Constructing Confidence: Adhering to Iowa’s Contractor Standards

In the state of Iowa, the landscape of contractor licensing presents a unique set of regulations and requirements. Unlike many states with extensive licensing mandates for general contractors, Iowa takes a different approach, focusing more on registration and compliance with specific legal and financial obligations.

Overview of Iowa’s Approach to Contractor Licensing

Iowa stands out for its absence of state-level licensing requirements for general contractors. This means that, at the state level, there is no comprehensive licensure process that general contractors must undergo to operate legally. However, this does not imply a lack of regulation within the industry. Instead, Iowa emphasizes the importance of registration and adherence to specific rules, especially for contractors meeting certain income thresholds or those from out of state.

Key Distinctions in Licensing and Registration Requirements

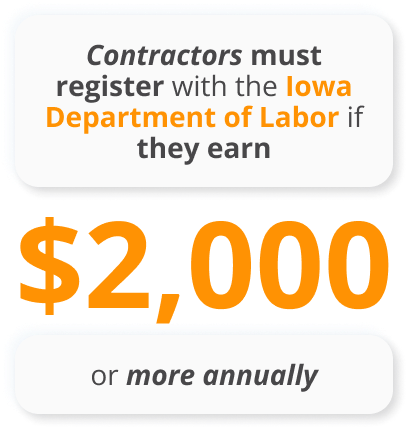

Understanding the distinction between licensing and registration is crucial for contractors operating in Iowa. While the state does not require a general contractor license, it does mandate registration for any construction contractor who earns at least $2,000 a year from construction work. This registration is facilitated by the Iowa Division of Labor and serves as a means to ensure contractors meet the state’s business operation standards.

Registration Requirements for Contractors in Iowa

Understanding the Registration Mandate: Criteria and Processes

In Iowa, while there are no state licensing requirements for general contractors, there is a crucial mandate for contractor registration. This mandate is primarily focused on ensuring that contractors operating in Iowa adhere to certain business standards and legal obligations.

- Purpose of Registration: The registration requirement is designed to maintain a record of contractors operating in the state, ensuring they meet basic operational standards and comply with state laws.

- Applicability: This requirement applies to any individual or entity engaging in construction work within Iowa.

Earning Threshold for Registration: The $2,000 Annual Income Requirement

One of the key criteria for registration in Iowa is the annual income threshold.

- Income Threshold: Contractors who earn at least $2,000 a year from construction work are required to register with the Iowa Division of Labor.

- Scope of Work: This encompasses a wide range of construction activities, including building, altering, repairing, or demolishing any structure or part thereof.

Steps for Registration: Navigating the Process with the Iowa Division of Labor

The process for registering as a contractor in Iowa is straightforward but requires attention to detail to ensure compliance.

Application Form

The first step is to obtain and complete the contractor registration application form. This form is available on the Iowa Division of Labor’s website.

Documentation

Contractors need to provide necessary information and documentation, which may include personal identification, business information, and details about their construction activities.

Fee Payment

There is a registration fee that must be paid at the time of application. The fee amount and payment instructions are provided by the Iowa Division of Labor.

Submission

The completed application, along with the required fee, should be submitted to the Iowa Division of Labor, either through mail or online, as per the provided guidelines.

Verification and Approval

After submission, the Division of Labor will review the application. This process may include verification of information and a check for compliance with other state regulations such as tax laws.

Issuance of Registration Number

Once approved, the contractor will receive a registration number. This number is often required when bidding for work, obtaining permits, or conducting other business operations.

Renewal

Contractor registration in Iowa is not permanent and needs to be renewed periodically. Contractors should be aware of their renewal date and comply with the renewal requirements set by the Iowa Division of Labor.

Out-of-State Contractor Considerations in Iowa

Requirements for Out-of-State Contractors: The Need for a $25,000 Bond

Out-of-state contractors seeking to work in Iowa face specific requirements that are crucial for ensuring compliance with state regulations. One of the key mandates is the procurement of a contractor bond.

- Bond Requirement: Out-of-state contractors planning to work in Iowa must secure a $25,000 contractor bond. This is a prerequisite before commencing any construction work within the state.

- Eligibility: This requirement applies to any contractor who does not have a physical business presence in Iowa but intends to undertake construction projects within the state.

Purpose of the Contractor Bond: Ensuring Tax Compliance in Iowa

The primary purpose of the $25,000 contractor bond for out-of-state contractors is to safeguard the state’s financial interests, particularly concerning tax obligations.

- Tax Compliance: The bond acts as a financial guarantee that the out-of-state contractor will adhere to Iowa’s tax laws and regulations. It ensures that any applicable taxes related to the construction work will be paid to the state.

- Consumer Protection: Additionally, this bond provides a layer of protection for consumers in Iowa, ensuring that out-of-state contractors are accountable for their work and financial obligations within the state.

Process of Obtaining the Bond: Essential Steps for Compliance

The process of obtaining the required contractor bond involves several key steps:

Contact a Surety Company

Contractors must reach out to a surety company that issues contractor bonds. It’s advisable to choose a company experienced in dealing with out-of-state contractor bonds for Iowa.

Application for the Bond

Complete the bond application provided by the surety company. This may involve providing business details, financial information, and proof of previous construction work.

Assessment and Approval

The surety company will assess the contractor’s application and financial stability. Based on this assessment, the bond may be issued.

Payment of Bond Premium

Upon approval, the contractor will need to pay a premium for the bond. The cost of the premium varies based on factors such as the contractor’s credit score and financial history.

Submitting Bond Proof to Iowa Authorities

Once the bond is obtained, contractors must submit proof of the bond to the relevant Iowa authorities, typically the Iowa Division of Labor or the specific department overseeing out-of-state contractors.

Renewal and Maintenance

It’s important to maintain the bond as long as the contractor operates in Iowa and ensure it is renewed as necessary.

For out-of-state contractors, securing and maintaining the $25,000 bond is an essential compliance step for legally conducting construction activities in Iowa. This process not only meets the regulatory requirements but also instills confidence among clients and state authorities regarding the contractor’s commitment to fulfilling their financial and legal obligations in Iowa.

Insurance Requirements for Contractors in Iowa

Workers’ Compensation Insurance: Mandatory for Contractors with Employees

In Iowa, as in many other states, maintaining workers’ compensation insurance is a critical and mandatory requirement for contractors who have employees. This insurance plays a vital role in the protection of both the workforce and the contractor.

- Coverage for Employees: Workers’ compensation insurance provides coverage for medical expenses, rehabilitation costs, and lost wages for employees who suffer job-related injuries or illnesses.

- Legal Requirement: Under Iowa law, contractors with employees must carry this insurance to comply with state regulations. Failure to do so can result in significant legal and financial consequences.

- Risk Management: Apart from being a legal necessity, carrying workers’ compensation insurance is a prudent business practice. It mitigates the risk of costly lawsuits and ensures that injured employees receive necessary medical attention and financial support.

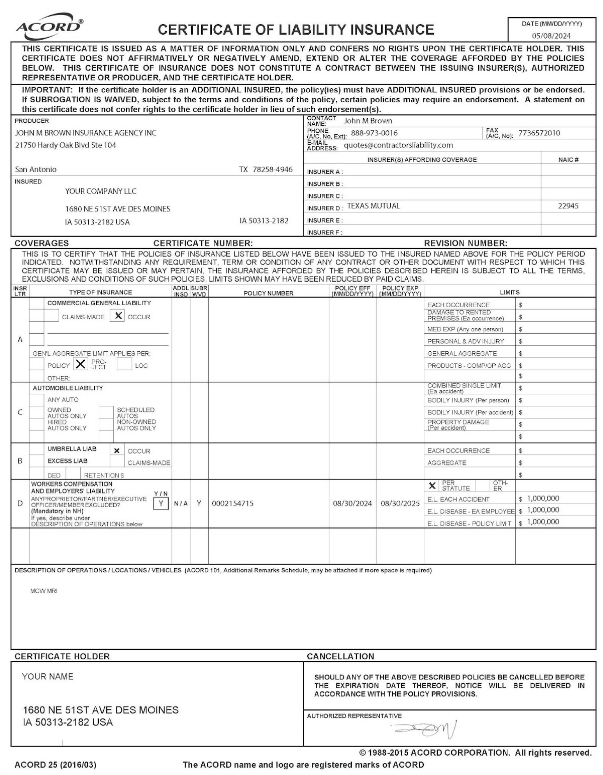

Certificate of Insurance Submission: Documenting Coverage to the Iowa Division of Labor

To comply with Iowa’s regulations, contractors must provide proof of their workers’ compensation insurance coverage.

- Submitting Proof of Insurance: Contractors are required to submit a Certificate of Insurance from their insurance company to the Iowa Division of Labor. This certificate should clearly indicate the effective date of coverage.

- Listing Iowa Division of Labor: The certificate must list the Iowa Division of Labor as a certificate holder, ensuring that the state is informed of the contractor’s compliance with insurance requirements.

- Renewals and Updates: Contractors must ensure that the certificate is kept up to date and resubmitted in case of renewals or changes in the insurance policy.

Frequently Asked Questions (FAQ)

These are common questions about General Contractor License in Iowa.

No, Iowa does not have state licensing requirements for general contractors, but contractors who earn at least $2,000 a year from construction work must register with the Iowa Division of Labor.

Out-of-state contractors planning to work in Iowa need to secure a $25,000 Out of State Contractor Bond to ensure tax compliance with the state.

Yes, contractors in Iowa with employees must have workers’ compensation insurance and must submit a Certificate of Insurance to the Iowa Division of Labor.

Contractors can register by completing an application form available on the Iowa Division of Labor’s website and submitting it along with the required fee.

The bond is required to ensure that out-of-state contractors comply with Iowa’s tax laws and regulations.