Ensure your major contracting projects are well-protected with specialized insurance solutions designed to guard against unforeseen events and risks. From extensive residential developments to significant commercial undertakings, large contractors’ insurance offers the financial security and peace of mind necessary to keep your operations running smoothly.

The contracting sector, especially for large projects, encounters distinct challenges that can lead to unexpected expenses. Without appropriate insurance, a single incident could result in substantial financial setbacks, jeopardizing project timelines and budgets. Large contractors insurance provides crucial protection against:

Large construction projects can be physically demanding and often take place in dynamic environments, leading to potential accidents. The right insurance can protect your business from the financial fallout of job site incidents. Safeguard yourself against:

Only 5 minutes of your valuable time. We can often get same day coverage.

By choosing our large contractors insurance solutions, you gain access to various benefits tailored to meet the specific needs of your business. Here’s what we offer:

We collaborate with leading insurance providers to deliver competitive coverage options, ensuring you receive top-notch protection without overspending.

Our experts recognize the unique risks associated with significant contracting work and will tailor insurance policies to suit your specific requirements, from liability to workers’ compensation.

In large contracting, promptness is crucial. Our insurers streamline the claims process, allowing you to resolve issues quickly and minimize disruptions to your workflow.

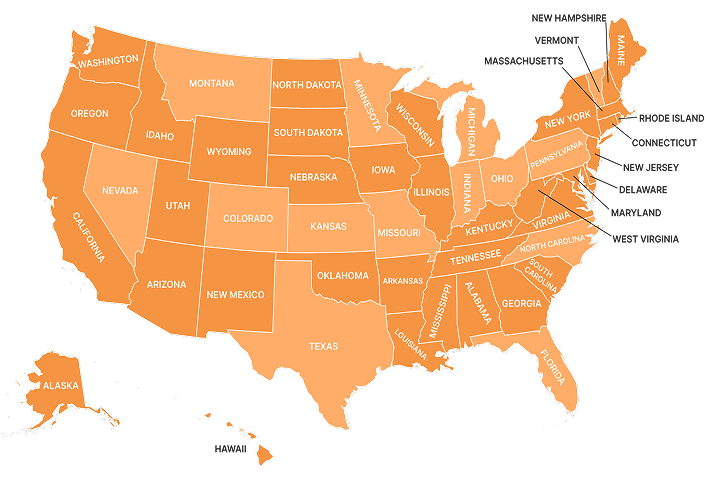

We offer state-specific insurance solutions to ensure your business meets local regulations, no matter where your projects are located. Stay compliant and informed with our comprehensive resources.

Understanding the financial management challenges in large projects, we offer adaptable payment schedules that align with your cash flow, providing options for quarterly or annual payments.

Although large contractors insurance provides significant benefits, it’s crucial to understand its limitations. Here are some scenarios where this policy might not offer coverage:

This table displays typical rates and coverage for Large Contractors General Liability

for $1 Million/$2 Million Policy.

State

Annual premium above includes unlimited certificates of insurance.

Rating assumes $1,500,000 in annual gross revenues for contracting/general contracting, with 10% subcontractor costs. Actual premiums vary based on trade, payroll, location, claims history, and selected limits.

Premium are subject to underwriting approval and financing charges may apply.

Workers’ Compensation Insurance is a major expense for a large contractor. Going to my point of needing a PhD working on your insurance solutions, maybe you current agent has told you what your current experience modification is.

Have they ever sat down with and explained to you how that number was calculated? Have you ever checked to make sure it was calculated correctly? Did you even know there was something you could do about it? I guarantee your agent has never done this with you.

The basic Workers’ Compensation Experience Rating Form lists the Following:

It is very important that these are correct. As a salesman classified under a roofing code could be costing you thousands of dollars. Also the class codes need to be reviewed themselves to make sure they accurately reflect the work the employee is performing. Again the wrong class codes listed can cost you money.

This is the amount of payroll multiplied the expected loss ratio.

Has your current agent ever went over anything like this with you? The answer is probably not. That it is why it is time to graduate to ContractorsLiability.Com

This is the claim number from the insurance carrier and it identifies a specific case file. Specific claims will be listed individually if they are open. This information can be quite useful in identifying trouble spots. As you know the more claims you have the higher your experience modification will be.

Let us say after review of this claim data you see one employee Homer Simpson in the warehouse has had three accidents in the last 2 years. This employee is either on a losing streak or is just plain bad news. Simpson is making $37,000 a year. He is costing you an additional $100,000 in Workers’ Compensation premiums per year. It might be time for some downsizing or at the very least additional training.

This means for every $100 of payroll, in this class code, other companies, on average, have experienced this amount of workers’ compensation claims.

This is the amount of the actual losses incurred by your business.

Again this must be reviewed for accuracy to ensure the payroll is being properly classified.

There is good chance you do not even know what your experience modification is let alone how it is calculated. It is also highly unlikely your current agent has reviewed it for accuracy. Inaccurate experience modifier calculations are often the result of mistakes in payroll amounts, erroneous job classifications, improper claim reserves and open claims that should be closed.

A comprehensive process should include a detailed analysis of an organization’s payroll, class codes and claim history, which will ensure the experience modifier is accurate and that workers’ compensation premiums are reduced accordingly. We will complete a comprehensive evaluation of exposures before submitting your information to underwriters.

This will allow your business to take control of your workers’ compensation costs, rather than allowing a carrier to simply dictate what you will pay. An incorrect experience modification may also exclude you getting coverage in preferred markets. It may also in some instance bar you from bidding or getting large contracts that require a minimum Experience Modification. ContractorsLiability.Com will also work with you on proactive solutions to improve your safety record.

Along with preventing employee injuries it will also save you money and improve employee morale in the long run.

Captive insurance is an alternative risk financing solution for companies of medium to large size. It is a fact that 90% of the Fortune 500 companies own at least 1 captive insurance company arrangement. As a captive owner, you are basically creating your own insurance company.

Either on your own or by joining a group of similar businesses. This allows you to gain ownership and control of all aspects and costs of your insurance programs while creating the potential for significant financial gains.

3 Important Benefits of a Captive are:

In only 5 minutes of your valuable time. We can often get same day coverage.

Most larger contractors have an extensive fleet of vehicles. The cost of insuring these vehicles is expensive.

As you can see some of these you have no control of. However the main components of cost are driver history and prior losses. We can work with you to establish safety programs that can reduce accidents and losses. This will increase your bottom line by lowering your Commercial auto insurance costs. Also we can review your driver history.

An example of this would be after reviewing your driver history we are able to find out that one employee Barney Gumble has 2 driving under the influence convictions and accidents and tickets on his record.

The simple change of prohibiting him from operating vehicles could save you thousands. The problem with things like this is that you do not know what they are until you investigate. The average insurance agent does not normally do such active investigations and advise you of the steps you can take to reduce costs.

There are a number of factors that drive the cost are:

Large contractors insurance is crucial for protecting your financial interests on complex, high-value construction projects. This insurance provides essential coverage against unexpected events, such as accidents, natural disasters, and third-party liabilities, that can disrupt project timelines and inflate costs.

Many stakeholders, including lenders, require contractors to hold this coverage as a condition for project financing, underscoring its value in managing risk. By investing in comprehensive large contractors insurance, you secure your projects and gain the confidence to navigate unforeseen challenges while keeping focused on delivering successful outcomes.

What Isn’t Covered by Large Contractors Insurance?

No, large contractors insurance generally only covers incidents or damages that happen during the project. Any pre-existing structural issues are typically excluded from coverage.

No, damages that arise from intentional misconduct or negligence are usually not covered. This insurance is intended to cover accidental damage and liability, not preventable errors.

In most cases, personal tools and equipment aren’t covered unless a specific equipment protection endorsement is added to the policy. Large contractors insurance mainly addresses liability and property damage rather than equipment protection.

No, regular wear and tear on construction materials or structures isn’t typically covered. Large contractors insurance focuses on damage from specific incidents, not routine degradation over time.

No, large contractors insurance generally doesn’t cover delays caused by weather or unexpected events. The primary purpose of this coverage is to protect against liability and property damage directly related to construction activities, not scheduling delays.

Just read and in 30 minutes you will know everything about insurance.