Errors and Omissions Coverage — Vital Protection for Professionals

Safeguard your professional practice with comprehensive errors and omissions coverage, specifically designed for service providers. This essential insurance shields you from claims arising from mistakes, negligence, or omissions in your professional services.

Whether you’re a consultant, doctor, or lawyer, this protection allows you to focus on delivering quality work without the constant fear of potential legal disputes.

Obtén tarifas de los principales proveedores de seguros de América con una cotización instantánea de nuestra parte.

Introduction

Operating in a professional capacity involves various responsibilities and risks. Even the most diligent professionals can encounter unforeseen issues that lead to claims. Errors and omissions coverage is crucial for mitigating the financial impact of such events, ensuring you remain secure while serving your clients effectively.

Expert advice

What Is The Difference Between Professional Liability Insurance And General Liability Insurance?

General Liability Insurance is needed for contractors and professional handyman services because it covers legal fees for any sort of settlement a company and its client might have in court.

Professional liability insurance is what covers any sort of incident of negligence on the part of a professional contractor or handyman.

What Is Professional Liability Insurance?

Professional liability insurance, also known as errors and omissions insurance, protects professionals from claims made by clients for inadequate work, negligence, or errors in services rendered. This type of coverage is essential for those in fields where mistakes can have significant consequences, including consultants, healthcare providers, and legal advisors.

As a professional, maintaining a strong reputation is vital for your business. However, even minor oversights can lead to claims that jeopardize your credibility. That’s where professional liability insurance plays a crucial role, providing necessary protection for your career, reputation, and financial stability. Many states and industries require this insurance to ensure professionals are protected against potential liabilities.

Get a Free General Liability Insurance Quote

In only 5 minutes of your valuable time. We can often get same day coverage.

Get a Free General Liability Insurance Quote

What Does Professional Liability Insurance Cover?

Professional liability insurance offers a wide range of protections tailored to the unique risks faced by service providers. Here’s a breakdown of what this coverage typically includes:

-

Negligence Claims:

Protects against claims arising from alleged failures to perform professional duties.

Example: A client claims that a financial advisor failed to provide adequate investment guidance, resulting in significant losses.

-

Errors and Omissions:

Covers mistakes made during the course of providing professional services.

Example: An architect overlooks a crucial design element, leading to structural issues in the project.

-

Legal Defense Costs:

Covers expenses associated with defending against lawsuits, including attorney fees and court costs.

Example: You incur legal fees while defending yourself against a claim of professional misconduct.

-

Claims for Incomplete Work:

Protects against allegations that services were not completed as promised or were subpar.

Example: A client claims that a contractor failed to finish a renovation project, causing them financial harm.

-

Misrepresentation:

Covers claims alleging that you misrepresented your qualifications or the services you provide.

Example: A marketing consultant is sued for claiming expertise they do not possess, leading to a lawsuit.

Errors and omissions coverage provides essential protection for professionals, allowing you to operate with confidence while minimizing risks associated with your services.

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

Why Do You Need Professional Liability Insurance?

Having professional liability insurance is essential for protecting your practice from the financial fallout of legal claims. This coverage can help pay for legal fees and settlements if a client sues you for negligence, mistakes, or unsatisfactory services, which could otherwise lead to devastating financial losses.

Many clients and contracts require proof of this insurance, making it vital for securing business opportunities and maintaining professional credibility. By investing in this coverage, you protect your career, ensuring peace of mind and the ability to focus on your work without worrying about unexpected liabilities.

What’s Not Covered By Professional Liability Insurance?

While professional liability insurance offers crucial protection, it’s important to understand its limitations. Here are some situations where this policy may not provide coverage:

-

Employee Injuries:

Claims for injuries sustained by your employees while working are generally covered by Workers’ Compensation Insurance.

-

General Liability Claims:

Incidents such as property damage or bodily injury unrelated to your professional services are not covered.

-

Intentional Wrongdoing:

Deliberate acts of misconduct or fraud are typically excluded from coverage.

-

Contractual Obligations:

Certain contractual liabilities may not be covered unless specified in the policy.

-

Criminal Charges:

Claims arising from criminal activities are not protected by professional liability insurance.

Factors That Contribute To Cost Of Professional Liability Insurance

You can find a pair of socks at the dollar store, or you can find a pair of socks at Footlocker. The main factor differentiating the two is cost – but as we all know, the price is often determined by the quality of materials and other considerations that went into making the pair of socks. The same goes for professional liability insurance for specific industries.

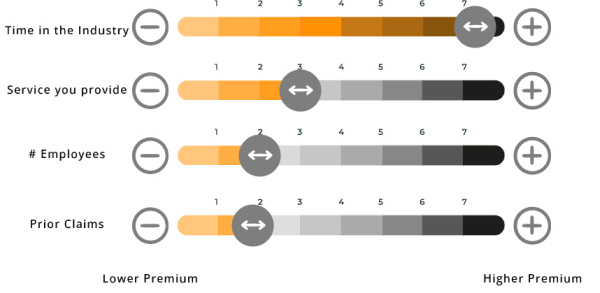

Your time in the industry, the number of employees you have, what services you provide, and so much more goes into figuring out exactly what type of coverage you need. Setting up a free consultation with the insurance company of your choice prior to purchasing professional liability insurance will guarantee that you get the most reasonable price for the coverage that you need.

Here’s What Contractors Think

FAQ: What Isn’t Covered by Professional Liability Insurance?

No, injuries sustained by employees are handled through Workers' Compensation Insurance.

No, general liability claims related to property damage or bodily injury are not included.

No, deliberate actions or fraud are typically excluded from this coverage.

Generally, no. Certain contractual liabilities may not be covered unless specifically outlined in the policy.

Claims resulting from criminal activities are not covered by professional liability insurance.

No, it specifically covers claims related to professional services and does not extend to all potential liabilities.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.