Ensure your piano maintenance and repair business is protected with specialized insurance coverage that guards against unforeseen issues. Whether you’re tuning for a concert hall or restoring a family heirloom, piano technician insurance allows you to work confidently with the security of financial protection.

Piano technicians face unique challenges that can result in unexpected expenses. Without proper coverage, even a minor mishap could lead to significant financial strain. Piano technician insurance provides essential protection against:

Piano maintenance is highly specialized, and technicians often operate in environments that present various risks. Having the right insurance plan can protect your business from financial repercussions. Guard yourself against:

Only 5 minutes of your valuable time. We can often get same day coverage.

When you choose our piano technician insurance solutions, you gain access to a range of benefits tailored to your specific needs:

We work with trusted insurers to provide competitive policies, offering comprehensive protection at reasonable rates ranging from $1,500 to $3,000.

Our experts will design insurance packages tailored specifically to your business, covering everything from liability to workers’ compensation.

We understand that your work is time-sensitive. Our efficient claims process ensures minimal disruption to your projects.

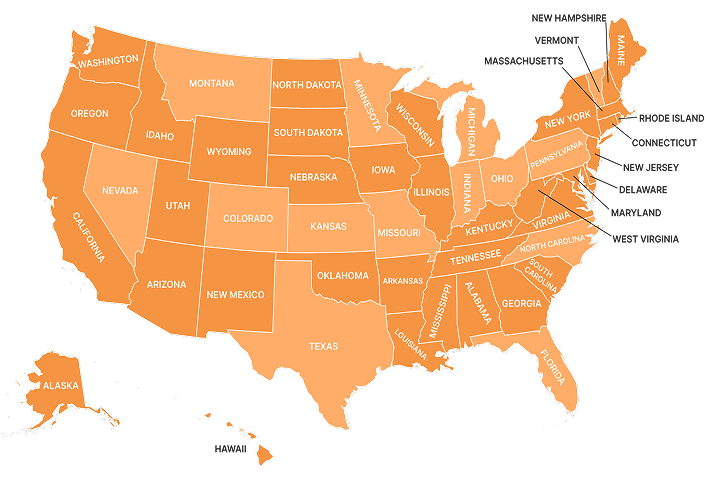

Our policies ensure you stay compliant with local laws and guidelines, no matter where you operate.

Choose from convenient payment options—whether quarterly or annually—designed to fit your cash flow needs.

Therefore, it is prudent that we investigate a few examples of injury and damages associated with this line of work.

Any injury inflicted upon the third party or client’s person at your worksite.

Example: The stools that the performer and sight-reader sit on are considered a part of the piano itself. If a technician fails to fix any structural weaknesses in these stools, a performer or sight-reader might fall and break their tailbone or hip, upon which the technician will be responsible for the damages.

Any claim or action was taken against a competing company that is inherently false leads to said company suing for loss of business.

Example: You claim that all of your regional competitors refuse to touch brands such as Steinway due to their level of risk when in truth, another competitor specializes in working on Steinways.

Any damage that is added to the instrument or its accessories.

Example: Failing to secure the apparatus that holds up the piano lid may cause the lid to crash down onto the piano and crack the lacquer or split the wood.

This covers the medical bills of a third party who is injured by your negligence.

Example: A backstage technician trips over your equipment left on stage. You are technically at fault, and therefore must pay for whatever injuries the technician sustained.

Not the same as an injury to the body; rather, it is defined as a loss of reputation for reasons created by you and not the performer.

Example: Assuming there is no change in the tone of the piano after two or three days causes a performance where the piano is out of tune. The performer takes action against you because of the negative response to the performance.

While piano technician’s insurance provides comprehensive protection, it’s important to know its limitations. Some instances where coverage may not apply include:

Pre-existing Structures:

Coverage does not extend to already completed structures or projects.

Employee Injuries:

Injuries sustained by employees are typically handled under workers’ compensation, not general liability insurance.

Mechanical Failures:

Damages caused by faulty equipment or mechanical breakdowns are not covered.

Contractor’s Tools:

Tools owned by contractors often require separate insurance for theft or damage protection.

Intentional Damage:

Acts of vandalism or intentional harm to property are not included in coverage.

Specialized piano technician’s insurance is crucial for protecting your business from unexpected risks. It provides essential coverage against damages, liabilities, and accidents that can disrupt your operations.

By investing in this protection, you can ensure your projects and reputation remain intact, allowing you to focus on delivering high-quality service.

What Isn’t Covered by Piano Technician’s Insurance?

No, this insurance only applies to damages that occur during service or repair. Any pre-existing scratches, dents, or internal issues in the piano are not covered.

No, damages resulting from intentional actions or improper handling are excluded. The policy covers only accidental incidents during routine maintenance or repairs.

Generally, personal tools and equipment, like tuning forks and specialized wrenches, are not covered under standard piano technician insurance unless additional equipment coverage is purchased.

No, general wear and tear on pianos, such as aging strings or gradual hammer wear, is not covered unless specified in the policy.

No, delays or cancellations due to scheduling conflicts or weather impacts are typically not covered. This insurance primarily addresses liability and damage risks during the technician’s active work.

Just read and in 30 minutes you will know everything about insurance.