Phantom Coverage for Employee Injuries — A Key Protection Strategy

Ensure your business is safeguarded with phantom coverage for employee injuries, an essential type of insurance that helps manage unforeseen workplace incidents. Whether you operate a small business or a large corporation, this policy offers a safety net that shields you from potential liabilities related to employee injuries. Our customized options provide essential protection, allowing you to concentrate on your operations without the burden of potential financial repercussions from workplace accidents.

Introduction

Running any business involves inherent risks, particularly when it comes to your workforce’s safety and health. Phantom coverage is crucial in mitigating these risks, ensuring your employees receive the support they need while also protecting your organization from unexpected legal and financial challenges.

Did you know?

Uninsured Sub-Contractor = Employee

What Is a Workers Compensation Ghost Policy?

A workers compensation ghost policy is a unique type of insurance that provides coverage for businesses that may not have employees on the payroll or are in the process of transitioning between policies. It functions as a placeholder, ensuring that any claims arising from past employees are still addressed without active coverage. This policy is essential for safeguarding against potential liabilities that can arise even when a business is temporarily without employees.

As a business owner, it’s vital to maintain adequate coverage, even during transitional periods. The ghost policy offers peace of mind, ensuring that you remain compliant with regulations and can handle any unexpected claims that may surface

Get a Free General Liability Insurance Quote

In only 5 minutes of your valuable time. We can often get same day coverage.

Get a Free General Liability Insurance Quote

What Does a Workers Compensation Ghost Policy Cover?

A workers compensation ghost policy primarily covers claims related to employee injuries that may arise during the period when active coverage is not in effect. Here’s what this type of policy typically includes:

-

Past Claims:

Addresses any claims related to employees who may have been injured while working, even if they are no longer with the company.

Example: A former employee files a claim for an injury sustained years ago while working for your business.

-

Liability Coverage:

Provides essential protection against potential legal repercussions for incidents that occurred during the time the employee was on the payroll.

Example: A claim arises related to a workplace injury that was not fully resolved before the employee left.

-

Regulatory Compliance:

Helps ensure your business remains compliant with state laws regarding workers compensation, preventing fines or penalties for lapses in coverage.

Example: Avoiding legal trouble when an inquiry reveals past employment injuries that could lead to claims.

Phantom coverage is a crucial tool for managing risk, especially during times of transition, ensuring that your business can respond effectively to any claims that may arise.

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

Why Do You Need a Workers Compensation Ghost Policy?

A workers compensation ghost policy is vital for maintaining coverage continuity and protecting your business from potential liabilities. It ensures that you are safeguarded against claims related to past employees, even when there are no active staff members.

This policy is particularly important for businesses that experience fluctuations in employment or those undergoing structural changes. By having a ghost policy in place, you demonstrate your commitment to compliance and employee welfare, providing crucial support should any claims arise unexpectedly.

What’s Not Covered By a Workers Compensation Ghost Policy?

While a workers compensation ghost policy provides essential coverage, it’s important to recognize its limitations. Here are some situations where this type of policy won’t provide protection:

-

Current Employees:

Claims arising from injuries to active employees are not covered by a ghost policy and require a standard workers compensation policy.

-

New Claims:

Injuries sustained by new hires after the ghost policy is established are not covered until a standard policy is active.

-

Professional Liability:

Any claims related to professional negligence or errors are excluded and need a different type of coverage.

-

Intentional Acts:

Injuries resulting from deliberate actions or misconduct by employees are not covered under this policy.

-

Non-Work Related Incidents:

Injuries that occur outside of work duties or responsibilities are not included.

How Does A Workers Compensation Ghost Policy Work?

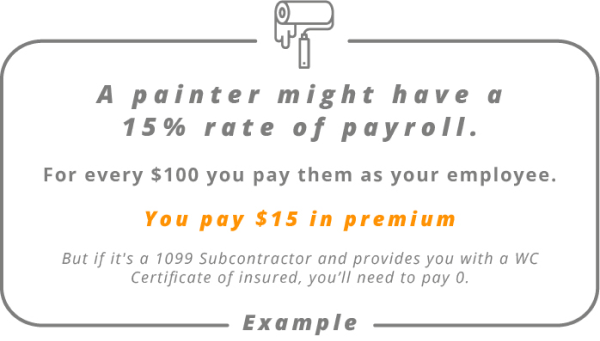

So let’s first think about how Workers Compensation Insurance is billed. Workers compensation is billed by classes of employees and the type of work they do on a percentage basis of payroll. For example, a painter might have a 15% rate of payroll.

This means for every $100 you pay them as your employee (Workers Compensation is meant to cover your employees) you pay $15 in premium. Now if that same painter you pay $100 to is not an employee, but a 1099 subcontractor, and provides you with workers compensation insurance naming your business as additional insured, you would have to pay 0. No problem.

What Does A Workers Compensation Ghost Policy Cost?

The cost of these policies typically runs about $1200 but does depend on what state you need it for. You will have to incur this cost and this cost is protecting your customers as much as you. It’s important that you figure out the cost of your labor correctly and pass that cost on to your customer. In our painting scenario, it would be a good idea to add 20% on to your labor costs for insurance.

It’s easy to get overwhelmed trying to negotiate the terms of a workers’ compensation insurance policy, but ContractorsLiability.com is here to help.

- Evaluate your year halfway through and check your projections on your application to make sure they are still in line.

- Be Militant about your certificates of insurance. If someone does not have insurance, you will have to charge them for it. Simple as that. If you do not, they will rarely come forward with money when you are audited.

- Plan Ahead set the money aside for the additional audit. If you plan for it, you can pass this cost onto your customers.

Here’s What Contractors Think

FAQ: What Isn’t Covered by a Workers Compensation Ghost Policy?

No, current employee injuries require active workers compensation coverage, not a ghost policy.

No, any new claims resulting from injuries incurred by newly hired employees are not covered until a standard policy is in effect.

No, claims related to professional errors are excluded and require separate professional liability insurance.

Typically, injuries that result from deliberate misconduct are not covered under this policy.

No, any injuries that happen outside of work duties are not covered by a ghost policy.

Yes, it covers claims for injuries incurred while the employee was with your company before the ghost policy was established.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.