- Key Takeaways

- What is Dwelling Policy Coverage?

- Other Homeowners Insurance

- Understanding Personal Liability

- Calculating Your Dwelling

- Policy Exclusions and Endorsements

- A Proactive Approach to Your Policy

- Conclusion

- Frequently Asked Questions

- What does dwelling policy protect?

- How is dwelling different from homeowners insurance?

- How do I calculate the right amount of dwelling?

- Are personal belongings included in dwelling policy?

- What are common exclusions in dwelling policies?

- Can I add extra to my dwelling policy?

- Why is personal liability important?

Understanding Dwelling Coverage in Homeowners Insurance: What Your Policy Really Protects

- Dwelling policy, which is the cornerstone of homeowners insurance, covers the main structure and attached components against various hazards. Knowing your policy forms and covered perils is key to risk management.

- HO-3, dwelling policy, should cover your main dwelling, attached and detached structures, personal property, loss of use, and liability. This is everything you need in homeownership.

- Policyholders should periodically review their policy limits and revise them to current costs and property changes, using accurate resultant figures based on square meter estimates and local construction costs.

- Knowing what is excluded from the policy and what endorsements or riders are available helps homeowners fill in the holes in standard policy, particularly for commonly excluded risks such as natural disasters.

- Keep a personal property inventory and home maintenance documentation to make the claims process easy and help you succeed during loss events.

- Active management, such as yearly policy evaluations and seeking advice from experienced insurance agents, keeps homeowners insurance suited to changing requirements and compliance requirements.

How Much Dwelling Coverage Do You Need in Your Homeowners Insurance — What’s Covered and How It Protects Your Home

Dwelling policy provides protection for the home’s structure against hazards such as fire, wind, and theft. Most policies will pay for damage to built-in items such as walls or floors.

Some may assist when a home is uninhabitable during repairs. Policies vary in what they insure, so watch for restrictions or additional terms.

This guide outlines the key components of dwelling insurance in simple steps.

What is Dwelling Policy Coverage?

Dwelling insurance coverage is a crucial aspect of a homeowners insurance policy that protects the physical structure where you reside. This includes repair and rebuilding costs if the insured structure is damaged by a peril covered by the dwelling policy. It encompasses the roof, walls, built-in appliances, and attached fixtures. Understanding the options and what perils are included is essential, as specifics can vary by policy form, ensuring it matches the actual rebuild cost rather than the market value.

1. Structural Protection

Structural policy indicates your policy will cover repairing or replacing the home in the aftermath of fire, lightning, vandalism or a windstorm. This portion of your policy protects the dwelling itself, giving you a protected place to reside. Fix-it expenses can be steep, particularly if the residence is constructed with one of a kind materials or specialized features.

If a fire burns your house to the ground, this policy kicks in for a new roof and new walls or even a rebuild. It can cause you out-of-pocket expenses if you’re underinsured. Homeowners should verify their limits equal the actual rebuild cost, which an appraiser can determine for current prices.

2. Attached Structures

These are garages, decks, porches and sometimes carports anything attached to the primary residence. These pieces are protected under your dwelling policy, so if a storm takes down your garage or a fire torches your porch, it’s included in the claim.

These amenities add to the home’s value and convenience. If the limit is too low, fixing the garage or deck might not be entirely covered, which could put you in a bind. Damage to attached areas can affect your entire property’s value and livability.

3. Named Perils

Named perils are the particular dangers enumerated in the policy fire, theft, smoke, hail, lightning, etc. Almost all dwelling policies insure against sixteen perils. If your home is destroyed by something not on the list, the policy won’t cover it.

For instance, flooding is typically not a named peril and requires its own policy. Going over the list assists in aligning protection with your region’s dangers. Those in earthquake zones may require additional insurance. Always see if you need add-ons for perils omitted.

4. Open Perils

Open perils, known as all-risk policy, cover all risks other than those explicitly excluded in the policy. HO-3’s are the most typical. It reduces arguments because if the risk isn’t excluded, it’s insured.

Homeowners dig this one too it just seems more whole. Even still, it’s smart to read the exclusions carefully. War, government action or wear and tear are some typical exclusions.

5. Policy Forms

Policy forms differ in what they cover and how much they cost. HO-1 is pretty barebones, covering just a handful of perils. HO-2 covers more, with a specific list of perils.

HO-3 is the most common, employing open perils for the house and named perils for personal property. Your ideal form depends on your needs, the home’s characteristics, and your risk aversion. Understanding the distinction can help you steer clear of policy gaps and select what applies best to your scenario.

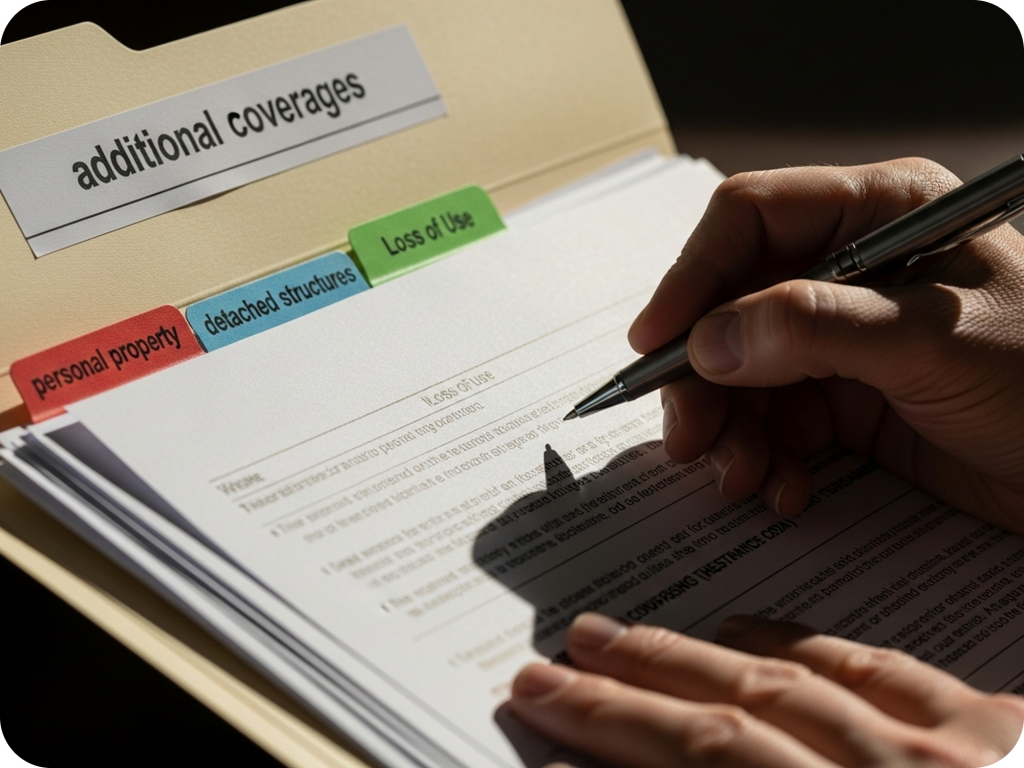

Other Homeowners Insurance Coverages

It typically provides other protections that plug holes in the basic dwelling insurance, and these additional protections assist in covering belongings, detached structures, and living expenses if the house is severely damaged. Being adequately covered remains essential to financial security, as unforeseen losses extend well beyond easy fixes to the structure.

Homeowners should consider their needs and risks in determining whether they require additional protection.

Personal Property

Personal property covers stuff inside the house. This covers items like clothes, TVs, laptops, kitchen utensils, and furniture. If fire, theft, or water damage ruins these items, this could help pay to replace or fix them.

Valuables such as jewelry, art, or rare collectibles may require additional protection if their worth is significant. Other lines of homeowners insurance have limits, so it’s smart to review what you own.

There are two primary ways insurance covers personal belongings. Actual cash value provides you with the item’s value less depreciation for age and use. Replacement cost pays what it costs today to purchase a new one of similar kind.

The cost is pricier, but it can save you a bundle after a major loss. For instance, if a three-year-old laptop gets stolen, actual cash value pays less than you would need to replace it with a new one.

Inventorying your valuables, including photos, prices, and receipts, gets you full shielding. It expedites claims. A recent inventory is a great tool in verifying assurance matches your needs and nothing slips through the cracks.

Detached Structures

Detached structures are buildings or fixtures not attached to the home. They include sheds, garages, fences, greenhouses, and guest houses. Homeowners policies typically provide a limited amount for these, often a percentage of the dwelling protection amount.

Some policies won’t cover certain structures or cap protection by use, so specifics count. Coverage for detached structures varies. Certain policies cover solely buildings that are privately used, not for business. Others might exclude specific types, such as swimming pools or barns.

Review your policy and see if you require additional coverage for high-value or unique-purpose structures.

Checklist for detached structures:

- Write down all detached buildings and fixtures.

- Note their sizes, uses, and value.

- Check if each is covered under your policy.

- Update the list after you add or remove anything.

Checking limits makes sure you’re not stuck underinsured if disaster strikes. For big or expensive detached structures, you need extra coverage.

Loss of Use

Loss of use coverage is a vital aspect of homeowners policies, as it covers living expenses if your home becomes uninhabitable after a covered incident. This includes costs like rent for a temporary apartment, meals, storage, and transport. If a fire ravages your primary residence or acute water leakage displaces you, this portion of your dwelling policy ensures you won’t have to cover essential expenses out of pocket while restoration unfolds.

The duration and extent of loss of use coverage can vary significantly among different homeowners insurance providers. Some policies place a maximum duration, such as 12 months, while others limit payments to a percentage of the dwelling coverage limit. It’s crucial to understand what these limits are to ensure adequate protection.

In expensive cities or for larger families, fees can accumulate quickly. Homeowners should estimate their living expenses to determine if the basic coverage is sufficient. If you anticipate being displaced for a while, consider where you’d stay, for how long, and any special needs that may increase costs.

If you’re considered high risk, it’s wise to increase the dwelling coverage limits for added security and peace of mind. This proactive approach can safeguard your financial stability during unexpected events.

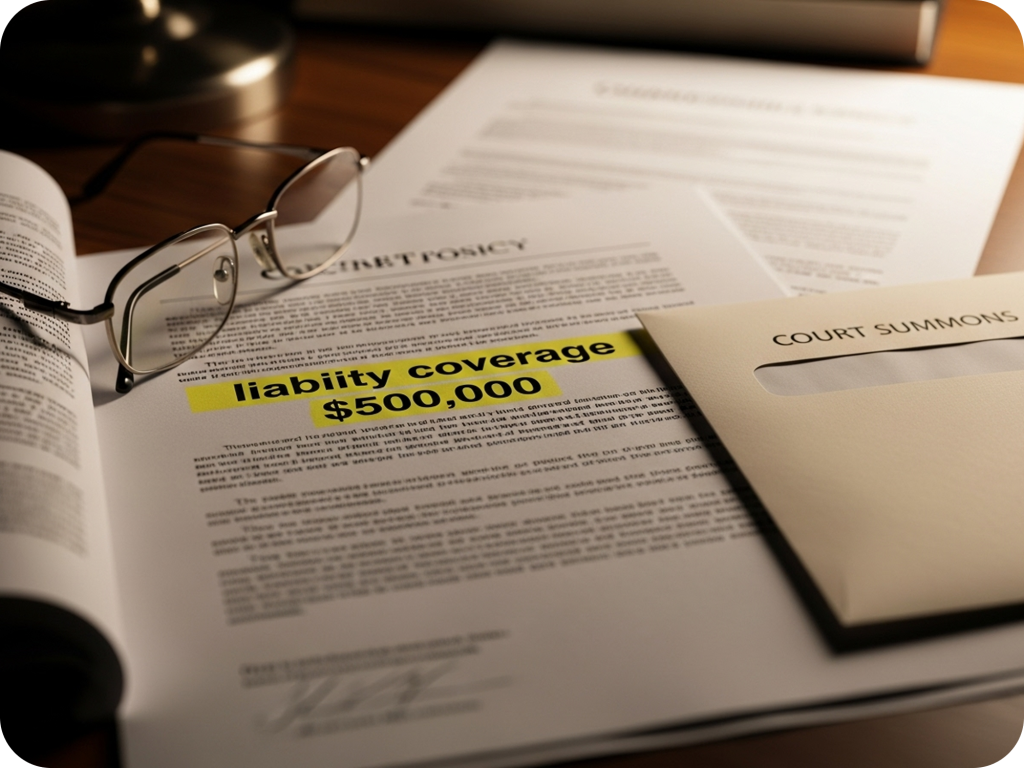

Understanding Personal Liability Coverage

Personal liability coverage is a staple of home insurance, alongside dwelling protection, personal property coverage, and additional living expenses. It protects homeowners against claims or lawsuits when someone is injured on their property or they damage someone else’s. It covers legal fees, settlements, and medical bills if the homeowner is liable.

The typical policies have minimums and maximum limits from USD 100,000 up to USD 500,000, although the coverage limits could be higher, especially if you have more assets to safeguard.

Bodily Injury

Bodily injury coverage protects you if someone gets physically injured on the insured premises. For instance, if a guest slips on wet steps or falls during a dinner party, this coverage may assist in covering their medical bills and any legal fees should a lawsuit ensue.

Homeowners are at genuine financial risk when injuries occur and medical expenses can easily mount, particularly if long-term care or rehabilitation is required. If coverage limits are too low, homeowners could be personally liable for additional costs.

Being aware of what hazards are present on your property, such as loose railings, uneven walkways, or poorly lit locations, and mitigating them before mishaps happen protects guests and can diminish the likelihood of costly claims.

Property Damage

Property damage liability pays for costs if the homeowner or anyone in the household inadvertently damages another person’s property. This includes a child breaking a neighbor’s window or a tree branch falling and damaging a car in a storm.

Holiday get togethers or home renovation projects are popular times for these accidents. Knowing how much coverage you actually have is important as policy limits determine how much the insurer will pay on a claim.

If damages exceed those limits, the homeowner is on the hook for the rest. Mitigating risk, such as trimming trees, watching children closely, and maintaining the property, can prevent these situations from arising in the first place.

Medical Payments

Medical payments coverage covers medical bills if a guest is injured on the property, whether you’re at fault or not. This can assist with doctor visits, hospital stays, or X-rays, sometimes prior to a liability claim even being filed.

By immediately treating minor injuries, homeowners can skip the larger liability aggravation of a claim or lawsuit. Standard coverage limits are far less than personal liability coverage, generally ranging from $1,000 to $5,000.

This coverage plugs an important hole, assisting in keeping good relationships with visitors and neighbors. For those constructing a comprehensive protection plan, medical payments coverage is a wise supplement.

Calculating Your Dwelling Coverage

Dwelling Coverage

Simply put, your dwelling coverage should be based on how much it would cost to reconstruct your home from scratch in the event of a total loss. This is based on the home’s replacement value, not market price, since coverage needs to account for the cost to rebuild, not what a buyer may be willing to pay for your home.

Most insurance companies will suggest that you multiply your home’s total number of square meters by the average local rebuild cost per square meter for the coverage amount. Always err on the side of a policy limit that would completely finance a rebuild as construction costs tend to increase.

It’s a good idea to talk to your insurance agent too; they can help you determine if your dwelling coverage reflects current local costs and building codes. Many policies will insist on coverage of at least 80% of your home’s value while others demand full (100%) cost insurance.

Extended dwelling coverage, which adds 10–15%+ to your limit, can be great for additional coverage if prices soar following a catastrophe.

Replacement Cost

Replacement cost coverage pays to rebuild your home with materials of like kind and quality at today’s prices. It excludes the land value. Here again, it’s different from market value, which could drop due to changes in buyer demand or a neighborhood’s popularity because it’s tied specifically to the cost of construction and materials.

Periodically adjusting your coverage keeps it current with local building costs. If you don’t check these figures and prices soar, you might find yourself underinsured, paying on your own for a portion of the rebuild.

In most areas, the ‘80% rule’ comes into effect where your policy pays out only if your dwelling is insured for at least 80% of its replacement value. Others base a need for 100% coverage.

These extended cost options can give you 125% or even 150% of your original coverage limit in the event of a major loss, a handy protection against cost overruns.

Market Value

Market value is what a buyer would pay for your home. It takes into account location, amenities, and market demand, not the reconstruction cost. It may be above or below replacement cost.

If your dwelling assurance is on market value instead of replacement cost, you’re likely underinsured. For instance, a house in a hot market may have a high value, but it could be cheaper to rebuild than the going rate to buy it.

If the reverse holds, market value is low but construction costs are high, you may end up with an assurance gap. Homeowners, you want replacement cost estimates, not market value, for insurance purposes so that you have the funds available to put it back after a loss.

Premium Factors

|

Factor |

Impact on Premiums |

|---|---|

|

Coverage Limit |

Higher limit raises premium |

|

Deductible Amount |

Higher deductible lowers premium |

|

Construction Type |

Durable materials may lower cost |

|

Location Risk |

High-risk areas cost more |

|

Extended Coverage |

Adds to premium |

Premiums go up as you add more coverage limits. Opting for a higher deductible of $5,000 instead of $500 will diminish your yearly premium, but you’ll pay more in the event of a claim.

Material quality, local rebuilding costs, and neighborhood risk all factor in. Shopping around for quotes from different insurers gets you the best rate, but never sacrifice coverage for price.

Personal property coverage usually begins at 50% of your dwelling limit, but can be modified.

Policy Exclusions and Endorsements

Policy exclusions are perils or occurrences that a homeowners insurance policy will not insure against. These exclusions are described in the policy, but many homeowners don’t pay attention to them until they submit a claim and discover a loss is excluded. Understanding what’s excluded is crucial to not having costly surprises if disaster strikes.

Endorsements or riders allow homeowners to supplement coverage for hazards excluded in a basic policy. For special needs such as a home office, fine jewelry, or a home under construction, endorsements can fill gaps and limit financial risk.

Common Exclusions

- Floods, earthquakes, and mudflows

- Landslides and mine subsidence

- Damage from war or nuclear hazard

- Wear and tear, mold, and pest damage

- Intentional acts or neglect

- Certain breeds of dogs for liability coverage

- Outbuildings, such as sheds or fences, are usually capped at a portion of the home’s value.

If you’re a homeowner in a flood or earthquake zone, tread carefully. Your regular policy won’t cover losses from these. Instead, individuals must purchase separate coverage for these hazards. For instance, flood insurance is a necessity in many regions of Southeast Asia and the US, where flooding is prevalent.

Earthquake coverage is distinct and frequently has a high deductible. Without these additional policies, you could be looking at large repair bills. A lot of policies exclude coverage for detached structures, like fences or garden sheds. This can leave homeowners with insufficient funds to rebuild after a storm or fire.

It is smart to check the limits and consider additional coverage if you have valuables in outbuildings. Reviewing your policy annually helps you stay informed about what is excluded as coverage options change.

Natural Disasters

Natural disasters, such as earthquakes, floods, and landslides, are among the most common exclusions in homeowners insurance policies. Nearly all standard homeowners insurance policies exclude these events, and the financial fallout can be enormous. For instance, one flood can wipe out walls, floors, and wiring, resulting in repair costs in the tens of thousands of euros or US dollars internationally.

In seismic areas, lacking adequate dwelling insurance coverage exposes homeowners to serious risk. Earthquake or flood coverage typically requires separate policies, so you should consider the price versus your risk. If you live on a hillside or next to water, the risk of loss is significantly increased.

Knowing your risk by zip code is a great initial step. If you reside in an area affected by storms or earthquakes, purchasing supplemental coverage is typically the only means to safeguard your residence and nest egg.

Available Riders

Riders, known as endorsements, allow you to tack on coverage for items the base policy neglects. These are for things like coverage for expensive personal property, such as art or jewelry, or for special risks, like a home business.

Another instance is dwelling under construction coverage, which assists if you’re building or renovating and desire protection from theft or damage during that period. We have riders to cover things like theft of building materials or tools. This is convenient if you’re doing serious work and don’t want to foot the bill if something disappears.

Certain policies provide riders for pets, particularly if you have a breed that is commonly excluded from liability coverage. Tailoring your policy like this means you’re less prone to be blind-sided by a coverage gap. It’s a wise option for anyone with unique exposures or prized possessions under their roof.

A Proactive Approach to Your Policy

Dwelling policy coverage isn’t a set it and forget it affair. It requires active, continuous management to ensure it meets your evolving needs. Life events, changes in statutes, and new risks all impact whether you have enough or too much coverage.

By staying involved, you’ll be able to identify holes, ditch what you don’t need, and even discover when you’re able to save or get better rates. Proactiveness means that you’re not simply reactive to issues; you’re prepared for them, and you know exactly what’s in your policy and why.

Regular Reviews

Yearly checkups to your homeowners insurance policy are essential. Your home and possessions can become more or less valuable over time, and so can local construction costs. If you upgrade with new appliances, finish a basement, or purchase high-dollar electronics, these all impact your coverage requirements.

It’s tempting to forget the details of minor changes, but even small home upgrades can alter your risk status and necessitate a policy revision. Shifting market conditions and local building costs are important as well. If the rebuild cost in your neck of the woods doubles and your coverage hasn’t, you could stand to take a post-loss hit.

Policies should be examined not only for deductibles but for riders extras that can shore up weaknesses, like coverage for jewelry or river and stream flooding. Discussion with your agent during these reviews helps clarify what is and isn’t covered and opens the door to cost-saving adjustments. Occasionally, dropping extraneous riders or simply bundling policies can lower premiums without compromising coverage.

Maintenance Impact

Routine home care has a direct impact on your policy. Insurers frequently reward well-kept homes with lower premiums or discounts. Fixing roof leaks, replacing old wiring, or trimming overgrown trees all reduce risk, which makes you less likely to submit claims.

Ignoring hazards can do the opposite. Insurers will deny claims if culpable neglect is established. A cracked walkway, broken locks, or bad drainage increase the risk of damage or injury, which can result in claims being denied or more expensive premiums.

It helps to document upgrades and repairs with dated photos or receipts. If you do have to file a claim, having the ability to demonstrate a history of care may get you through more quickly and engender trust with your insurer. It’s an easy but frequently overlooked step that operates on your behalf.

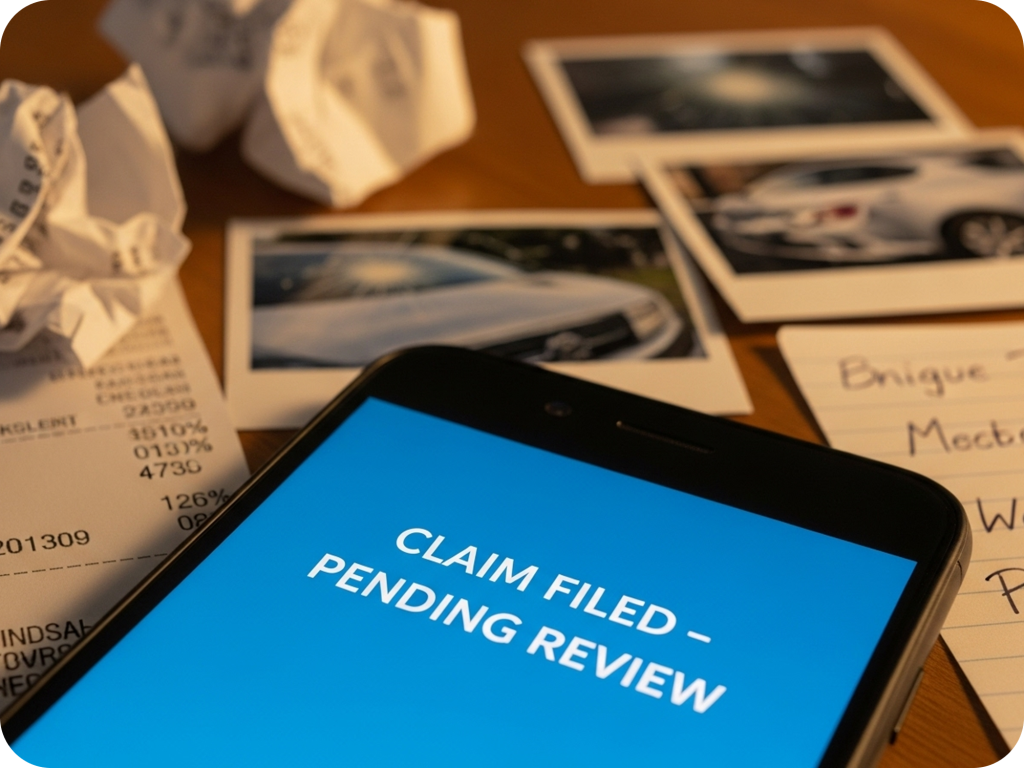

The Claims Process

The claims process begins the moment you report an incident, whether fire, theft, or storm damage. Understanding how this process unfolds allows you to make quick decisions and prevent errors. File the claim promptly, as delays can hinder payouts or even lead to denial.

Keep detailed records: photos of the damage, police reports, and an up-to-date inventory of your property all help. This documentation streamlines the process and provides you with bargaining power if questions or disagreements arise.

Knowing the paperwork, deadlines, and documentation required allows you to be in control of the process rather than overwhelmed by it. Policyholders who understand what is expected are less likely to encounter surprises or disappointments.

Conclusion

Dwelling coverage protects your home against major perils, such as fire or storms. You receive assistance repairing or reconstructing your home if an insured peril strikes. The right policy covers holes and provides comfort. Every home or flat requires its own fit, so take time to examine your requirements and identify priorities. Review your policy annually and inquire if anything seems confusing. Transparent conditions and robust assistance help you sleep well. Want to see how your policy stacks up? Contact your agent or a trusted professional to discuss options. Protect your home and your future. Stay up to date and keep your coverage current.

Frequently Asked Questions

What does dwelling policy coverage protect?

Dwelling insurance coverage protects the actual structure of your home against covered perils like fire, wind, or vandalism, but does not include liability coverage or personal property unless added to the homeowners insurance policy.

How is dwelling coverage different from homeowners insurance?

Dwelling insurance covers the home’s structure while homeowners insurance policies offer personal property, and liability for broader protection.

How do I calculate the right amount of dwelling safeguarding?

Quote dwelling insurance based on the cost to rebuild, not the market value of your home. When considering homeowners insurance policies, think about local building costs and materials to ensure full property protection.

Are personal belongings included in dwelling policy safeguarding?

Most personal property is not covered under a standard policy, so you may need to add protection for your belongings.

What are common exclusions in dwelling policies?

Typical exclusions in policies include quakes, floods, and abandonment; check your policy for specific risks excluded.

Can I add extra to my dwelling policy?

Yes, you can include endorsements or riders in your policy for perils such as theft or natural disasters, allowing you to tailor your policy options.

Why is personal liability important?

Personal liability in a policy protects you if someone is injured on your property or if you accidentally damage someone else’s property, safeguarding you from expensive lawsuits.