Insurance for Skilled Artisans — Critical Safeguards for Your Craft

Trades such as carpentry, plumbing, or electrical work carry specific risks that require specialized protection. Artisan Contractors Insurance shields your livelihood from unexpected issues, offering the reassurance you need on any job site.

Obtén tarifas de los principales proveedores de seguros de América con una cotización instantánea de nuestra parte.

Why Do Artisan Contractors Need Insurance?

Artisan work often involves precision and physical demands, which can sometimes lead to accidents. Without adequate insurance, even a single mishap could threaten your business’s financial stability. Artisan Contractors Insurance offers vital coverage for:

- Accidental Injuries: Tradespeople are often at risk of physical injuries while performing tasks. Workers’ compensation ensures that medical expenses and lost wages are covered if any employees are injured on the job.

- Property Damage: Whether working at a client’s home or business, accidents can happen, such as tools damaging property. General liability insurance covers these claims, keeping you financially secure.

- Legal Disputes: If a client claims that your work caused damage or harm, legal fees and settlement costs could put your business at risk. Insurance helps protect against these liabilities, offering coverage for defense and settlements.

Common Risks Faced by Artisan Contractors

Artisan professionals handle complex, hands-on tasks that can sometimes lead to injuries or property damage. Having proper insurance in place helps mitigate these risks. Here are some common scenarios that contractors face:

- Falls from Heights: Many contractors work on scaffolding or ladders, which increases the chance of fall-related injuries.

- Tool-Related Accidents: Using sharp or heavy tools can lead to cuts or injuries if not handled properly.

- Electrical Hazards: Working with electrical systems can result in shocks or fires, requiring specific safety measures.

- Equipment Malfunctions: Faulty or misused tools can cause accidents, underscoring the importance of having proper coverage.

Get a Artisan Contractors Insurance Quote fast

Only 5 minutes of your valuable time. We can often get same day coverage.

Comprehensive Coverage Options for Artisans

To effectively protect your business, it’s essential to have a variety of coverage types. Below are some of the most important insurance options for artisan contractors:

-

General Liability:

Covers claims for injuries or property damage caused by your work. For example, if a tool falls and injures someone, this coverage helps with medical expenses and legal fees.

-

Workers’ Compensation:

Provides financial protection for your team by covering medical expenses and lost wages for work-related injuries, ensuring compliance with legal requirements.

-

Tool and Equipment Coverage:

Ensures that you can replace essential tools if they are lost, stolen, or damaged, helping you avoid disruptions to your work.

-

Commercial Auto Insurance:

Covers vehicles used for business purposes, protecting against damages from accidents, theft, or other incidents while transporting materials or tools to job sites.

-

Customizable Insurance Plans:

Every artisan business has its unique needs. Tailored insurance plans are available to meet specific demands, ensuring that you have the exact protection required for your trade.

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

Benefits of Choosing Our Artisan Insurance Plans

By partnering with us for your Artisan Contractors Insurance, you’ll benefit from:

-

Affordable Premiums:

We work with trusted insurers to offer competitive rates for your business needs, with options for flexible payment plans that help manage your budget.

-

Fast Claims Handling:

In the event of an accident or claim, our efficient claims process ensures that you get back to work quickly without lengthy delays.

-

Expert Advice:

Our team of specialists understands the specific risks faced by artisan contractors, providing guidance on the most appropriate coverage for your trade.

Get a Free Artisan Contractors Insurance Quote

In only 5 minutes of your valuable time. We can often get same day coverage.

What Kind Of Insurance Do Artisan Contractors Need?

There are different types of insurance that cover different contracting needs.

Some of the major ones include artisan contractor’s insurance, Commercial Auto Insurance, Workers Compensation for artisan contractors with more than one employee, and liability insurance that covers third parties in the event of an accident.

However, there are other types of insurance that might be right for your specific company as well. Discuss with your insurance agency further about what types of artisan contractor’s insurance might be right for your small business.

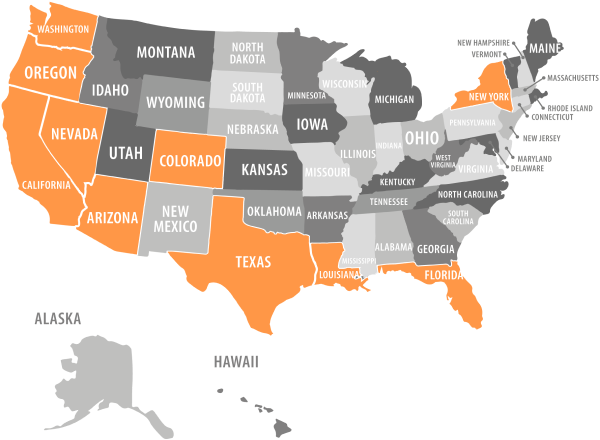

Get Affordable Artisan Contractors Insurance In All States

In addition to the worries associated with general Contractors Liability, artisan contractors must also consider their location within a “pain state,” or a state that has higher after-completion claims. These states include Arizona, Colorado, Florida, Washington, New York, California, Nevada, Louisiana, Oregon, and Texas.

While artisan contractors everywhere fight for legislation that will help them defend their work against potential harmful suits, be assured that most insurance companies, like Contractors Liability, will also have your back in instances like this,and get the policy you need at an affordable rate.

Artisan contractors insurance gives protection against any financial losses that arise during work on a construction site.

Real Client Experiences

Our insurance services have helped numerous artisans continue their work without financial stress:

Safeguard your artisan business today! Contact us for a personalized consultation and get a quote tailored to your needs.

Here’s What Contractors Think

Frequently Asked Questions

The following are common questions about Artisan Contractors Insurance.

Artisan contractor’s insurance can cover employees if the policy includes Workers Compensation. Liability coverage generally only covers third parties, which do not include your employees.

In some states, it is against the law to not provide worker’s compensation to your employees. If you have hired extra help for your business, it’s important to make sure that worker’s compensation is included in your policy.

If you’re unsure about whether Artisan Contractors Insurance is right for you, let’s take a look. Artisan contractors are also known as “casual contractors”. These types of workers can be contracted on a full or part-time basis, and provide a skilled contracting trade for profit.

- A custom insurance policy based on your skills and trade, ready to cover you in the event of an accident.

- Affordable prices on policies that provide comprehensive coverage.

- Customer service and support from people with a background in covering contractors and licensed insurance agents.

- A-rated insurance policies from insurance companies that you know and trust.

- At Contractors Liability we are passionate about working with small businesses to get you the coverage you need.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.