Workers Compensation For Roofers

Being Roofers in the top 5 of most dangerous occupations in the country, is no surprise that workers compensation insurance for roofers is a difficult policy to place.

Contractorsliability.com is specialized in roofers insurance, and we can help you to find the best coverage at the lowest rate, keep reading to find out if you need to pay premiums for W2 employees or workers comp “Ghost Policy”.

Get Fast Quote

Add details for the fastest quote

Call Us 24/7

We’ll answer at any time, call us.

Customer Service (888) 766-4991

What Is Workers Compensation For Roofers?

Workers Compensation for Roofers is one of the most difficult lines of business for insurance companies to make money at. The obvious reason for this is that when there are claims, they tend to be very severe.

This makes it exceedingly difficult for the insurance companies to price for and there is naturally a ton of risk.

There are two ways for Roofing Contractors to be insured. The first is to pay premiums for your employees to be up on the roof working for you. The second is to have sub-contractors do your work and pass the cost on to them.

Get An Instant Workers Compensation For Roofers Quote

You can fill out the online quote form below to get an instant quote or call (866) 225-1950 to talk to an agent now.

Paying Premium For W2 Employees

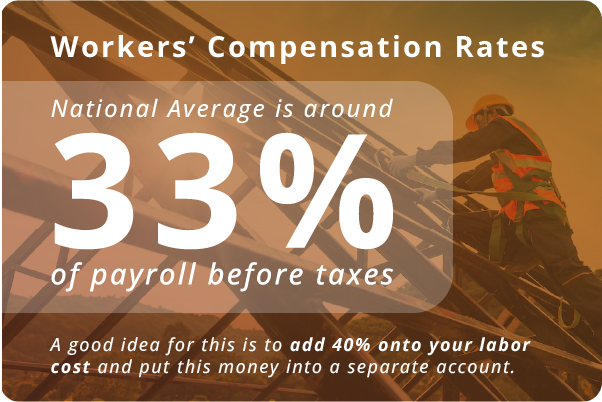

Many people do not like this option for it is expensive. Workers compensation rates for roofing vary from state to state, but the National Average is around 33% of payroll before taxes.

This is BIG; however, if you price for it, you can pass this cost onto your customers. A good idea for this is to add 40% onto your labor cost and put this money into a separate account.

Our recommendation would be to go to 50% for forced savings with the understanding you might not have 100% collectibles. Many businesses are scared of the premiums in doing this; but there are some advantages in that you can control your team being W2 Employees and know your costs. There are no surprises at the end of the year with this option.

Reputation Matters

Our customers trust us for great customer service and cost-effective coverage.

The Second Option Is To Buy A “Ghost” Policy Or “If Any” Policy.

This means you are excluding yourself from coverage and everyone you hire is a sub-contractor 1099 WITH workers compensation.

The sub-contractors you hire can also have an “if any” or “Ghost” policy, but they must have insurance and MUST have a certificate of insurance adding you on as an ADDITIONAL INSURED.

The reason you need to be an additional insured is that you are passing the risk from your company to your sub-contractor’s insurance company.

This means if they or their employees get hurt on your job, the coverage will fall under them. If you hire an UN-INSURED SUBCONTRACTOR and they are injured on your job. THEY ARE COVERED FOR UNDER YOUR INSURANCE POLICY. This means at the end of the year, if you can’t prove you have insurance for them, you have to pay the premium on AUDIT. If not planned for, this comes straight out of your pocket.

Uninsured Sub-Contractor Payroll = Employee = You pay premium

E-Book of Workers Compensation Now Available

Learn all you need to know about Workers’ compensation insurance, where it is required, class codes, ghost policies, and Audits.

Read NowContractorsLiability.com is here to help with all your insurance coverage needs, including specialized plans and tailored insurance policies. All our highly trained agents can help you in English or Spanish.

At Contractors Liability we value and respect your privacy. That’s why we don’t sell or share your information with any third parties and we only use it for our commercial purposes.