Ensure your masonry work is protected with specialized insurance coverage tailored to shield against unforeseen risks and events. Whether tackling small residential jobs or extensive commercial projects, masonry insurance provides the financial security necessary for smooth operations.

The masonry industry encounters specific challenges that can lead to unexpected expenses. Without appropriate coverage, a single incident could cause significant financial distress, disrupting your projects. Masonry insurance offers critical protection against:

Masonry tasks can be physically demanding and often take place in unpredictable environments, leading to potential accidents. The right insurance can protect your business from the financial repercussions of job site incidents. Protect yourself against:

Only 5 minutes of your valuable time. We can often get same day coverage.

By choosing our masonry insurance solutions, you will gain access to a variety of benefits designed to meet your business’s unique needs. Here’s what we provide:

We collaborate with top insurance providers to deliver competitive coverage at affordable rates, ensuring you receive quality protection without exceeding your budget.

We recognize the financial challenges in contracting. That’s why we offer adaptable payment schedules to match your cash flow, allowing you to select between quarterly or annual payments.

In the masonry business, prompt responses are crucial. Our insurers handle claims efficiently, enabling you to resolve incidents swiftly and resume your work without unnecessary delays.

Our experts are well-versed in the distinct risks associated with masonry projects and will customize insurance policies to address your specific requirements, from liability to workers’ compensation.

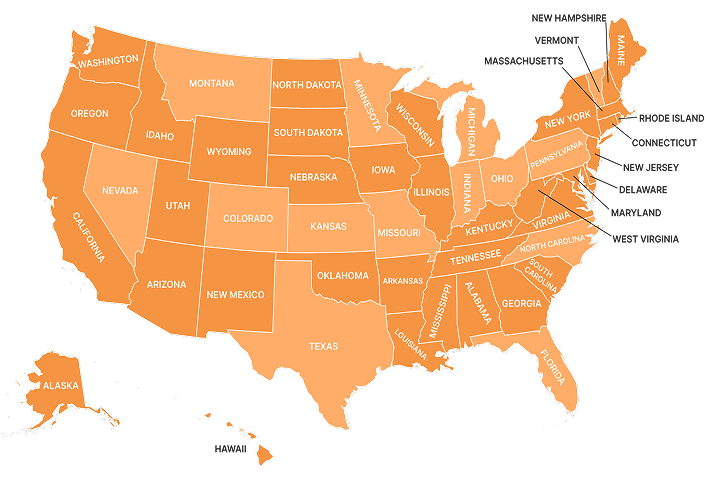

We provide state-specific insurance solutions to ensure that your business remains compliant with local laws, regardless of your project location. Stay informed and protected with our comprehensive guides.

This table displays typical rates and coverage for Masonry General Liability

for $1 Million/$2 Million Policy.

This table displays typical rates and coverage for Masonry General Liability for $1 Million/$2 Million Policy.

State

Annual premium above includes unlimited certificates of insurance.

Rating assumes 150,000 gross revenues for masonry contracting/general contracting with 10% subcontractor costs.

Premiums are subject to underwriting approval and financing charges may apply.

In only 5 minutes of your valuable time. We can often get same day coverage.

Stoneworkers, cement pourers, and brick layers are working with the literal foundations of livelihoods, whether they’re houses or skyscrapers. While all masons are extremely skilled at what they do, it is important that they consider the risks to third parties who may be involved during the building process. Here are some of the more common types of injuries covered by masonry insurance, as well as examples of injuries associated with the trade.

Any injury made directly to the body of a third party or client at your worksite.

Example: The area around a house that is being leveled is not secured after work hours. A third party manages to enter and breaks their ankle, leaving you responsible for the medical bills.

Think of this as any sort of claim or action was taken against a competing company or any other company you speak out against that causes that company to lose assets.

Example: Your company uses hearsay about another company to boost up the prestige of your own company. This causes the other company to lose business and reputation credit and the competitor sues in response.

This includes any sort of damage directly related to completed work or units installed.

Example: Improper jacking of a house causes cracks in the walls of a house and the owners of the house are more than displeased.

This covers the medical bills of a third party that is injured by the fault of your masonry company.

Example: A homeowner trips over equipment left in the yard and sustains significant medical injuries. You are technically at fault, and therefore must pay for the injuries sustained.

This injury deals less with physical harm, but rather to the loss of reputation or image of a client based on your handiwork.

Example: The employees working on a building project build an improper foundation which creates uneven floors in a new business. This causes the business who commissioned you for work to lose its good reputation.

While masonry insurance offers substantial advantages, it’s important to be aware of its limitations. Here are scenarios where this policy may not provide coverage:

Masonry insurance is a critical layer of protection for masons, providing coverage against unexpected events that can impact both small repairs and large construction projects. This insurance protects against various risks, including accidental property damage, injuries on-site, and even potential legal liabilities.

With masonry insurance, professionals gain peace of mind, knowing they have financial protection from unforeseen costs that might otherwise jeopardize the project. By securing masonry insurance, contractors can focus on delivering precise, high-quality work, confident that they’re safeguarded from the unexpected challenges that can arise in masonry work.

With masonry insurance, professionals gain peace of mind, knowing they have financial protection from unforeseen costs that might otherwise jeopardize the project. By securing masonry insurance, contractors can focus on delivering precise, high-quality work, confident that they’re safeguarded from the unexpected challenges that can arise in masonry work.

What Isn’t Covered by Masonry Insurance?

No, damages caused by intentional or negligent actions are not covered. Masonry insurance is designed to protect against accidental damages and liability, not preventable errors or misconduct.

Standard masonry insurance usually doesn’t cover personal tools or equipment unless additional equipment coverage is added. The primary coverage is focused on liability and property damage, not tool protection.

No, typical wear and tear on masonry structures, like natural erosion or aging, is generally not covered. Masonry insurance focuses on damages that arise from specific incidents rather than gradual deterioration.

No, masonry insurance generally does not cover delays caused by adverse weather or other unforeseen events. Its primary purpose is to cover liability and property damage associated with work, not scheduling delays.

Just read and in 30 minutes you will know everything about insurance.