If you own a contracting business then you are familiar with all the liability exposures that can lead to massive expenses if they are not managed properly. In every business there are specific risks of injuries or damages which should be thought of prior to signing your contractor insurance policy. It is important that every contractor understands the necessity for obtaining the insurance policy. As a contractor you deal with clients who visit your offices or premises.

If a client or one of your employees get hurt at your premises, you can expect to pay for the medical costs and the lost wages while the person is in hospital. Another important issue is that once a contractor gets insurance policy he should make sure it is handled properly. There are contractors who are just too busy to control the certificates of insurance or do not understand the importance of the certificate. This negligence can cost your business thousands of dollars and more.

Before you renew your liability it would be helpful if you could consider the following tips:

- Give accurate payroll to your agent as well as subcontractor cost. It is vital that all your subcontractors carry insurance policies and you should know that the cost of their general liability depends on your payroll.

- Inform your insurance agent of any possible claims as this can save you lots of money and time

- If you have subcontractors then make sure their insurance policies are also renewed. If their policies are not updated you must know that the costs will be added to your policy which will increase the amounts you pay for your insurance.

- In case you have additional insurance requirements and want to add them to the existing policy, always inform your insurance agent ahead of time as with some insurance companies you will have to wait until your new requirements are approved.

- Make sure that you pay your insurance premium regularly. Most insurance company refuse to renew policies to contractors that have irregular payment history.

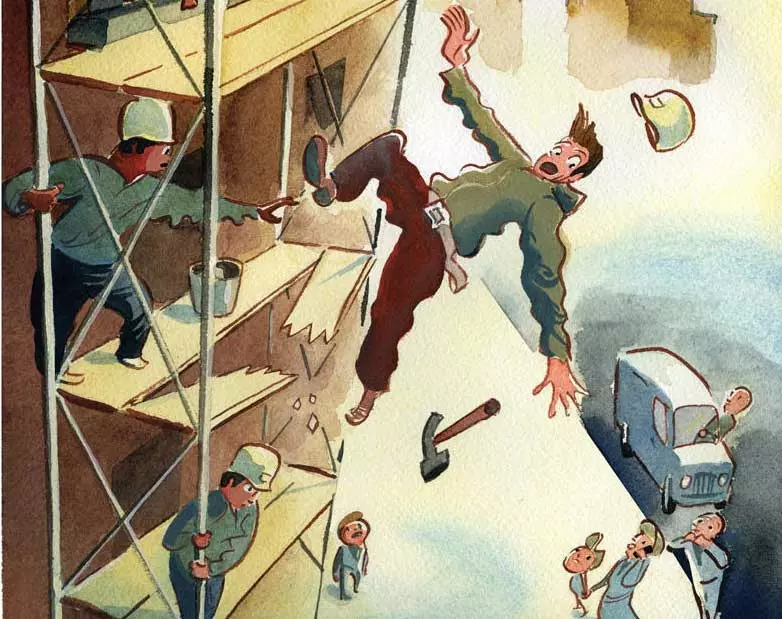

The worst scenario that you may expect to see if you let your insurance policy expire is probably a huge financial loss that can even ruin your business. Think of worker`s compensation insurance when your employees may sue you for covering their medical expenses in case of accident, think of the money you will lose in case one of your partners sues you for damages to his own business caused by your errors. Finally, think of all the fees, legal forms and lawyers you might need to pay for if you do not renew your policy.

If you want to know which insurance is best for you, call us or get a free quote today.