Contractors Liability: What is a risk retention group?

The Liability Risk Retention Act (LRRA) is a federal law that was passed by Congress in 1986 to help U.S. businesses, professionals, and municipalities obtain contractors liability insurance, which had become either unaffordable or unavailable due to the “liability crisis” in the United States.

In passing the Liability Risk Retention Act, Congress provided insurance buyers with a marketplace solution to the “liability crisis,” enabling them to have greater control of their liability insurance programs. To achieve this goal, Congress created risk retention groups (RRGs).

A risk retention group (RRG) is a liability insurance company that is owned by its members, in this case contractors. Under the Liability Risk Retention Act (LRRA), RRGs must be domiciled in a state.

Once licensed by its state of domicile, an RRG can insure members in all states. Because the LRRA is a federal law, it preempts state regulation, making it much easier for RRGs to operate nationally. As insurance companies, RRGs retain risk.

What is the benefit of a Risk Retention ?

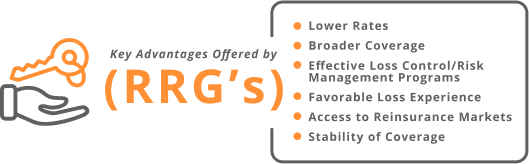

A risk retention group is, essentially, an insurance company that is owned by its members, who in turn, retain the risk themselves. As an insurance company owned by its members, some of the key advantages offered by risk retention groups (RRGs) to their members relate to the control members obtain over their liability programs.

This control often translates into lower rates, broader coverage, effective loss control/risk management programs, participation by RRG members in favorable loss experience, access to reinsurance markets, and stability of coverage, notwithstanding insurance market cycles.

A key benefit RRGs can bring to insurance buyers is long-term stability. This allows insureds to obtain contractors liability insurance coverage at more predictable rates and terms than they can get from traditional insurers. RRG members can also gain control of their insurance programs, providing effective risk management and loss control that is often not available from traditional insurers.

Another beneficial aspect that gives RRGs an edge over traditional insurance companies is the fact that RRGs are mandated to be made up of members in the same industry.

This important aspect allows RRGs to give their insureds an insight on the particular vocation that they are representing that no one else will have. A RRG must write organizations that are of a similar type, so they are forced to really understand and serve that particular niche because that’s all they do.

When claims are handled the RRG works with the member, on the same side. RRG’s do not have that adversarial relationship that so frequently exists between policyholders and the company. It helps RRG’s to get better resolutions to claims than if there was an adversarial relationship with policyholders.

Do you need more information? Let’s talk to an expert and get insured today!