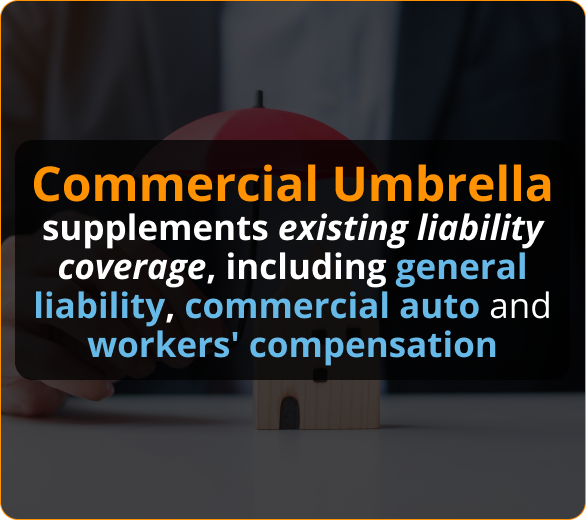

At Contractors Liability, we offer tailored policies for Ohio Plumbers Insurance, and you can include Commercial Auto, Inland Marine, Workers’ Compensation, Business Owners Policy (BOP), Umbrella Insurance, Surety Bonds & much more.

Among the policies you might need, you could find:

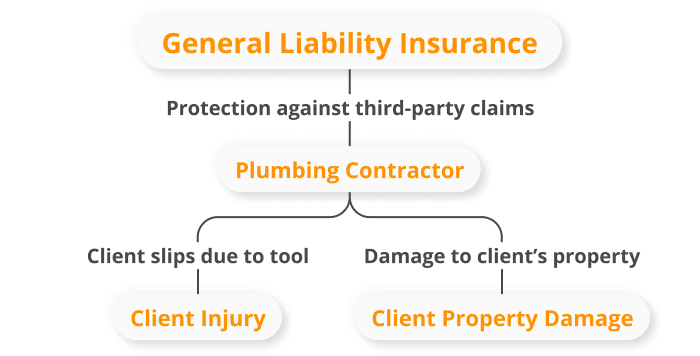

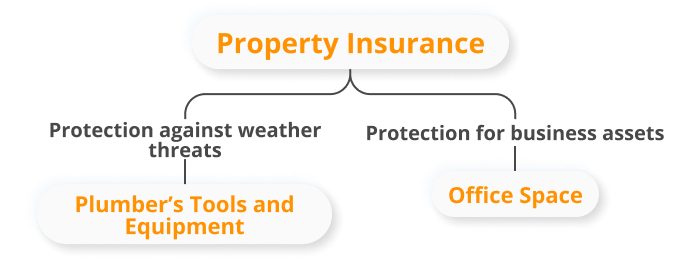

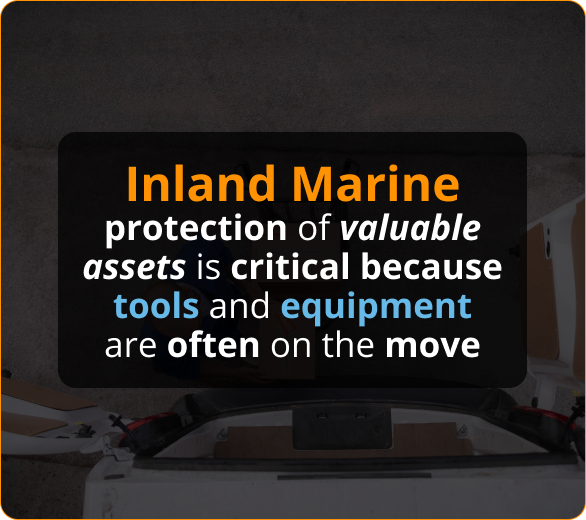

To protect your business, it is essential to understand the variety of insurance options available to plumbers. Each policy, whether it’s the Business Owner’s Policy (BOP), which covers both general liability and property damage or the specialized Inland Marine Insurance, which protects your tools, is tailored to address the specific risks inherent in the plumbing profession. Comprehensive coverage not only protects your business from unforeseen financial burdens but also demonstrates your commitment to professionalism and your customers’ and employees’ well-being.

A BOP is a comprehensive insurance package specially designed for small to medium-sized businesses. For plumbing professionals in Ohio, this policy is tailored to fit the nuanced risks of the trade. Here’s what it typically covers:

Ohio’s diverse landscapes and urban centers make for varied driving conditions. Plumbing installations need an insurance policy tailored to their specific needs and their unique challenges on Ohio’s roads. By investing in comprehensive commercial auto insurance, plumbing professionals in Ohio not only comply with state regulations but also secure the future of their businesses.

Ohio, the heart of the Midwest, is bustling with activity, and its plumbing contractors are an essential part of its infrastructure development and maintenance. Protecting these valuable assets becomes crucial with tools and equipment often on the move. Enter Inland Marine Insurance – a safeguard designed explicitly for the modern-day Ohio plumbing contractor.

Workers’ Compensation Insurance, commonly referred to as Workers’ Comp, is a type of insurance that provides wage replacement and medical benefits to employees injured during the course of employment in exchange for the mandatory relinquishment of the employee’s right to sue the employer for negligence.

While it’s a comprehensive coverage, there are scenarios typically not covered:

While Ohio, like many states, has its own set of regulations and industry standards for plumbers, the inherent risks remain similar across regions. However, the local legal environment, claim history, and specific challenges faced by Ohio’s plumbers make it essential to have an insurance policy tailored to the state’s landscape.

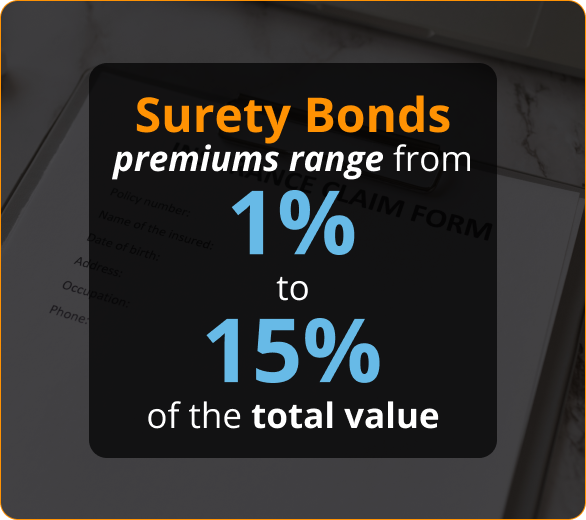

A Plumber’s Surety Bond is not insurance in the traditional sense. Instead, it’s a three-party agreement involving the plumber (principal), the state or client (obligee), and the surety company. This bond guarantees that the plumbing contractor will perform their duties ethically and in accordance with Ohio state regulations and codes.

The bond protects consumers from potential financial loss resulting from a plumber’s failure to meet contractual obligations or state-mandated standards.

Get answers to your most common questions from Contractors Liability

In most States Plumbers are licensed at the State level. This is largely due to the strong public health concerned with plumbing. There is usually a rigorous examination that must be passed and a minimum insurance requirement. Sometimes general liability insurance is not required; however, it is highly recommended that you obtain affordable Plumber’s General Liability Insurance That way, in case of an accident of which you are culpable, your reputation and your assets are covered.

No. Worker’s compensation is a type of insurance that covers employees, and that is a separate policy. Plumber’s General Liability Insurance covers only third parties and their property in the case of an accident. However, you will need to purchase a worker’s compensation policy for your plumbing employees if you want them to be covered.

If your State requires it you will lose your license and be subject to administrative action. If you have a claim you will have to cover all the costs of the claim, including attorney’s fees from your own funds. This could easily result in you losing everything you own.

As compared to other trades it is about the middle of the pack. It is less expensive than Roofer’s insurance but more than a drywall contractor. It certainly is not expensive if you have a claim.

We understand that it is hard to work in a trade that requires so much time and management for seemingly thankless jobs. To thank you for your service, we offer plumbers:

Our customers trust us for great customer service and cost-effective coverage.