If you are a contractor or aspiring to become one, you need to know about blanket insurance to make sure your business is growing the way you want it to.

Blanket insurance is a type of insurance that will protect one from accidents, liabilities occurred during a contract and many other things in regards to general contractoring. There are some cases where something may go wrong during the course of a contract and warrant a lawsuit, bringing a contractor down in his business. However, if he has contractors liability insurance, the reverse would be the case.

That is why it is very advisable for contractors to adopt this system because mere thinking of how to get a good lawyer to defend you in such cases would be time wasting and expensive and in the long run it might put you off your business. Consider the factors involved when you want to choose contractors liability insurance.

Blanket Insurance for Sub-Contractors

Apart from protecting you from lawsuits and covering lawyer bills, contractors’ liability insurance can also be of help to those working under you. This is because when your workers encounter accidents during the course of the contract, your insurance company will be the one to cover their medical bills.

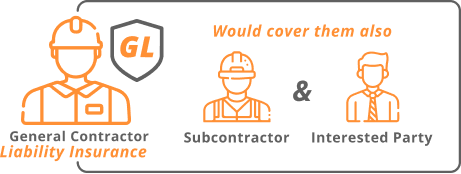

When getting an insurance cover for yourself, make sure it is general liability insurance. So that those working under you wouldn’t have to get sub-contractor’s liability insurance as well. Since they are working under you, the general liability insurance coverage would cover them also.

Remember that the general contractor would be the one held responsible for the mistakes of his sub-contractors that is why you need to make sure that your workers are carrying insurance as well. Contractors’ liability insurance is very necessary for everybody under the contract job because a case may occur where anyone would be held responsible for his action.

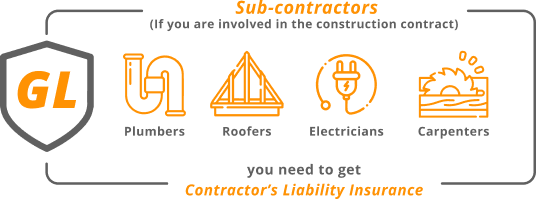

Both roofers, plumbers and other household workers can be classified as sub-contractors because the general contractor would hire them at one point or another. Each and every one of them needs to get contractor’s liability insurance because it is very necessary and you never can tell when the need might arise. It doesn’t really matter if you are a self-employed contractor or you work with a large scale contracting firm, as far as you are involved in the contracting business, you need to get contractor’s liability insurance.

It is good to hire an all-in-one contractor when you want to start your construction project, but you need to find out if he is covered by any sort of insurance; it could be blanket insurance or contractor’s liability insurance. This is because whenever something happens along the line, you will be sure that you won’t be held responsible for the damages.

You should know that this type of insurance is not all about having your tools stolen or whether your construction site gets damaged by fire or flood. It is a type of insurance that covers you in the period of working under your contract that is why it is called blanket insurance.

This insurance covers two aspects when it comes to liabilities:

1. Liability to the Public

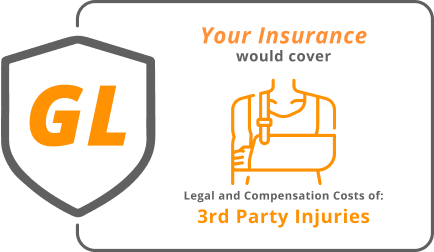

This simply means if you are working on a contract job and someone else get affected or a passer-by was injured in the process, the public liability insurance will come in handy in this situation. The person involved in the accident might want to sue you for one thing or another, but you can rest assured because your insurance coverage would cover the legal and compensation costs of the person.

2. Liability to Employees

This means that as a general contractor, when you employ other workers as subordinates you should have your employer’s liability insurance in place so that your sub-contractors would be protected. That means that if any of them should get injured on account of working for you, your insurance coverage would cover for their costs in any aspect.

Accidents can occur at any given time, so instead of waiting for an accident to occur before getting your contractors liability insurance, you should get it beforehand. Make sure that you get the right type of contractors liability insurance which could include blanket insurance because in the long run it would come in handy.

Benefits of Contractors Liability Insurance

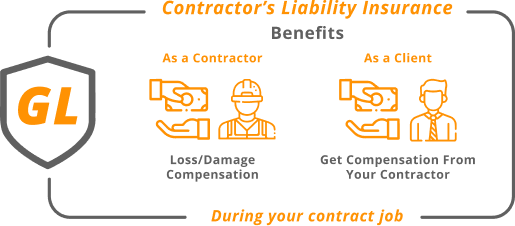

First, it will help you get compensation whenever you encounter loss/damage during your contract job. As a client, it will also help you to get compensation from your contractor when you encounter problems with using their services.

Second, you should keep in mind that it depends on the type of project you are handling that will determine the type of compensation you get. As a general contractor, getting this contract will save you a lot from many misfortunes in the sense that you would not have to be sued all the time by your clients. Always make sure you get the required compensation when such a thing occurs.

Lastly, all liabilities during the project would be covered with the liability insurance so whenever you are hiring plumbers, roofers and other household workers, make sure you get general liability insurance. This way all the problems encountered during the course of the project would be compensated.

The Insurance Agent

The insurance agent you choose to represent you should be able to help you with the procedures from start to finish. If you are into contract business, you wouldn’t want to experience a situation where you are sued or get an accident in the course of your contract because it could be very devastating. At ContractorsLiability.com we can assure that our agents are highly trained and qualified to mee your insurance needs. We will help you shop for the best insurance policy.

Are you into contract business? Let’s talk to an expert and get insured today!