ALASKA WORKERS’ COMPENSATION INSURANCE: REQUIREMENTS, RATES, AND BENEFITS

Obtén tarifas de los principales proveedores de seguros de América con una cotización instantánea de nuestra parte.

Introduction

Workers’ compensation insurance is key in keeping workplaces safe and secure in Alaska. This vital coverage protects employees and employers. It ensures workplace injuries and illnesses get quick attention while also shielding businesses from expensive lawsuits.

The Alaska Workers’ Compensation Act requires most employers with one or more employees to have workers’ compensation insurance. This rule applies to full-time, part-time, and seasonal workers offering broad protection across many industries.

Alaska’s unique setting and high-risk jobs, like fishing, oil and gas, and construction, make workers’ compensation insurance even more necessary. This coverage gives strong support to employees during tough times. It includes medical care, wage replacement, help to find new jobs, and death benefits.

WHO NEEDS WORKERS’ COMPENSATION INSURANCE IN ALASKA?

Alaska’s workers’ compensation system aims to protect employees from workplace injuries and illnesses while guarding employers against expensive lawsuits. The Alaska Workers’ Compensation Act requires most employers to have coverage making sure they follow state rules.

Mandatory Coverage

The law requires any employer with one or more employees to have workers’ compensation insurance. This rule applies to all employee types, including:

- Full-Time Employees: Regular staff who work standard hours.

- Part-Time Workers: People who work fewer hours but still face workplace risks.

- Seasonal Employees: Workers hired for short periods during busy times.

Exemptions

The law says most employers need to give workers’ compensation coverage, but some don’t have to: Remember: Bosses need to closely examine how they classify each worker to ensure they follow Alaska’s –

rules. Getting it wrong can result in penalties checks by officials and bigger legal risks.

| Exemption | Details |

|---|---|

| Sole Proprietors and Partners | Not required but can opt for coverage if no employees are hired. |

| LLC Members or Corporate Officers | Exempt if owning at least 10%; must cover employees if hired. |

| Independent Contractors | Must have their own business license, tools, and work control. Misclassification leads to fines. |

| Part-Time Domestic Workers | Exempt if earning less than $2,500 annually (e.g., nannies, housekeepers). |

| Volunteers and Charity Workers | Exempt if unpaid and working for non-profits or charity organizations. |

Get a Free Workers’ Compensation Insurance Quote

In only 5 minutes of your valuable time. We can often get same day coverage.

Get a Free Workers’ Compensation Insurance Quote

ALASKA WORKERS’ COMPENSATION BENEFITS

Alaska’s workers’ compensation system has an influence on supporting employees hurt at work while shielding employers from legal risks. Here’s a breakdown of key benefits unique to Alaska:

Pay Replacement

Workers who can’t do their jobs can get:

- Temporary Total Disability (TTD): Money for workers who can’t work at all while they heal. It’s about two-thirds of what they make each week.

- Temporary Partial Disability (TPD): Payments for employees working fewer hours because they got hurt.

- Permanent Partial Impairment (PPI): A one-time payment for lasting injuries. A doctor decides how much based on how bad the injury is.

Medical Benefits

Hurt employees have the right to:

- Full Medical Care: Covers visits to doctors, stays in hospitals, operations, and drugs from prescriptions.

- Money Back for Travel: Workers get money back for transport costs linked to medical care.

- Artificial Limbs and Tools: Gives needed devices to recover and move after injuries.

Death Benefits

If someone dies at work:

- Funeral Expenses: The program gives up to $12,000 to cover burial or cremation costs.

- Support for Dependents: The deceased worker’s spouse and children get weekly payments. These payments are a percentage of what the worker used to earn each week.

- Education Assistance: The program helps spouses learn new job skills. This can help them go back to work.

Vocational Rehabilitation

When workers can’t go back to their old job, Alaska offers:

- Help and support to get ready for new jobs.

- Money for school or training programs.

Do you have a question?

Call us 24/7.

- Get your certificate of insurance.

- Update your coverage.

- Edit billing information.

- Change business address.

- Customer service.

WHAT EMPLOYERS MUST DO UNDER ALASKA WORKERS’ COMPENSATION LAW

Main Duties

Alaska law sets strict rules for employers to provide workers’ compensation coverage. Here’s a simple breakdown:

- Keep Insurance Active: Make sure workers’ compensation insurance never lapses.

- Show Insurance Info: Put up details about coverage in three easy-to-see spots at work.

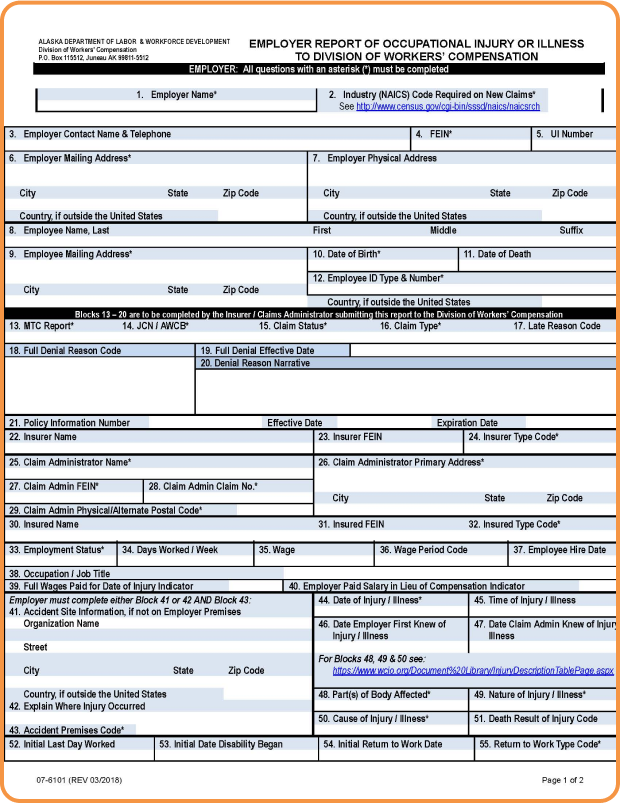

- Send in Form 6101: Tell the Workers’ Compensation Division about injuries or illnesses within 10 days.

- Pay Right Amount: Don’t label employees or report less payroll to avoid fines.

Fines for Breaking Rules

- Fines: Up to $1,000 for each worker every day without coverage.

- Full Liability: Bosses must pay all injuries-related costs, including doctor bills and lost wages.

- Stop-Work Orders: Companies that don’t follow the rules might have to shut down their work.

BENEFITS OF WORKERS’ COMPENSATION IN ALASKA

For Employees:

- Covers medical expenses, lost wages, rehabilitation, and death benefits.

- Examples include payments for Temporary Total Disability (TTD) and Permanent Partial Impairment (PPI).

For Employers:

- Protects against lawsuits and ensures compliance with Alaska’s legal requirements.

Specific Definitions and Classifications

Alaska’s Workers’ Compensation Act considers most people working under an employer’s guidance as employees making coverage necessary. Wrong classifications can result in fines.

Who Qualifies as an Employee?

Employees include:

- Full-Time, Part-Time, and Seasonal Workers: All need coverage no matter how many hours they work.

- Minors and Family Members: Even relatives or workers under 18 need coverage if they get paid.

- Compensated Volunteers: People who receive stipends, housing, or other perks.

Independent Contractors

To skip out on coverage, contractors must:

- Have an Alaska business license.

- Be in charge of when and how they work.

- Bring their own tools and gear.

- Work on their own with many different clients.

Risks of Wrong Classification: Companies can be fined up to $1,000 each day for every worker they classify. They also become responsible for injuries if a court decides a contractor should have been an employee.

Who is Exempt?

- Part-Time Domestic Workers: These workers make under $2,500 a year (like nannies).

- Volunteers: They don’t need coverage if they work for free.

- Sole Proprietors and Partners: They don’t have to get coverage unless they hire people.

- LLC Members or Corporate Officers: They’re off the hook if they own 10% or more.

Smart Moves

- Check worker classifications often.

- Write contracts that state independent status and make sure they follow Alaska’s tough rules.

PREMIUMS AND POLICY OPTIONS FOR WORKERS’ COMPENSATION IN ALASKA

Alaska workers’ compensation premiums depend on several key factors. Knowing how companies calculate and manage these premiums helps employers follow the rules and cut unnecessary costs.

How Companies Calculate Premiums

| Factor | Description |

|---|---|

| NCCI Classification Codes | Assigns a specific rate based on the type of work employees perform and the associated risk level. |

| Payroll | Premiums are calculated per $100 of payroll, with higher payrolls resulting in higher premiums. |

| Experience Modification Rate (EMR) | Adjusts premiums based on the employer’s past claims history. A clean claims record results in lower premiums. |

Workers’ compensation premiums rely on how is shown in table.

Premium Audits

When the policy period ends, insurance companies check to make sure they’ve calculated premiums. This process includes:

- Checking payroll records.

- Making sure employees are classified.

- Changing premiums if they find mistakes or differences.

What Audits Can Lead To:

- Money Back: Companies might get some of their premium back if they overestimated payroll.

- Extra Charges: Companies might have to pay more if they underreported payroll or put employees in the wrong categories.

Here’s What Contractors Think

Frequently Asked Questions

The following are common questions about Workers’ Compensation Insurance.

All employers with one or more employees, including full-time, part-time, and seasonal workers, must have coverage.

Exemptions include part-time domestic workers earning under $2,500 annually, volunteers, sole proprietors, and independent contractors meeting specific criteria.

Benefits include medical care, wage replacement for temporary or permanent disabilities, vocational rehabilitation, and death benefits for dependents.

Premiums are based on NCCI classification codes, payroll, and the employer’s claims history, adjusted by the Experience Modification Rate (EMR).

Employers face fines up to $1,000 per day per employee, stop-work orders, and full liability for injury-related costs.

We’ve collected all the most useful things in our e-books

Just read and in 30 minutes you will know everything about insurance.