Legal Fees And Their Effect On Your Insurance Policy Limits.

Every business owner knows that the Country is in the grip of liability lawsuits mania. The number of lawsuits against small businesses has skyrocketed in the last ten years. No one party is willing to take responsibility for their own actions.

Any accident, mishap, libel or product liability is always someone else’s fault. Attorneys are bombarding the airwaves drumming up cases for their firms. You have lost control and are the responsible party that the court of law will determine being responsible for the liabilities for injury and harm caused to a plaintiff As a result, the lawsuits are coming fast and furious. If you operate a small business it is only a matter of time before the sheriff is knocking on your door ready to seize all your property.

This is why you need the protection of a Business General Liability Insurance policy.

You should also have an Affordable Commercial Auto Insurance Policy. This will protect you from any legal liabilities you may be held liable for by any court decision after the legal process runs its course. The liability exposures that certain types of businesses that use vehicles for income producing services is quite broad. If an employee in the course of their employment is party to an accident and causes injury or bodily injury to a plaintiff or their property, the responsibility and the legal liability for the injuries will fall on the employer.

One of the most overlooked benefits of a Low cost Business General Liability Insurance Policy is that it includes coverage for legal fees in the event of a covered claim. This is included with your coverage for any judgements, awards or settlements for any claims that the courts may find your business has legal liability for.

If you do not have insurance these fees along with any judgments will be paid by you. For most small businesses this would more than likely force them to close their doors for good. It is important to realize that no matter how careful you are, accidents will happen. Also, a meritless claim still has to be defended and legal fees paid.

Business General Liability Insurance Policy Limits

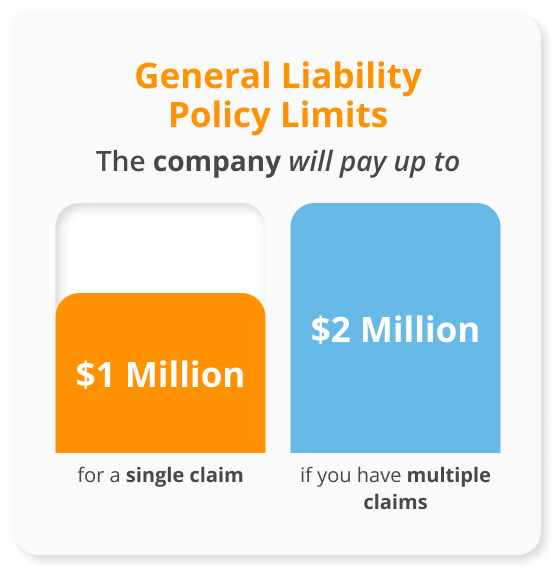

With all Business General Liability Insurance Policies you have Policy limits. These are the maximum amount the insurance company will pay on your behalf in the event of a claim. They are usually stated as two numbers such as $1 Million/$2 Million.

What this means is that the company will pay up to $1 Million for a single claim and up to $2 Million if you have multiple claims. (On a side note, run away from any agent that attempts to sell you a lower amount.

Pro Tip

The difference in cost of a $250,000 and $1 Million policy is generally less than $50 per year.

Legal Costs Inside The Policy Limits VS Outside The Policy Limits

The insurance companies have taken notice of this trend. One of the things more and more policies contain is that costs of defense are included in Inside The Policy Limits. What does this mean you may ask yourself? Well here is a simple explanation.

When your policy has legal costs Inside the Policy Limits wording this means that any costs generated in defending the claim against you will reduce the amount available to pay any judgment, if one is awarded.

Here is an example. A customer files a lawsuit against you for damages caused by negligence or libel. The insurance company spends $400,000 in legal costs defending you. You have a $1 million policy limit. You will only have $600,000 to pay any judgment because of the Inside the Policy Limits wording. The insurance company is only responsible for $1 Million and $400,000 was legal costs.

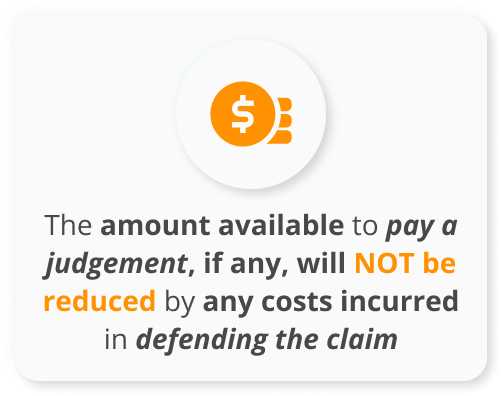

When your policy has legal costs Outside the Policy Limits wording this means that any costs generated in defending the claim will NOT reduce the amount available to pay any judgment if one is awarded. Here is the same example as above but in this case, the policy contains Outside the Policy Limits wording.

A customer files a lawsuit against your business. They spend $400,000 in legal costs defending you. You have a $1 million policy limit. You will still have $1 Million to pay any judgment because of the Outside the Policy Limits wording. The insurance company is still responsible for $1 Million for any judgment and $400,000 legal costs.

This may seem like a trivial matter, but in the real world, this can mean life and death for your business. It does not take much in this day and age for legal bills to reach the stratosphere. You need to be aware that if there is a judgment against you that exceeds the policy limits of your insurance policy you will be the party left holding the bag for the difference. If your policy has Inside the Policy Limits wording the greater the chance of this happening.

Is There Anything Else That Will Give Me Greater Coverage Limits?

There are a couple of ways you can protect yourself before you become a defendant in a negligence or tort court case. These will protect officers, owners, and employees from lawsuits that may prove their negligent actions were the proximate cause of the parties injury.

The relevant factors in such cases were damages awarded to the suing party prove to be greater than the policy limits, and the liable party or parties will be liable for the harm caused. This is generally an amount of money given to a plaintiff as a breach of duty was found by the law courts for a failure to act or a specific type negligent action.

The following tips and strategies will help you meet your legal liabilities in the event of a catastrophic event that seems to be happening more and more in the business world where the court would award damages to a plaintiff for an injury a defendant was found to be liable for.

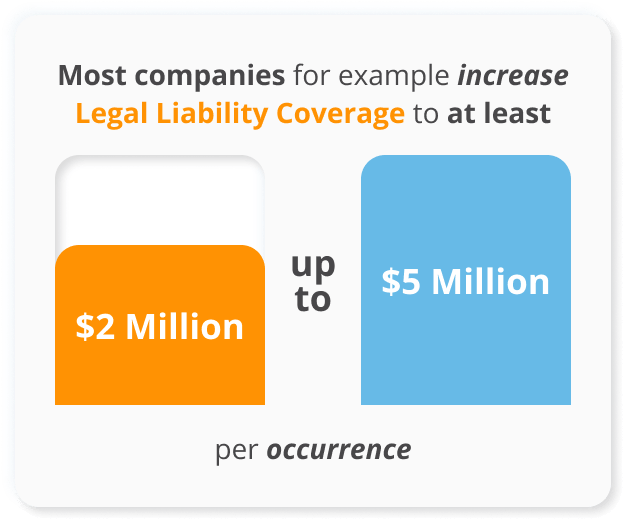

Increase your underlying Policy Limits

If you want to increase your protection for legal liability the easiest way is to increase your liability insurance. Most companies for example increase coverage to at least 2 Million dollars up to 5 Million dollars per occurrence.

Excess Insurance

This type of policy adds additional coverage limits only on top of an existing liability insurance policy. It increases the liability coverage of just that policy. So for example let us say you have a general liability policy with a $1 Million underlying policy with $3 million excess coverage and a commercial auto insurance policy with a $1 Million policy for bodily injury. An employee or employees in the course of their employment is negligent and causes a vehicle accident where the legal liability exceeds the $1 million dollar coverage, the employer would be the party legally liable for paying the person for their injury.

Umbrella Insurance

This type of Excess insurance lays over the top of all the policies of the insured.That is why they are called Umbrella policies they cover everything like an umbrella. They are issued in amounts of $1 million increments in most cases. Using the same example as above in the Excess Insurance section.

So for example let us say you have a general liability policy with a $1 Million underlying policy with and instead of $3 million excess coverage, they have a $3 million Umbrella and a commercial auto insurance policy with a $1 Million policy for bodily injury. An employee in the course of their employment is negligent and causes a vehicle accident where the legal liability exceeds the $1 million dollar coverage, the employer and any other officers or covered parties would have coverage for any court verdicts up to $4 million.

Pro Tip

It is in your control to determine how much protection you need. In some situations the contract or sub contract you have determines the amount of coverage you need. It is important to read the contract to see the requirements before you take the job.

Depending on the contract requirements it may not be economically viable to meet the terms of the contract. As an owner you do not want to be liable for the violation of a contract term by failure to meet your contractual duty.

A simple example of this would be a person who signs a contract for a $12,000 job with a prime contractor. The contractor requires a $5 Million Umbrella policy for liability. This policy may cost over $5,000 for a year. Unless the contractor had more contracts subject to this liability requirement it would probably not make sense to enter into this contract.

However, having access to higher policy limits for liability should make your services more attractive to a property owner who has the responsibility to hire a party that has access to their property in the event of injuries. So in the long run you may be able to by having additional insurance.

Have Any Other Insurance Questions?

We are happy to answer any questions you may have contractorsLiability.com has the capability to provide quotes for the hard-to-place risks and get you insured quickly and conveniently. We have the experience to analyze and recommend the appropriate affordable Business General Liability Insurance Coverage. Call now to speak with a knowledgeable agent.

Our experts can review your needs and get you the proper coverage your business deserves. They will make sure you have the coverage you need at the best price for you. Best of all, you can get a free, no-obligation quote in minutes.

So act now If you have any questions about this or any other insurance needs feel free to contact the knowledgeable agents at ContractorsLiability.com at 866-321-5711 or go to our website for a. We offer 5 Star customer service and can often get you insured in under an hour.