General Liability Insurance —

Essential Coverage for Your Business

Protect your business from unforeseen risks with comprehensive general liability insurance. Whether you’re a small contractor or managing a larger operation, this coverage shields you from third-party claims related to property damage or bodily injury.

Our tailored solutions ensure that your business stays secure, allowing you to focus on your projects without the stress of potential legal complications.

Obtén tarifas de los principales proveedores de seguros de América con una cotización instantánea de nuestra parte.

Why Concrete Contractors Need Insurance:

Running a contracting business comes with various risks, from property damage to accidents involving third parties. General Liability Insurance is essential for safeguarding your business against these unexpected events, ensuring you’re protected no matter what happens on the job.

What Is General Liability Insurance?

General Liability Insurance protects contractors from claims made by clients or third parties for damages caused by the contractor or their employees. Despite best efforts to ensure safety, accidents can still occur, making this type of coverage essential.

As a contractor, you work hard to maintain a safe job site and protect your reputation. However, even the most cautious businesses can experience unforeseen incidents. That’s where General Liability Insurance comes in, offering protection for your business, assets, and yourself.

This insurance is often mandatory in most states, ensuring you’re covered for potential liabilities without overpaying. ContractorsLiability.com specializes in providing affordable and reliable General Liability Insurance to keep your business safe.

Get a Free General Liability Insurance Quote fast

Only 5 minutes of your valuable time. We can often get same day coverage.

What Does General Liability Insurance Cover?

General Liability Insurance safeguards your business from claims related to property damage, bodily injury, and more. A crucial benefit of this coverage is that it includes legal defense costs, such as attorney fees, if your business is sued over a covered claim.

Here’s a breakdown of what General Liability Insurance typically covers:

-

Bodily Injury:

Protects against claims of injury caused by your business operations or products.

Example: While installing flooring, someone trips over your tools and is injured.

-

Harm to Reputation:

Protects against claims such as libel, slander, or misuse of client images.

Example: Using a client’s home in your marketing materials without permission could lead to a lawsuit.

-

Medical Payments:

Covers medical expenses if someone is injured on your business premises.

Example: A client falls and injures themselves while visiting your office.

-

Property Damage:

Covers damage to a client’s or third party’s property.

Example: An employee accidentally damages a client’s vehicle while installing a garage door.

-

Damage to Premises Rented to You:

Protects against claims for damage to rented property due to specific incidents.

Example: A propane tank leak from your roofing business causes a fire in a rented building.

-

Advertising Mistakes:

Helps protect your business if you’re accused of infringing copyrights or making advertising errors.

Example: You use a brand name in an ad without proper authorization, leading to a claim.

General Liability Insurance offers broad coverage to keep your business protected from everyday risks and potential lawsuits.

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

What’s Not Covered By General Liability Insurance

While General Liability Insurance offers essential protection, it’s important to understand what it does not cover. Here are some situations where this policy won’t provide coverage:

-

Employee Injuries:

Injuries to your employees are not covered by General Liability Insurance. These are handled by Workers’ Compensation Insurance. For example, if an employee falls off a ladder and gets injured, it won’t be covered under General Liability.

-

Professional Mistakes:

If your business provides advice or professional services, errors or omissions are not covered. For that, you’ll need Errors and Omissions Insurance (also known as Professional Liability Insurance) to protect against claims stemming from advice or recommendations you give.

-

Auto-related Incidents:

General Liability Insurance does not cover accidents involving your business vehicles. For that, you’ll need Commercial Auto Insurance to protect against vehicle-related claims.

-

Punitive Damages:

Most General Liability policies do not cover punitive damages, which are financial penalties in lawsuits intended to punish the defendant.

-

Intentional Acts:

Damages resulting from intentional actions, such as an employee deliberately damaging property, are not covered by General Liability Insurance.

-

Workmanship Issues:

Faulty workmanship or poor-quality work, often referred to as the “workmanship” or “warranty” exclusion, is not covered. For example, if the paint you applied starts peeling due to improper preparation, this would not be protected by General Liability Insurance.

Expert advice

Is the cheapest General Liability Insurance for contractors always the best?

The cheapest General Liability Insurance for contractors can be perfect for your needs and your wallet. There is no reason to purchase expensive policies or ones that are not suitable to your needs, preferences, and budget.

However, focusing exclusively on price could be an unnecessary risk because it may not offer the right coverage. You need to ensure that you’re getting a reasonable rate in keeping with industry norms and one that’s most suitable for your unique requirements.

Why do you need General Liability Insurance?

General Liability Insurance is crucial for protecting your business from costly lawsuits and accidents. It covers legal fees and damages if a third party sues you for property damage or bodily injury, preventing significant financial loss.

Many contracts require this insurance, making it essential for securing projects and maintaining credibility. By having this coverage, you safeguard your business, ensuring peace of mind and allowing you to focus on growth without worrying about unexpected liabilities.

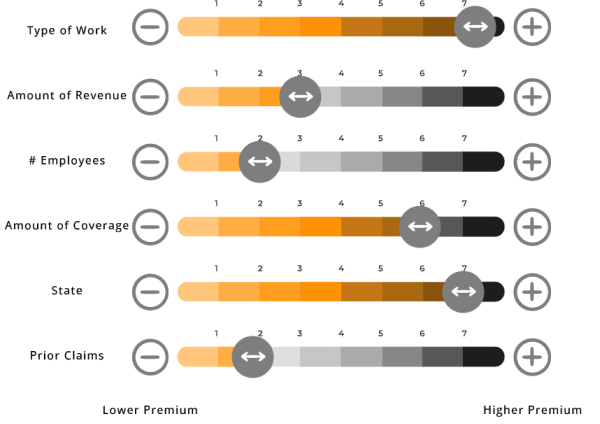

Common Factors That Affects Your General Liability Insurance Cost

There are common factors that insurance companies use to determine insurance costs. These are:

- The type of work being performed.

- The amount of revenue of the company.

- The number of employees.

- The amount of coverage requested.

- The State where the company is located.

- The prior claims history of your business.

General Liability Additional Insureds

Once you have purchased a General Contractors General Liability Insurance policy different people or companies may ask you to have them named as additional insured’s on your policy.

The most common requests are from clients who you are doing work for, Cities that you are working in, and landlords to make sure you have coverage as required by any lease you may have. If you will anticipate you will need a number of Certificates of Insurance to be issued you should consider adding a blanket additional insured endorsement to your policy.

This is sometimes included in policies or there maybe an additional charge for this endorsement. The blanket additional insured allows you to add as many clients as you need to your General liability Insurance Policy.

It also offers coverage as long as you have a contractual relationship with a client whether or not a certificate is issued specifically to them. This is especially important if you deal with a large number of certificate request as the chances of making a mistake is great. With the blanket endorsement you are covered.

Types of Additional Insured for General Liability Insurance Policies

The most common types of additional insured forms are listed below. They are reference by their ACORD form number. The acronym “ACORD” stands for Association for Cooperative Operations Research and Development. These are standard insurance forms used in the insurance industry:

-

4 Great Reasons to Choose Contractors Liability

Along with our customer satisfaction guarantee, we:

- Work with A-rated insurance companies, to get you service that you can trust

- Provide you with customer service, tailored to your needs from a licensed insurance agent

- Create a customized General liability insurance policy that fits with your needs

- Provide you with the lowest price for the best coverage out of any of our competitors

-

ACORD form CG 2010 revised 4/13:

This is the most common form. Under this, the additional insured is not covered for their sole negligence. The insured must be liable in whole or in part before there is any coverage. This covers only ongoing operations. Once the work is complete this endorsement terminates. The project is also required to be named for coverage.

-

ACORD form CG 2037 revised 4/13:

The CG 2037contains the same limitations and conditions as the CG2010. It differs in that this endorsement insures the additional insured for completed operations of the contractor and not ongoing operations. This endorsement supplements the CG2010. As a result, if an additional insured requires additional insured status for the project, the contractor will need both the CG2010 and the CG2037 endorsements in order to comply.

-

ACORD form CG 2033 revised 4/13:

The CG 2033 is the blanket additional insured form and is similar to the CG 2010. It only covers on going operations and requires that the insured be liable in whole or part for the loss before there is any coverage.

-

ACORD form CG 2038 revised 4/13:

The main distinction between the CG 2033 and the CG 2038 is that the CG 2038 provides coverage for upstream parties. Upstream parties are the entities or individuals above the level where an entity is contracting. Whereas the CG 2033 only provides additional insured status where there is a direct written contract, the CG 2038 extends coverage to “any other person or organization you are required to add as an additional insured under the contract or agreement.” Again if you need coverage for completed operations you need a separate endorsement to cover that.

-

What Can I Do About CG 22 94 Endorsement?

There are a number of options you have available to you to get around this exclusion:

- Many companies offer the option to buy back the coverage. However, the buy-back premiums vary greatly. In a few states, coverage is not available.

- Find a carrier that policies do not contain this endorsement, remember the premium will be more.

-

Working With Subcontractors And The CG 22 94 Endorsement

In the last few years, insurance carriers are regularly adding the CG 22 94 endorsements to the commercial general liability policy to exclude losses arising out of subcontractor-caused damage to a contractor’s work. The theory behind the CG 22 94 endorsements is that the damage caused by a subcontractor’s work should be the responsibility of the General Contractor as a business loss and not a loss covered by the General Contractors General Liability Insurance Policy.

A number of General Liability carriers that insure home builders and remodelers have added this exclusion. As a result, this exclusion results in a substantial reduction in coverage as compared to prior policies.

-

Working With Independent Contractors And Subcontractors. What does 1099 mean?

It actually is very simple a 1099 is an IRS form that businesses pay non employee compensation to any third party. This by definition makes anyone who receives money that is classified as 1099 income not an employee of the party issuing the 1099. However, just saying someone is a 1099 and not an employee does not make it so.

If to the IRS it walks like a duck and quacks like a duck even if you call it a chicken, they can reclassify the payee 1099 as a W-2 employee. This can result in massive tax liability. So why do contractors try to get away with this? Well, there are 2 main reasons. First if a worker is 1099, the contractor is not responsible for paying employment taxes as they would with a W-2 employee.

The second reason is that for worker’s compensation insurance any money paid on a 1099 is not considered payroll thereby reducing Worker’s Compensation costs. If a contractor is working with Independent Contractors and Subcontractors they must get certificates of insurance from these workers. If they fail to get a certificate they will be treated as uninsured subcontractors on the General Contractors General Liability Insurance Policy.

As a result, any amount paid will be added back to your income for premium purposes. The same goes for Worker’s Compensation Insurance. Also with Worker’s Compensation if someone you 1099 is injured there is a good chance a smart lawyer may make the claim that the injured party was actually an employee. If the court rules they were you could be on the hook for a lot of money.

Get a Free General Liability Insurance Quote

In only 5 minutes of your valuable time. We can often get same day coverage.

General Liability Ocurrency Policies

vs Claim-Made Policy

There are two types of General Liability policies:

-

Claims-made policy

On the other hand only covers claims made while the policy is in force including any extended reporting period that might be granted. If a claim is made after the policy expires you will not have any coverage even though the claim would have been covered if the policy was in force.

For example A covered claim happens on 10/31/2020. Your General Liability Insurance policy expires 12/31/2020 and you do not renew the policy. As an example, if a claim for the loss on 10/31/2020 is made on 3/1/2021 and you have an Occurrence policy, you will have coverage. This is since the occurrence was in the policy period. If you have a claim made policy you will have no coverage since the claim was made after the policy expired.

-

Occurrence policies

Where the event must take place during a set period. This means if a covered claim occurred during the time the policy was in force you will have coverage even if the claim is made after the policy is expired. This is the type of coverage you should have.

Once you have obtained a General Contractors General Liability Insurance Policy you can easily add other companies or individuals you do work for to your general liability insurance policy as an “additional insured“.

Here’s What Contractors Think

FAQ: What Isn’t Covered by General Liability Insurance?

No, injuries to your employees are not covered by General Liability Insurance. Employee injuries are handled through Workers’ Compensation Insurance. For example, if an employee falls from a ladder, General Liability won’t cover the medical costs or lost wages.

No, professional mistakes or errors in advice are not covered. For this, you’ll need Errors and Omissions Insurance (Professional Liability Insurance) to protect your business from claims related to advice, recommendations, or professional services.

No, General Liability Insurance does not cover vehicle-related incidents. You need Commercial Auto Insurance for protection in case of accidents involving business vehicles.

Typically, no. General Liability policies usually do not cover punitive damages, which are fines imposed by the court to punish intentional misconduct.

Intentional acts, such as an employee purposely damaging a client’s property, are not covered by General Liability Insurance. These are excluded because they are not accidental.

No, poor workmanship or faulty work is not covered. This is referred to as the workmanship or warranty exclusion. For instance, if you use the wrong materials and the work deteriorates, this would not be covered by General Liability Insurance.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.