Professional Liability Insurance

Everyone is prone to having an accident now and again. Knowing full well what can happen to you in your non-professional life, it would make sense that you would want to cover yourself in the event of an accident caused by your company. To protect your professional reputation, your work, and your customers, most states require you to have professional liability insurance.

Here are some things you need to know so you can make better decisions about professional liability insurance with your insurance provider.

Get Fast Quote

Add details for the fastest quote

Call Us 24/7

We’ll answer at any time, call us.

Customer Service (888) 766-4991

Types Of Professional Liability Insurance

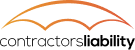

It is important to know that there are two different types of professional liability insurance policies. The first is known as a claims-made policy. This is the most common type of policy, as they only cover incidents that happen during a coverage period.

If an event happens prior to the beginning of the period, or a claim is made after coverage has ended, chances are your claim will be denied. Therefore, most insurance providers will suggest that companies purchase professional liability insurance as soon as possible.

The second type is known as an occurrence liability policy. These cover any event that takes place during coverage, but it can also be extended to cover any claim made after coverage ends.

Discuss with your insurance provider what type of coverage might be best for you, or contact us for a second opinion and comparative analysis.

How Can I Get Contractors Professional Liability Insurance?

You can either fill out the online quote form below or call (866) 225-1950 to talk to an agent today.

Factors That Contribute To Cost Of Professional Liability Insurance

You can find a pair of socks at the dollar store, or you can find a pair of socks at Footlocker. The main factor differentiating the two is cost – but as we all know, the price is often determined by the quality of materials and other considerations that went into making the pair of socks. The same goes for professional liability insurance for specific industries.

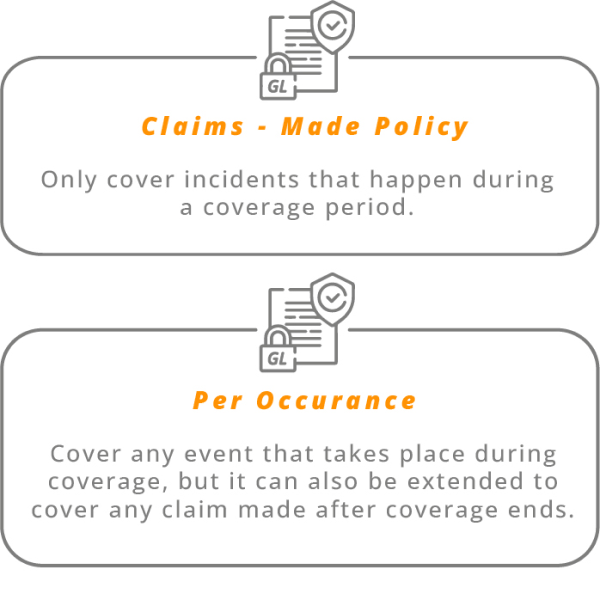

Your time in the industry, the number of employees you have, what services you provide, and so much more goes into figuring out exactly what type of coverage you need. Setting up a free consultation with the insurance company of your choice prior to purchasing professional liability insurance will guarantee that you get the most reasonable price for the coverage that you need.

What Does Professional Liability Insurance Cover?

This leads us to another question: What types of businesses need professional liability coverage? Most professional businesses obtain professional liability coverage to look more professional and to meet legal requirements. For contractors and other artisan builder businesses, this can include:

-

Electrician’s Liability Insurance

Claims Example: A piece of faulty wiring has caused lost productivity at a business post-construction, and that company is suing you for damages related to the unaddressed problem.

-

Excavator’s Liability Insurance

Claims Example: An area of the neighboring property is accidentally damaged during an excavation.

-

General Contractor’s Liability Insurance

Claims Example: The building your company constructed has run into some structural issues directly related to poor craftsmanship. The company occupying the building is suing you for damages relating to repair cost.

-

Roofer’s Liability Insurance

Claims Example: You did not properly secure the construction area and a piece of debris falls on the head of a passerby.

-

Plumber’s Liability Insurance

Claims Example: A person who works with the company that you are contracted with has suffered an injury on the worksite.

What Is The Difference Between Professional Liability Insurance And General Liability Insurance?

General Liability Insurance is needed for contractors and professional handyman services because it covers legal fees for any sort of settlement a company and its client might have in court. Professional liability insurance is what covers any sort of incident of negligence on the part of a professional contractor or handyman.

Reputation Matters

Our customers trust us for great customer service and cost-effective coverage.

Frequently Asked Questions (FAQ)

The following are common questions about professional liability Insurance.

In short, no, but most clients do require that their contractors have professional liability insurance. Not having it might make it harder for you to gain a foothold in your professional community. If your company is found to be negligent, not having it can make the difference between a minor setback and a devastating financial blow.

For all intents and purposes, this type of policy has you covered in the event of nearly every case of negligence. However, it does not always cover criminal cases, and usually does not cover intentional mistakes, which include dishonesty and non-financial losses.

Are you feeling less than confident in your ability to purchase the best professional liability insurance option? Do you feel as though you need more help? Regardless of where you are in your search for professional liability insurance, you can feel confident that the folks at Contractors Liability are here to help you when you need it.

You wouldn’t choose a horror movie makeup artist to choose the cosmetics for your wedding day, so why would you choose a generic insurance agency to provide you with coverage that needs to be specific?

Contractor’s Liability has been in the insurance business long enough to understand the complexities of covering your contracting or artisanal/handyman business.

We understand the risks involved in these areas of industry, and we seek coverage that amplifies your security and professional nature. Additionally, our focus is to ensure:

E-Book Now Available

Learn the nuts and bolts of Contractors Insurance and how to protect your staff, your business and you.

Read NowContractorsLiability.com is here to help with all your insurance coverage needs, including specialized plans and tailored insurance policies. All our highly trained agents can help you in English or Spanish.

At Contractors Liability we value and respect your privacy. That’s why we don’t sell or share your information with any third parties and we only use it for our commercial purposes.