Ensure that your window and door installation projects are safeguarded with specialized insurance that covers all unexpected risks. From residential homes to large commercial projects, this insurance offers peace of mind and financial security for every installation.

The window and door installation industry faces specific risks that can result in financial loss if unprotected. With the right insurance, you can shield your business from incidents that could otherwise jeopardize your projects. Window and door installation insurance provides essential coverage against:

Window and door installation can be a challenging task, often performed in environments that are prone to accidents. Having insurance can protect your business from potential liabilities such as:

Only 5 minutes of your valuable time. We can often get same day coverage.

By opting for our tailored insurance solutions, you’ll gain access to numerous benefits designed to protect your window and door installation business:

We collaborate with trusted insurers to offer coverage between $1,800 and $3,600, ensuring top-quality protection at an affordable rate.

Our policies are designed specifically for window and door professionals, covering everything from liability to workers’ compensation.

Delays can be costly in this industry, and our insurance partners ensure a quick resolution to any incidents, so your work can continue without major interruptions.

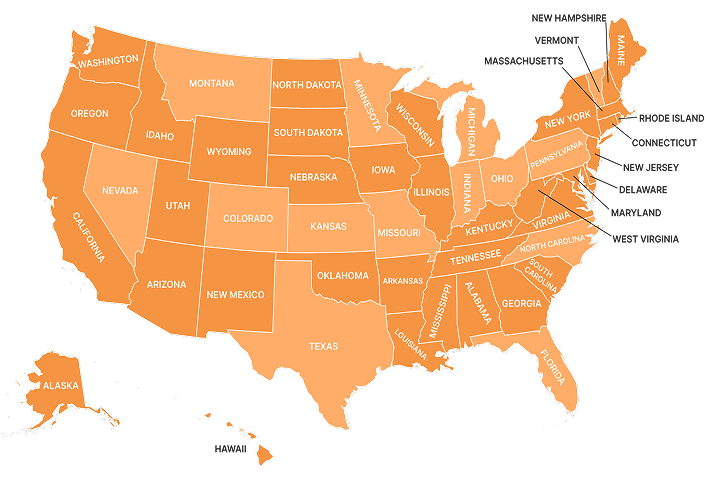

We provide state-compliant insurance solutions to ensure your business meets all local regulatory requirements, regardless of where you operate.

Manage your cash flow effectively with payment options that suit your business, whether you prefer monthly, quarterly, or annual payments.

Here are some examples of things that could go wrong when working with window and door installation, which are often covered by the window and door installation insurance:

These injuries affect a third party, most commonly an injury that is directly the fault of the window and door installation company.

Example: Your failure to protect a client from getting too close to a window being sanded down on site has created an accident where particles of glass have caused severe eye injury.

Advertisement injuries are any sort of action taken against a company for their reckless business practices, such as copyright infringement or libel.

Example: One of your radio advertisements plagiarized a jingle associated with a competitor, which prompts a suit against you for copyright infringement.

If a third party is injured because of an event directly related to your company, often you must pay for the resulting medical payments.

Example: A window breaks on the job site and the broken glass causes a laceration on a client’s arm or leg. Their medical bills are ultimately the responsibility of your company.

Example: Your company publishes a false statement about another business in an ad or online post, and they sue for reputational damage and lost income.

While this insurance offers extensive coverage, there are certain limitations. Here are some aspects that are not typically covered:

Specialized window and door installation insurance is crucial for protecting your business from unexpected risks. It provides essential coverage against damages, liabilities, and accidents that can disrupt your operations.

By investing in this protection, you can ensure your projects and reputation remain intact, allowing you to focus on delivering high-quality service.

No, intentional harm or damage caused by employees is excluded from coverage.

Generally, no. Separate coverage is needed for personal tools or equipment used on-site.

No, wear and tear from regular use is not typically included unless specified in the policy.

No, this insurance does not cover financial losses due to delays from adverse weather conditions.

Just read and in 30 minutes you will know everything about insurance.