Protect your waterproofing projects with specialized insurance coverage that shields against unforeseen risks. From residential properties to large-scale commercial applications, waterproofing insurance provides the financial security you need to complete your work confidently.

The waterproofing industry faces distinct challenges that can lead to significant unexpected costs. Without appropriate insurance, a single incident can result in substantial financial losses, disrupting your projects. Waterproofing insurance offers critical protection against:

Waterproofing work can be physically demanding and performed in unpredictable conditions, making accidents likely. The right insurance policy can shield your business from the financial fallout of typical risks, including:

Only 5 minutes of your valuable time. We can often get same day coverage.

When you choose our waterproofing insurance solutions, you’ll access a variety of advantages specifically designed to meet your business’s unique needs:

We collaborate with top insurance providers to offer competitive coverage ranging from $1,800 to $3,200. This ensures quality protection without straining your budget.

Our experts recognize the specific risks associated with waterproofing projects and will tailor policies to suit your unique requirements, covering everything from liability to workers’ compensation.

In the waterproofing industry, time is essential. Our insurance partners process claims quickly, enabling you to address incidents efficiently and keep your projects on track.

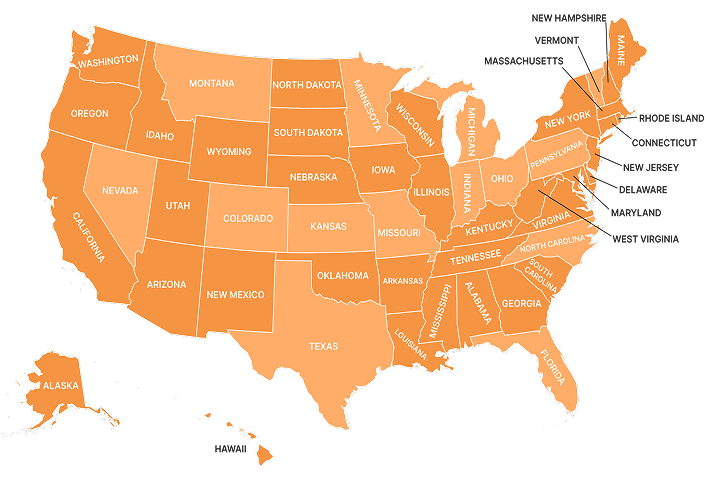

Our insurance solutions comply with local regulations, ensuring that your business is protected no matter where you operate, with comprehensive guides tailored to each state.

We understand the financial challenges of contracting work. That’s why we offer adaptable payment options to match your cash flow needs, allowing you to choose between quarterly or annual payments.

Contractors Liability knows that you do your best to prevent accidents from happening, but we also know they’re not always unavoidable. Here are some of the things that liability insurance covers and how it might apply to a waterproofing company.

Any direct damage done to the body of a client or third party that someone at your company is at fault for.

Example: You do not properly ventilate an area while you are waterproofing a residence, causing a client to fall ill because of the fumes.

Example: Your company uses a competitor’s photo in an online ad without authorization, and the competitor files a claim for copyright infringement.

Changes made to the property, which can either be intentional or unintentional, which go against the initial wishes of the client.

Example: Your waterproofing job covers more than the client originally asked for, which unintentionally decreases the value of the property because it changed how the property looked.

This includes payment of injuries that are either a direct result of the actions made by someone at your company or the result of a project that your company won a bid on.

Example: Your waterproofers fail to secure something on top of a scaffold. It falls and hits a passerby. Your company is thus held accountable when it comes to covering that person’s resulting medical bills.

Example: Your company publishes a false statement about a local competitor in an online ad or social post. The competitor claims the statement damaged their reputation, caused them to lose customers, and sues your business for the resulting financial losses.

How can I lower my insurance payments?

Most liability insurance costs are out of the control of both clients and insurance agents. However, working with a specialized insurance agent can ensure that you receive the best rate for the service

You require while getting coverage that you can actually use when you need to use it.

While waterproofing insurance provides essential coverage, it’s vital to understand its limitations. Here are some scenarios where this policy may not offer protection:

General liability insurance is essential for safeguarding your business against unexpected costs associated with property damage or injury claims. This coverage helps pay for legal fees and compensation, allowing you to maintain your financial stability in the event of accidents or incidents during waterproofing projects.

No, this insurance does not extend to damages present before the job starts.

No, damages resulting from intentional actions are not covered.

Generally, no. Personal tools and equipment may need separate insurance protection.

No, standard wear and tear is typically excluded unless specified in the policy.

No, this policy does not cover financial losses from weather-related project delays; it focuses solely on physical damages.

Just read and in 30 minutes you will know everything about insurance.