Crucial Insurance

for Glaziers —

Safeguard Every Installation

Ensure your glazing projects are protected with specialized insurance coverage that shields against unforeseen risks. From residential glass installations to large commercial projects, glazier insurance offers peace of mind and financial security throughout the process.

Obtén tarifas de los principales proveedores de seguros de América con una cotización instantánea de nuestra parte.

Why Glazing Professionals Require Targeted Insurance

The glazing industry encounters specific challenges that can lead to unexpected financial burdens. Without appropriate insurance, a single mishap can result in substantial losses, jeopardizing your project’s success. Glazier insurance provides vital protection from:

- Material Damage: Working with glass exposes your materials to various risks, including breakage during transport or installation. Insurance coverage helps cover repair or replacement costs, ensuring your project stays on schedule.

- Accidental Property Damage: Installing glass near existing structures can inadvertently cause damage. Glazier insurance covers repair expenses, protecting you from potential financial strain.

- Injuries on the Job: Handling heavy glass panels and sharp tools increases the likelihood of injuries. Workers’ compensation insurance ensures that medical costs and lost wages are addressed if an employee sustains an injury during work.

Common Hazards in Glazing Work

Glaziers operate in dynamic environments, often facing unpredictable conditions that can lead to accidents. A comprehensive insurance plan helps shield your business from the financial repercussions of incidents that may occur, including:

- Tool-Related Injuries: Using equipment such as glass cutters or suction cups carries risks. Accidental misuse or equipment failure can result in serious injuries.

- Property Incidents: Accidental damage to surrounding property can occur during glass installation, necessitating costly repairs.

- Weather-Related Issues: Sudden changes in weather, like high winds or rain, can halt work and damage materials, impacting timelines and budgets.

- Transporting Glass: Moving large glass panels poses risks of breakage or accidents during transit, leading to potential financial losses.

Get a Glazier Insurance Quote fast

Only 5 minutes of your valuable time. We can often get same day coverage.

Key Advantages of Our Glazier Insurance Policies

By selecting our glazier insurance solutions, you gain access to numerous benefits tailored to the specific needs of your business. Here’s what we provide:

-

Competitive Pricing from Reputable Insurers:

Our partnerships with top insurance companies allow us to offer comprehensive coverage at rates typically ranging from $2,500 to $4,500. This ensures you receive high-quality protection without straining your budget.

-

Streamlined Claims Process:

In the glazing industry, time is essential. Our insurers manage claims promptly, enabling you to resolve incidents swiftly and resume work with minimal delays.

-

Flexible Payment Plans:

Understanding the financial challenges of contracting, we provide flexible payment options to accommodate your cash flow needs. Choose from quarterly or annual payment schedules to maintain coverage without added stress.

-

Tailored Coverage for Glaziers:

Our specialists comprehend the unique risks faced by glazing professionals and will customize insurance policies to suit your specific requirements, encompassing liability and workers’ compensation.

-

Compliance Across Regions:

We offer state-specific insurance solutions to ensure your business adheres to local regulations, helping you stay protected with comprehensive guidelines tailored to your location.

Why Glaziers Need Specialized Insurance Coverage?

Glazier insurance is essential for protecting your business investment and ensuring projects progress smoothly without unexpected financial setbacks. It covers potential damages and losses, which can significantly affect your project budgets and timelines. Many contracts also require proof of insurance, making it a critical aspect of securing work and maintaining professional credibility.

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

Limitations of Glazier Insurance Coverage

While glazier insurance offers extensive protection, it’s crucial to be aware of its limitations. Here are circumstances where coverage may not apply:

- Pre-existing Glass Structures: Insurance does not cover glass installations or repairs on structures that were completed before your project begins.

- Employee Injuries: Worker injuries are addressed through workers’ compensation, rather than general liability insurance.

- Mechanical Failures: Damages resulting from equipment malfunctions are not included in glazier insurance policies.

- Tools Owned by Contractors: Equipment and tools owned by contractors typically require separate insurance for protection against theft or damage.

- Intentional Damages: Damages caused by deliberate actions, such as vandalism, are excluded from coverage.

How Much Does Insurance Cost For Glaziers?

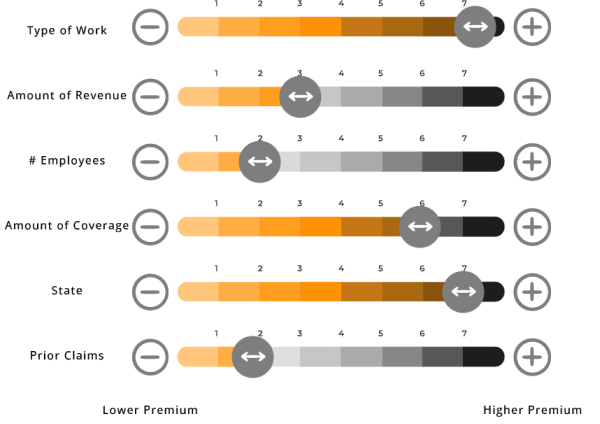

Your business is unique and so is your coverage. Insurance policy coverage is customized to match the scope of your work and your individual business requirements. Premiums for glaziers’ insurance packages can start from as little as $37 per month for small business owners, but the exact cost of your insurance will be determined by factors such as:

- Location: Prices will vary in different markets because the risk is greater, for example in Manhattan, New York than in Hamilton, Ohio.

- Specific services offered

- Payroll and revenue estimates

- Policy limits

- Crew size

Quality also matters. When you need it, you want your certificate of insurance to be worth more than the page it’s printed on. You want reliable insurers with a reputation for service. Contractors Liability works exclusively with A-rated insurance companies to deliver on every level.

The Main Types Of Business Insurance For Glaziers

Each type of insurance policy covers a different set of specific circumstances, which is why they’re kept separate.

-

General Liability Insurance:

General Liability insurance covers costs related to claims made by your client or a third party for property damage or bodily injury. For example, you’re replacing a window on the second floor, and one of the straps holding the window breaks. The window falls, crashing down onto your client’s car, or worse, onto a person.

Your general liability insurance provider covers the repair/replacement costs of the car or any other damaged property and any medical bills related to the claim. General liability insurance also covers advertising mistakes, harm to reputation, and damage done to property you rent.

-

Workers Compensation Insurance:

Workers Compensation insurance covers your employees’ costs if they have a work-related injury or illness. Using the above scenario, if, as the window fell, your employee got injured, spent some time in hospital, and couldn’t work for a few months, your workers’ comp insurance will cover their medical expenses and provide wage replacement benefits for the time they can’t work.

-

Commercial Auto Insurance:

Transporting glass requires your vehicle to have specialized equipment, but even that won’t protect your vehicle if it’s involved in a collision. Commercial auto insurance covers the cost of damages or collisions to your business vehicles and medical expenses for injury to drivers or occupants of your business vehicles.

In addition, it covers any third party sustaining accidental injury or damage caused by your vehicle or the driver of your vehicle. Commercial auto insurance also covers damages and injuries sustained by occupants of your business vehicles due to the negligence of an uninsured or underinsured motorist.

-

Commercial Property Insurance:

Commercial property insurance is designed to protect your company’s physical assets such as buildings, equipment, and tools from the financial cost of repairing damage caused by fire, explosions, burst pipes, storms, or other catastrophic events. Theft and vandalism are also typically covered.

Having commercial property insurance in place means you’re covered against the high cost of replacing specialist equipment in the aftermath of a disaster.

Here’s What Contractors Think

Frequently Asked Questions

What Isn’t Covered by Glazier Insurance?

No, it only applies to new installations or repairs, not existing structures.

No, injuries sustained on the job are typically covered under workers' compensation.

No, damages from equipment failures are not covered by glazier insurance.

Usually not. Contractors should obtain separate coverage for their tools.

No, damages resulting from deliberate actions are not included in glazier insurance policies.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.