter?

There are two huge differences this classification make when it comes to the business owners bottom line they are as follows:

Taxes:

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee’s wages. With a 1099-NEC the payer only pays the amount on the 1099-NEC, there is no requirement to pay federal taxes. So there is a large tax savings with a 1099-NEC.

Insurance:

With insurance, a contracting company with employees will pay more for their general liability insurance than a company with no employees. The reasoning is with more employees the greater the chance something can go wrong. The huge difference comes into play with workers’ compensation insurance. If you have employees the amount you will pay in premiums is based on your payroll. In riskier trades such as roofing, Workers Compensation Premiums can be 50% or more of your payroll costs.

So for example, if you had W-2 workers that you paid $100,000 in payroll your Workers Compensation premium could be $50,000 or more a year. If the people that did the work where 1099-NEC paid $100,000, you would have minimal Workers’ compensation premiums of around $1,500 per year.

Pro Tip

Mientras que usted puede pensar “pago a mis trabajadores por 1099-NEC”, ya que es más fácil y más barato, es necesario asegurarse de que realmente están cumpliendo con los requisitos de los pagos 1099-NEC. Si el IRS encuentra que en realidad debería haber pagado a los trabajadores por W-2, puede estar expuesto a responsabilidades y sanciones masivas. Nadie quiere que el IRS esté sobre su espalda.

Además, si un trabajador se lesiona como consecuencia de sus actividades y presenta una demanda diciendo que en realidad era un empleado, usted puede volver a cargar con las facturas médicas y las multas si resulta que deberían haber sido pagadas por W-2. Es necesario que se asesore bien con su contable o abogado sobre estas cuestiones.

At ContractorsLiability.com We think an informed client is the best type of client and we sincerely hope that this article was helpful and informative. If you have any Insurance questions please feel free to contact us at (866) 225-1950 or by email [email protected]