Getting a general contractor license in Delaware is a must for any professional in the construction industry. Whether you’re a general contractor, electrician, plumber, or specialized tradesman, the licensing process can be overwhelming. This guide will break down the licensing requirements in a simple step-by-step process, including insurance, bonding, and who to contact in Delaware. By following the steps and state regulations, you can ensure your business is legal and professional.

Licensing Authorities in Delaware

For contractor licenses, you can reach out to the Delaware Division of Revenue. The Delaware Department of Revenue and the Delaware Department of Labor are key authorities in this process. Here’s the contact information:

Delaware Division of Revenue

Web: Delaware Division of Revenue

Alternate Phone Number: 512-463-6599 (For calls outside Texas)

Alternate Phone Number: 512-463-6599 (For calls outside Texas)

Phone: (302) 577-8200

Alternate Phone Number: 512-463-6599 (For calls outside Texas)

Alternate Phone Number: 512-463-6599 (For calls outside Texas)

Address:

Main Office: Carvel State Office Building, 820 N French St. W., DE 19801

Contractor Licensing Process

Business Registration

Determine License Type

- Resident Contractor License: For businesses based in Delaware.

- Non-Resident Contractor License: For contractors whose businesses are based outside of Delaware but work in the state.

Get Business License

Submit Contractor Application

License Renewal

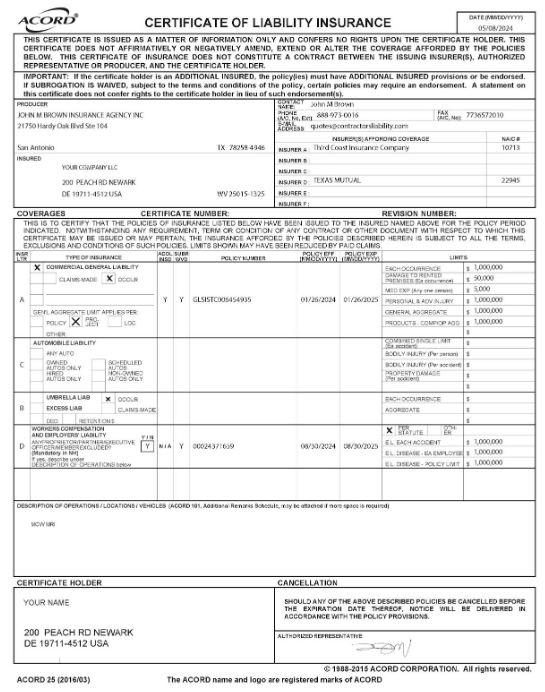

Insurance and Bonding Requirements

General Liability

Workers’ Comp

See the Official Document:

Surety Bonds

Insurance Costs

- General Liability Insurance: $500–$2,500 per year, depending on coverage.

- Workers’ Comp Insurance: $2,000–$8,000 per year, based on payroll and risk.

- General Contractor License: Required for contractors who perform general construction, remodeling, or repair work valued at $50,000 or more.

- Surety Bonds: 1%–5% of bond amount.

Special Considerations for Non-Resident Contractor License in Delaware

- Non-Resident Contractor License: Contractors not based in Delaware but working within the state must register for a Non-Resident Contractor License. Construction contractors must register their businesses with the appropriate authorities and file Delaware state income tax returns.

- State-Specific Taxes: Contractors must comply with Delaware’s Gross Receipts Tax, which applies to revenue generated from services provided within the state. Additionally, obtaining a Delaware business license is necessary, and contractors must follow the steps involved in the Combined Registration Application process. Contractors should also be aware of the Delaware contractor license and the specific processes managed by the Delaware Division of Revenue. Each local municipality has its own licensing requirements that may differ. The Delaware Division of Professional Regulation oversees various specialty trade licenses, exams, and the application process for general contractors and subcontractors.

Navigating the licensing and insurance process can be complex. Obtaining a Delaware contractor license is a crucial step in this process, as it outlines the necessary steps, required credentials, and specific licensing procedures managed by the Delaware Division of Revenue. For assistance in securing the necessary insurance coverage, visit Contractors Liability to get quotes.

Frequently Asked Questions (FAQ)

These are common questions about General Contractor License in Delaware

Yes, all contractors, whether general or specialty, need a valid contractor’s license to work in Delaware. Non-resident contractors must also register for a Non-Resident Contractor License.

To become a licensed contractor in Delaware, you must submit an application to the Delaware Division of Revenue, provide necessary documentation (such as proof of insurance), and pay the required fees. Specialty contractors, such as those in plumbing or electrical work, may also need additional licenses and must meet specific prerequisites.

All contractors are required to carry general liability insurance. If you have employees, you must also have workers’ compensation insurance. Specific bonding requirements may apply to certain projects.

Yes, non-resident contractors must file Delaware state income tax returns for any income earned from work performed within the state.

Delaware imposes a Gross Receipts Tax on contractors, which applies to the revenue generated from services provided in the state. The tax is calculated on gross earnings without deductions for labor, materials, or other business expenses.

Although there may not be a state-mandated exam for general contractors, specialty contractors such as electricians or plumbers may need to pass trade-specific exams to qualify for their license.