Contractors Insurance can be a tricky purchase. It is important to know what you are purchasing. There are different tiers of policies. A business doing $100,000,000 in revenue would buy a different policy than a handy man working alone doing $50,000 in revenue. It is important to know the coverages you are buying and how it is being priced. The basic coverages of a Commercial

| General Liability per Occurrence | $1,000,000 |

| General Liability Aggregate | $2,000,000 |

| Advertising Liability | $2,000,000 |

| Products and Completed Operations | $1,000,000 |

| Damage to Property of Others | $50,000 |

| Medical | $5,000 |

Definitions:

General liability covers your business for a variety of third party claims including property damage and bodily injury. Anytime your business has dealings with the general public, whether it is within your commercial property or on a job site, you can be held responsible.

Advertising Liability covers damages to third parties committed by a business in the course of advertising its products or services.

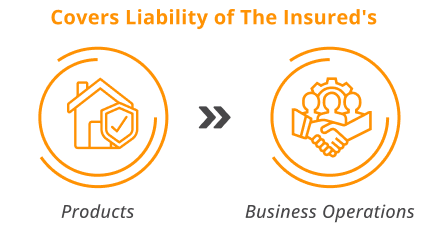

Products and Completed Operations covers liability arising out of the insured’s products or business operations off premises once those operations have been completed or abandoned. If you have ever purchased a CGL policy, you would certainly recognize these coverages.

So now let’s look at how your policy is priced for your premium. It’s generally priced in two different ways:

1. Annual gross income: This policy has a cost per $1,000 of income based on your tax return. You start out paying a “projected amount” for the year and after each year you are audited by your insurance company. If your income is higher, you pay more; however, if your income is lower, there is generally no reimbursement. Insurance companies are not always fair, so it is best to use a conservative amount. If you make more, you pay extra. The additional costs are not very high, as long as you break even.

2. Owner/Employee/Sub-Contractor costs: This is the most common type of CGL policy. Your premium in this type of CGL policy is based on a standard payroll for the owner and cost of employees (if you do not have a certificate of insurance naming your company “Additional Insured). As well as a cost of subcontractors (if you do have a certificate stating your insurance company as “Additional Insured”).

It is very important to know that the cost per $1,000 of an insured subcontractor is about 20% that of an uninsured sub-contractor or employee (an uninsured sub-contractor is simply looked at as an employee). The reason for this is that if a claim is the fault of your sub-contractor, you are on his/her policy and they cannot go after you/your insurance company. You have transferred your risk/your insurance company’s risk to your subcontractor. This is why the premium is so much less in that there is less risk for your insurance company.

A QUIK NOTE. THIS IS A VERY COMMON MISTAKE OF SMALL CONTRACTORS AND THEY GET HIT WITH BILLS ON AUDIT. YOU HAVE TO BE VIGILANT ABOUT COLLECTING CERTIFICATES OF INSURANCE FROM YOUR SUB-CONTRACTORS AND MAKE SURE THEY ARE NOT ALLOWED TO WORK BEFORE PROVIDING YOU WITH THIS CERTIFICATE NAMING YOU “ADDITIONAL INSURED”. IF YOU DO LET THEM WORK WITHOUT A CERTIFICATE YOU SHOULD HAVE THEM PAY A COST PER $1000 YOU PAY THEM. THIS WILL COVER YOU FOR THE ADDITIONAL PREMIUM COST ON YOUR AUDIT AFTER RENEWAL.

Insure your Business Now!

What type of policy are you purchasing? Is it a “claims made” policy or is it a “per occurrence” policy.

There is a very important distinction between these policies and many insurance agents feel the per/occurrence policy should not be sold; however, I disagree. It is a less expensive policy and provides less coverage long term, but there is a place for it in the market as long as you know what you are buying for these policies can be as much as 40% less in premium. So here are the main differences:

Claims made policies only cover you if you have the policy while you are insured. If you continue to buy them year after year, it is generally not a problem; however, you can open yourself to not being covered if you switch insurance companies or shut down your business. The reason for this is that if a claim comes up after your policy period and you did not renew the insurance, there will be no coverage. You can protect yourself from this by buying “tail coverage” covering your prior work.

Per Occurrence policies work different in that if the claim initiated while you were insured, there is coverage no matter when the claim is actually reported. A good example of this is that lets say you are a plumber and do work that damages someone’s house but is not noticed for three years. This would be covered under a “Per Occurrence” policy, but would not be covered under a claims made policy, unless you kept the same policy renewing for those three years.

What is the Rating of Your Insurance Company

Insurance company are graded by their ability to pay claims and stay in business. The ratings are done by two major companies: AM Best and Standard & Poors. It is very important not to do business with a company below a B rating or a company that is not rated at all for 2 main reasons.

Your Clients and Contractors:

You work for may not accept them for your certificate and you will have to buy another policy that is from a company rated B or higherYour company does not have strong financial footing:

If they have a bad year, they could go out of business leaving you with no insurance and there may or may not be any refund of premium. In the event you have a big claim, this could be a disaster

Am I buying insurance from an Insurance Company that is “admitted” and insurance company that is “non-admitted” or a”Risk Retention Group”?

This can be very important in that there is a major difference between the three, so here they are explained:

Admitted Insurance Company: This is the best type of company to buy from and includes most all companies you have heard of: Travelers, Hartford, Liberty Mutual, State Farm, Farmers, etc. This type of policy means that if the company goes bankrupt that the rest of the companies that are admitted will bail them out and you will have insurance even though your company has went bankrupt. Essentially, there is almost no risk of you being stuck without insurance if you have paid.

Non-Admitted Company: This means that your insurance company is not part of being admitted in the state you are buying insurance in and if they go “belly up”, you are left holding the bag. This is not always a bad thing in that many “non-admitted” carriers are still rated and can be rated higher than admitted companies. If you have an “A” rated “non-admitted” carrier, they still have very strong financials and the chance of them going bankrupt would be very little. There are some lines of business like roofing insurance where it is simply not possible to find an “admitted” insurance company.

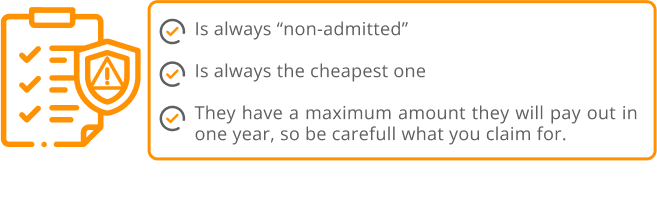

Risk Retention Group: This is the lowest form of insurance to buy in that is always “non-admitted”. They really do not need to go by any rules as far as the language of the policy; however, it does have a place in the insurance market for it is inexpensive. The major problem with these type of policies is that they have a maximum amount they will pay out in any one year, like lets say $5,000,000. Once they pay this amount out, there is no more coverage for anyone. So, if you have a big claim and they have reached their maximum, you are on your own.

Exclusions in your policy, what are the standard ones? There may be more.

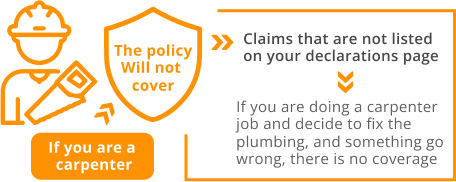

Designated work: You are not covered for claims that arise our of work that are not listed on your declarations page. This is a big one. So lets say you buy a carpenter policy and you are only carpentry work is listed on your policy. You run into a job working on a kitchen and you are good with your hands and also dabble in plumbing and electric. It is an easy job and you decide to do the plumbing yourself.

You make a mistake and flood your clients house causing $30,000 damage. There is no coverage. Make sure your policy covers other class codes than the ones listed. By nature, most contractors do other work and don’t pass up money to go back and look at their insurance policy. This is not expensive to have this removed. Handyman is the biggest danger with this endorsement.

Subcontractors that are independent: This is a big one. Lets say same situation and you hire friend to do work with no certificate of insurance . In face, he is uninsured and you are helping him out “Throwing him a bone”. He messes it up and it is on you. You were the lead in this situation and policy does not cover errors and omissions out of work that you were legally responsible for. This can be deadly.

Asbestos: This is not covered. Almost all policies exclude any work involving asbestos or any other hazardous material. This means the costs of removal or damage as well as the course of effecting such removal. This is a very common exclusion.

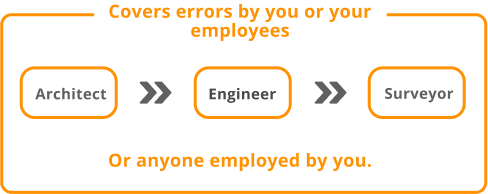

Professional Liability Coverage: This is coverage for incidents that arise out of the services you provide or fail to provide. Essentially this is Errors and Omissions coverage similar to what a doctor or lawyer might purchase. It may include work by you or by any architect, engineer, surveyor or anyone employed by you. Services related to professional liability could include orders, surveys, blue prints maps, designs drawings, structural changes, inspections, engineering services, etc.

Please note. If you are doing any type of approving, designing, consulting, drawing, etc., please buy this coverage. IT IS A NO BRAINER. The cost is about 1% of your revenue and you can pass the costs to your customer. This is becoming a more common lawsuit. If things go sideways on something you had any part of and the loss is large, you can bet you will be named in the lawsuit whether you were right or wrong. One of the most important parts of this coverage is it pays for your defense as well as damages if you lose. Without this coverage, your day starts with dropping off a $10,000 retainer fee to the attorney and on upwards from there. In construction law cases, many times the defense costs are larger than the amount of the lawsuit. This is something to think about for no coverage you can be “held up” by other parties knowing they can run you out of money.

X-C-U- Explosion.

Collapses and underground. Very important if you are doing any excavation or digging.Know Losses.

You are not covered for any losses going on that you know about. Obviously..Roofing.

This is a big one and please listen up. Many of the contractors we work with are small and do all kinds of work. The prices for a starting $1,000,000 policy can be as low as $700 where are roofing policies start at $2,800 to $3200 with New York being higher. We have some policies that will let you do roofing if it is less than 10% and you subcontract to INSURED sub-contractors naming you as additional insured. This is our most common denied claim and easiest for insurance companies to deny. The claim results from roofing and you signed off you do not do roofing. We know it is 3x the price to do roofing for general liability, but misrepresenting the type of work you do will provide you no coverage in the event of a loss for a non covered activity. So you are paying for nothing. Instead, pay the extra money for the insurance and pass it on to your customer. In the end, you are protecting them anyway. These insurance companies have been around and you will not beat them.Residential.

Residential work is excluded. In many types of contractors policies there is no coverage for residential work. This could state single family homes are excluded or dwellings up to four units.Condominium work.

Work done for condominium or HOAs are excluded. This exclusion will usually let you work for individual unit owner. i.e., A painter is painting the inside of a condominium.Apartment buildings.

Very similar to condominium exclusion in that work on residential apartment buildings are excluded.Height.

Many policies have exclusions for doing work over 3 stories, 4 stories or 6 stories. Self explanatory, but check your policy.Employment Practices Liability Insurance.

This exclusion involves claims arising out of employment related practices. Some good examples of claims from this could include the following: wrongful hiring, wrongful firing, sexual harassment, omission, race discrimination, etc. These claims have went up 5 times in the last ten years and will be rising.Pesticide and Herbicide exclusion.

You should have covered if doing landscaping.Exterior Insulation and Finish System.

If you work with this, you know what it is and you need to make sure this is not excluded on your policy. This exclusion has to do with exterior insulation or synthetic stucco. Claims arise out of this product from mold and insurance companies run.Pool Pop.

The rising of your pool from waterFoundation work.

Very important for General Contractors, Excavators, Waterproofing, etc..Lead.

Any claim that arises out of lead is generally not covered and expensive to buy coverage in that coverage will usually come from a pollution insurance policy. This may included but is not limited to repair, replacement, drawing, design, reinforcement, sub-structure, etc.

Additional Insured Language

There are all types of additional insured and most companies will take a simple certificate stating you have the coverages outlined on page 1; however, larger contractors generally want to protect their insurance policies and pass the risk “downstream” to you in asking for language that favors them. The 3 main endorsements that they may ask for on their policy along with special wording transferring more of the risk to you are as follows:

- Additional Insured CG2010

- Primary Wording

- Waiver of Subrogation

Manuscript Policies vs ISO Policy

Manuscript policies:

These are policies that can contain any language or exclusions the insurance company wants. They are usually only seen in the “non-admitted” market and may offer very little coverage for what is usually a low price. Your certificate may look the same, but behind the numbers there is very little coverage. There may be handwritten policies written for large companies that may add more coverage and be specific to a large company’s needs, but for small companies, this is usually not the case. Many times, certificates are sold that show numbers and show that you have insurance, but often little coverage. These policies have their place in the market for small businesses that can’t afford a better policy and need something that works.

ISO Policies

Are standard policies that the industry has agreed it to be fair for the client and for the insurance company. Most all large companies use ISO forms such as Travelers, Hartford, Farmers, State Farm, etc for they mean to be fair and the language is the same for the entire industry. Many Risk Retention Groups as stated earlier do use Manuscript policies that do not offer a lot of coverage, but are inexpensive to purchase.

Deductible

Slightly different than property insurance, but is generally the same. In liability insurance it is called self-insured retention or (S.I.R) meaning you retain the first amount of these dollars in the event of a claim. If you have chosen to purchase a $2500 S.I.R and have a $13,000 claim, you would pay the first $2,500 and the insurance company would pay the $11,500. The higher your self insured retention, the lower the price should be.

Short Summary in review

- Buy 1m/2m.

- If you are a light contractor buy name brand company (ISO) policy.

- You cannot buy a policy for less than 3 months.

- Ask broker if additional insureds cost per certificate of insurance or unlimited in price.

- Is there a deductible..how much is on your end and how much will the insurance company pay.

- Do you have “Blanket” additional insured. If not, you will be paying $100 for each certificate of insurance.

- Are you with an A rated Company ?

- Is it a non admitted or admitted policy?

- Do you work for large contractors. If so do you have language in place they will require.

- Do you need professional liability?

If you have any questions about this or any other insurance needs feel free to contact the knowledgeable agents at ContractorsLiability.com at 773-985-2528 or go to our website for a QUOTE. We offer 5 Star customer service and can often get you insured in under an hour.